Islamic Fund Management

4

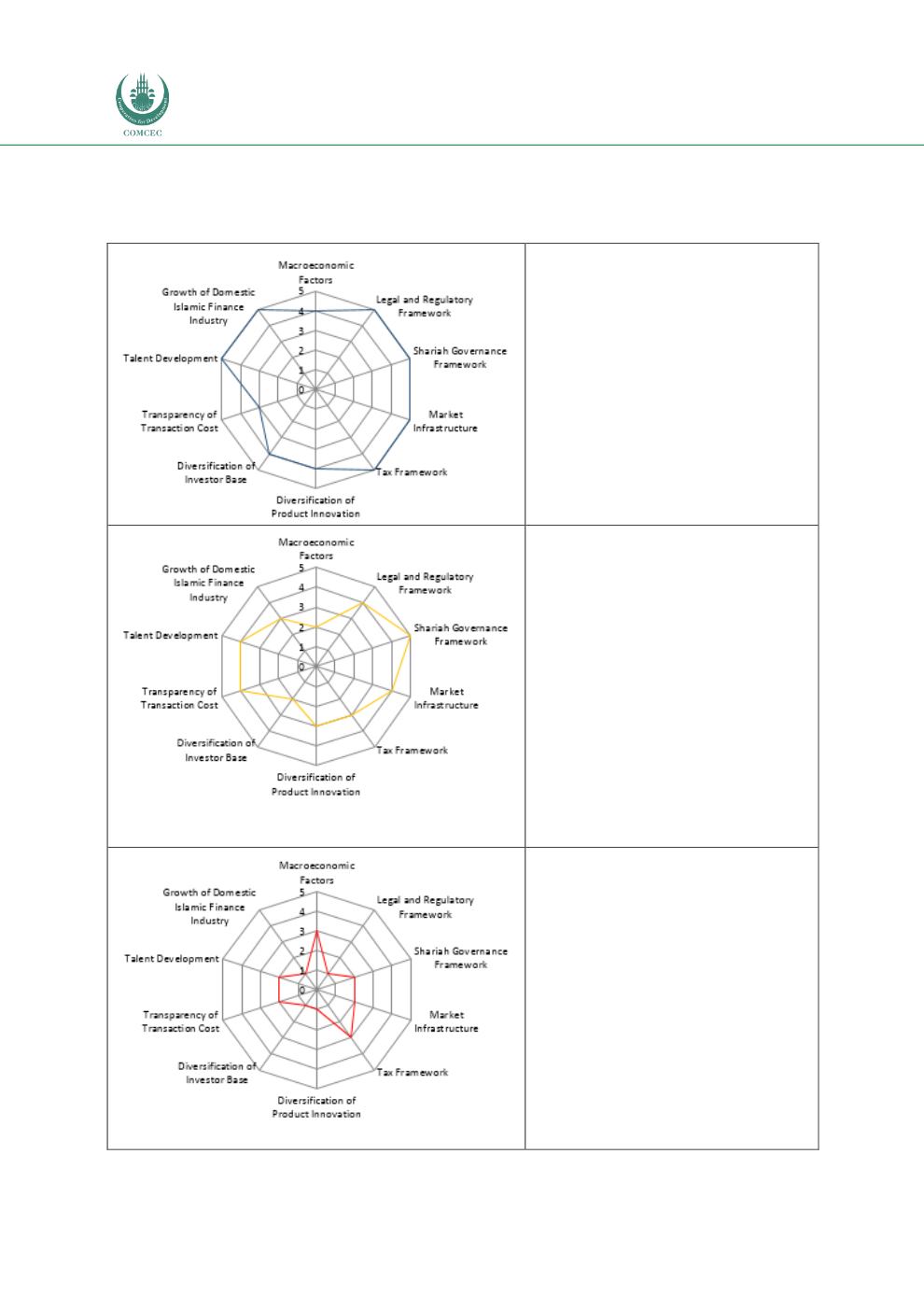

The following spider charts encapsulate the current state of each case country’s Islamic fund

management industry and the areas, which need to be further enhanced to facilitate the

industry’s progression:

Malaysia

Categorised as ‘matured’ due to

its level of market maturity.

Each

factor

was

ranked

favourably denoting the strong

eco-system that the government

and regulators have developed to

support a thriving Islamic fund

management industry.

Nevertheless, there is room for

further improvements which are

discussed in detail in the

respective case country section.

Pakistan

Categorised

as

‘developing’

(advanced stage) in view of a

growing equity and sukuk

market.

The government and regulators

have made concerted efforts to

improve

the

policies

and

guidelines

supporting

the

country’s

Islamic

finance

industry.

As market activities improve, so

will the level of progression for

the variables denoted in the

spider chart.

Morocco

Morocco’s

Islamic

finance

industry is still in a nascent stage

hence its categorisation as

‘infancy’.

The country’s Islamic capital

market has yet to be established.

Only Islamic banking has been

made

available,

having

commenced operations in 2017.

Its spider chart depicts the above

conditions and the pillars which

need to be developed.