Islamic Fund Management

8

4.

Country Groupings/Categories:

To facilitate analysis and recommendations, the study

has organised the country-specific case studies into country groupings/categories by

focusing on the geographical groups of the OIC (Arabian, Asian and African) and the

development level of their respective conventional and Islamic fund management

industry.

The study showcases four countries, i.e. Malaysia, Pakistan, Morocco (representing OIC

member countries) and South Africa (representing non-OIC member). The countries have been

selected based on their regional location, as reflected i

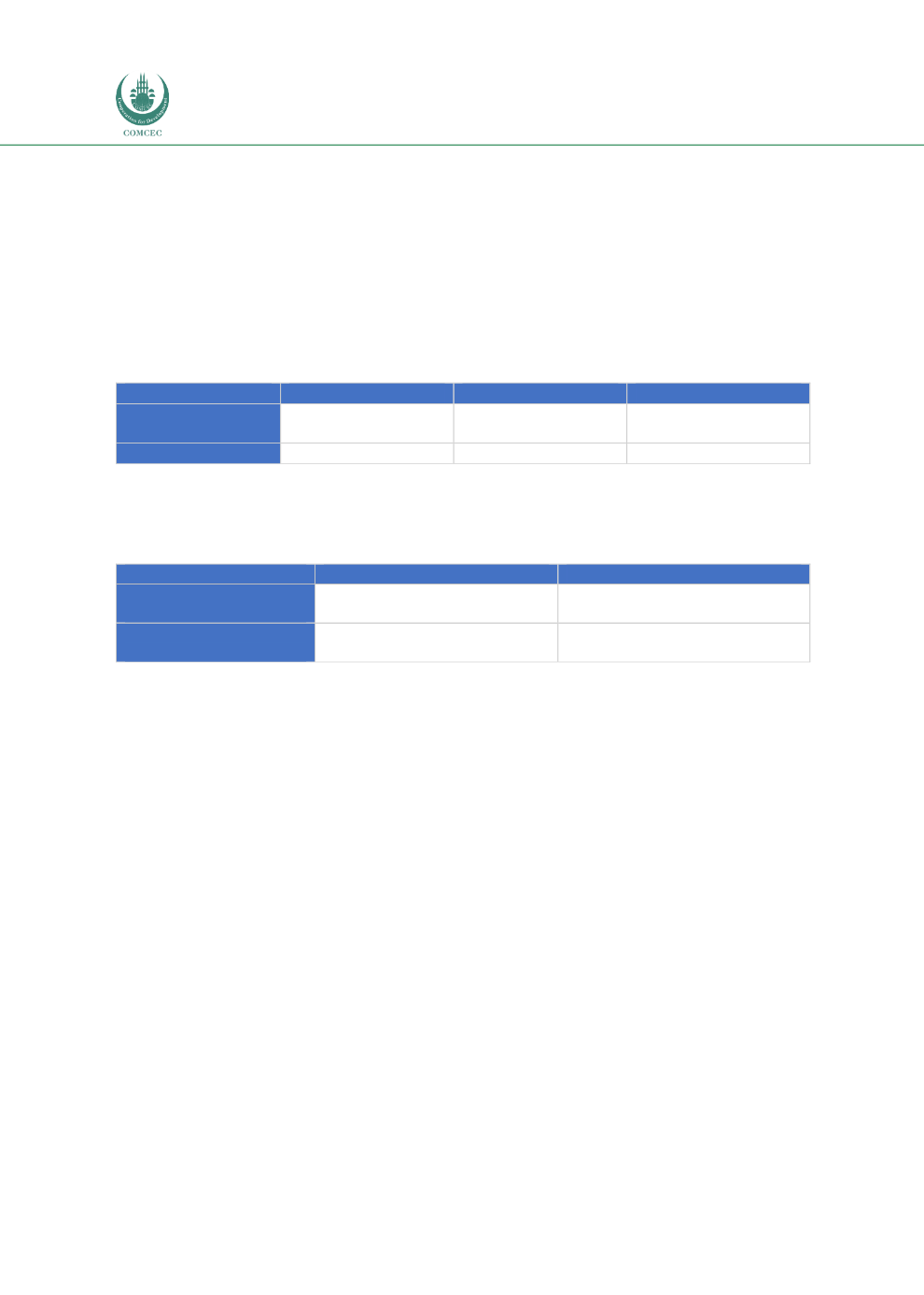

n Table 1.1 .Table 1.1: Case-Study Countries by Regional Location

Arab

Asia

Africa

OIC Member

Morocco

Malaysia

Pakistan

Non-OIC Member

South Africa

The development levels of the Islamic fund management industry in the respective countries

are categorised based on the analysis i

n Table 1.2 .Table 1.2: Case-Study Countries by Growth and Competitiveness Level

Slow market growth

Rapid market growth

Strong competitive

position

Category B

Category A

Weak competitive

position

Category D

Category C

Countries in

Category A

–

Rapid market growth and strong competitive position of

Islamic fund management industry

. They face challenges in their efforts to continue building

on their success while ensuring Islamic finance remains central to the development of their

capital markets as they evolve (e.g. Malaysia).

Countries in

Category B

–

Slow market growth and strong competitive position of Islamic

fund management industry

. They face challenges in trying to bring their Islamic fund

management industry on to a level playing field vis-à-vis the conventional segment. The

existing infrastructure may, however, be helpful in making the industry competitive relative to

its conventional counterpart. The improvement of macroeconomic conditions is crucial

towards driving the growth (e.g. Pakistan).

Countries in

Category C

–

Rapid market growth and weak competitive position of Islamic

fund management industry

. This is applicable to countries with an expanding Islamic fund

management industry, but which is still relatively small compared to the overall industry.

Countries in

Category D

–

Slow market growth and weak competitive position of Islamic

fund management industry.

This requires the fundamental enhancement of the

infrastructure of the Islamic fund management industry infrastructure (e.g. Morocco).