Islamic Fund Management

5

South Africa

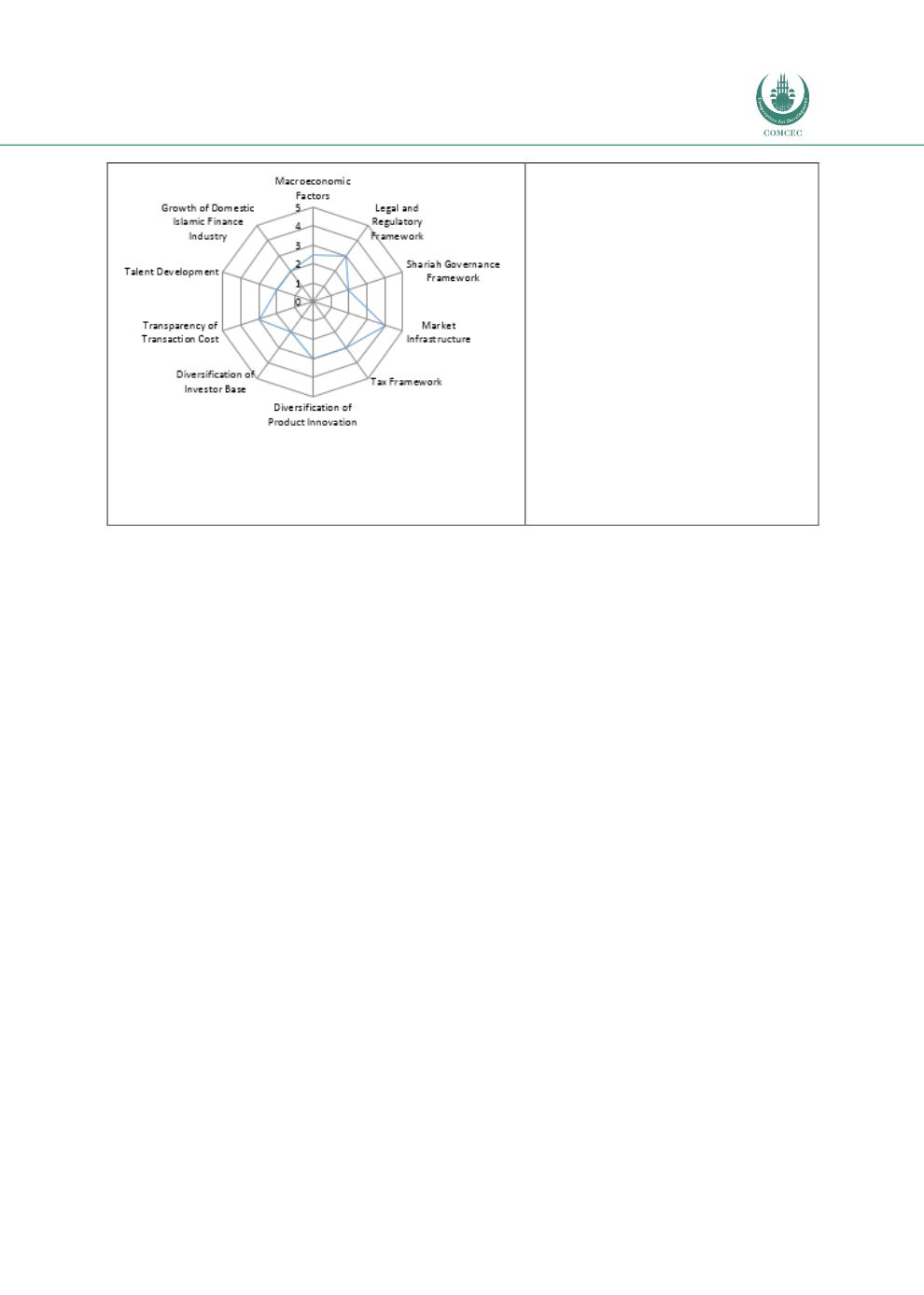

As a non-Muslim country, South

Africa has fared well to be

categorised

as

‘developing’

(intermediate stage).

Its robust banking system and

healthy capital markets depict its

budding potential to inculcate

Islamic finance into its financial

landscape.

Sustainability of its Islamic fund

management industry will be

dependent

on

market

practitioners’ efforts to portray a

valuable proposition in driving

future growth.

Sources: RAM, ISRA

In conclusion, a key measure of success for any Islamic fund market is the extent to which it

unlocks and promotes opportunities for wealth creation as well as capital formation. As such,

the pillars supporting the overarching stability of an Islamic fund management industry and its

collective development and progress will have a bearing on the pace of future growth. To

further boost growth, the preservation of trust and confidence among market participants,

especially retail investors, holds the key to success. Financial inclusion and the cohesive

collaboration of key market stakeholders will thus determine whether domestic wealth can be

created and leveraged to support a country’s economic expansion.