Islamic Fund Management

2

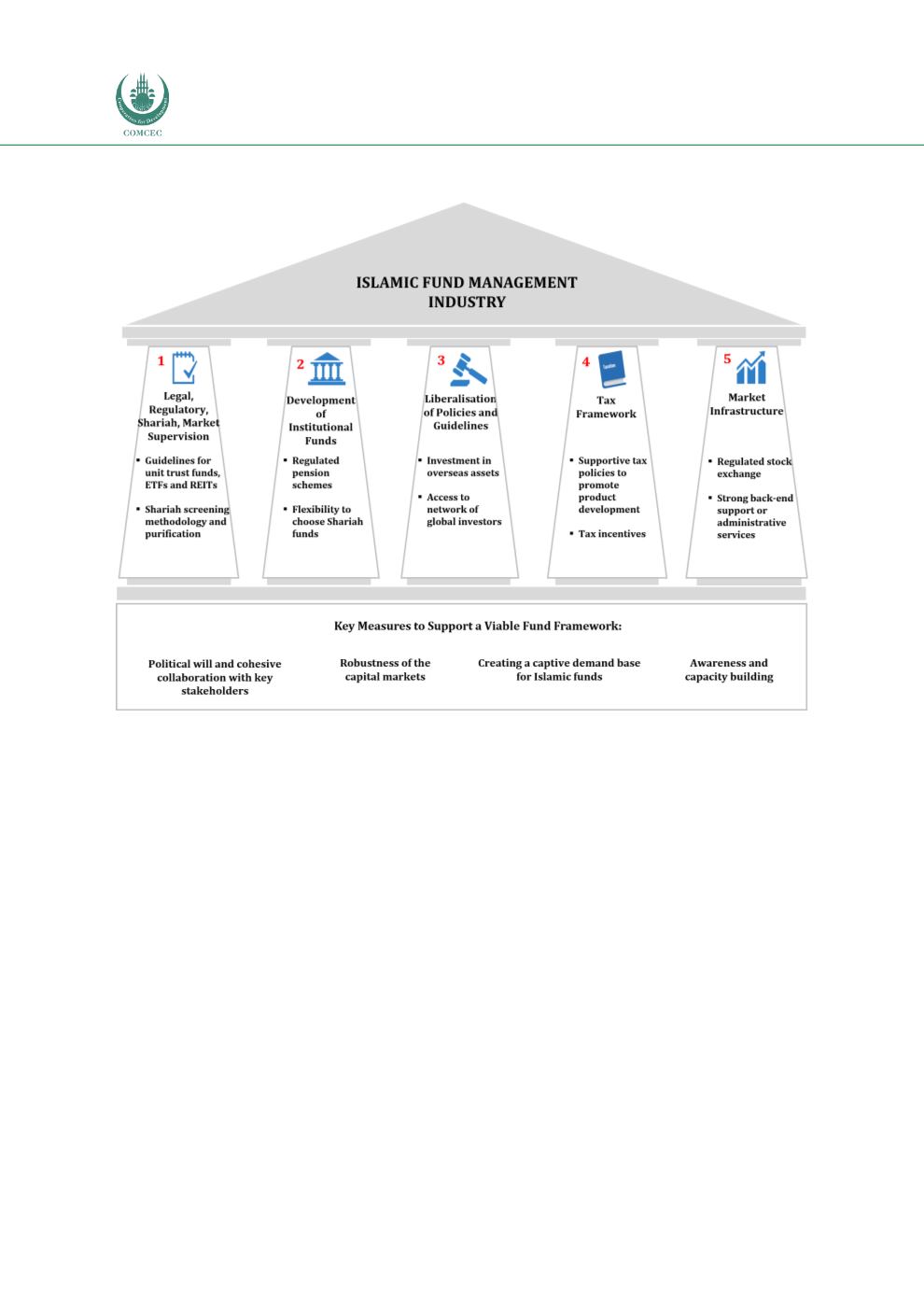

Figure 1: Building Blocks to Sustain the Long-Term Growth of Islamic Fund Management

Source: RAM

Pillar 1 – Legal, Regulatory, Supervision and Shariah Frameworks

The establishment of a robust regulatory framework and ongoing market supervision

engender trust in the markets, allowing greater transparency in product development,

approval processes and governance while ensuring the protection of investors’ interests. The

governing rules and regulations that are issued by a regulatory body set the tone on the

conduct of asset management companies (AMCs) or fund managers and facilitate the orderly

development of the Islamic fund management industry. Since licences are issued by the

authorities, misconduct or the provision of false information to the public will result in the

revocation/suspension of licences and/or imposition of fines.

Equally important is the development of a trusted Shariah framework to govern the operations

of the Islamic fund management industry within accepted Shariah parameters. The issuance of

guidelines on Shariah screening and purification processes provides greater clarity to

investors and other market participants as regards their business conduct.

Pillar 2 - Development of Institutional Funds

The development of a captive market for Shariah-compliant assets is key to building an

investor base for Islamic funds. Wealth preservation and capital appreciation start with