Islamic Fund Management

158

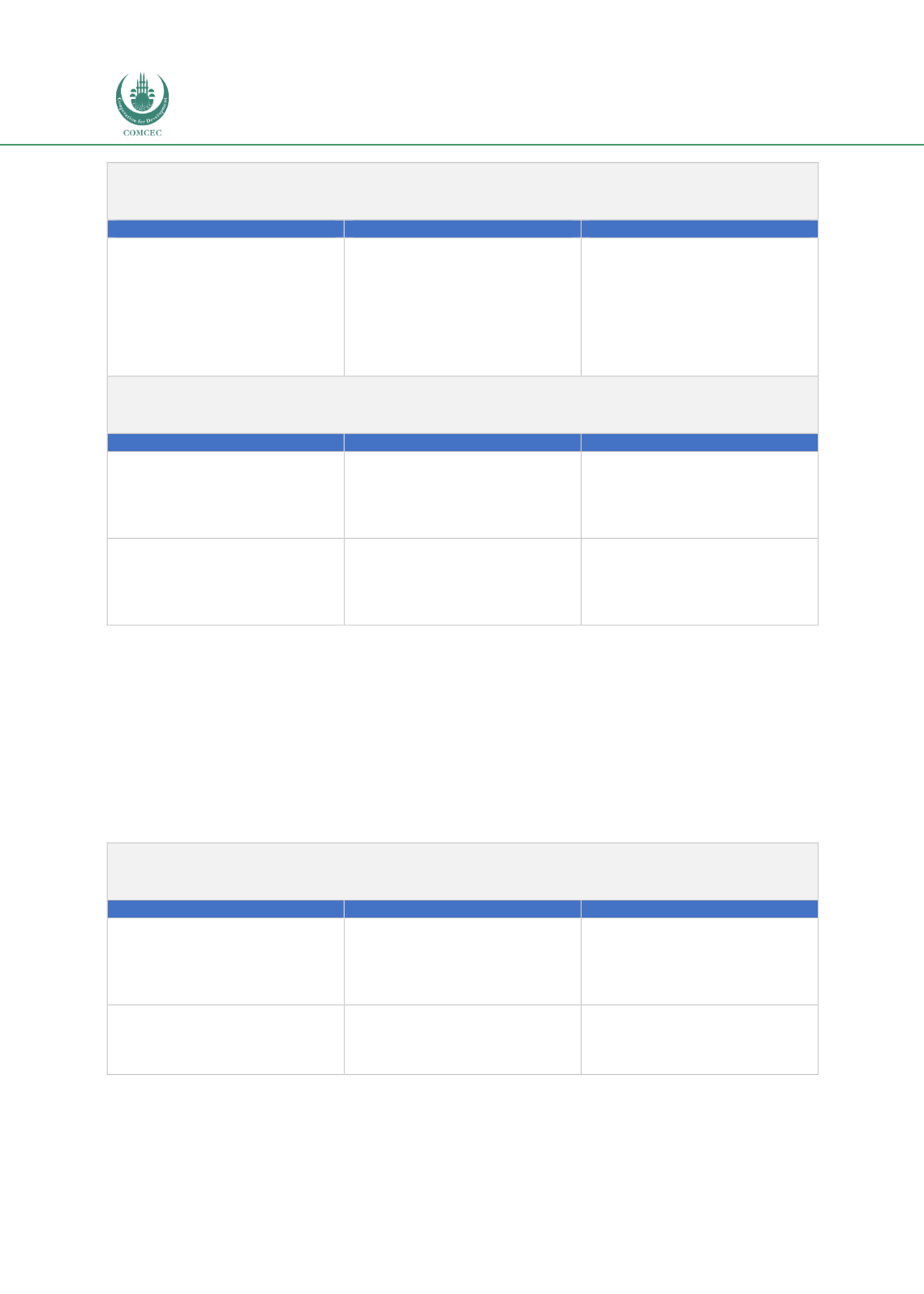

Pillar 4 – Tax Framework

Thrusts

Issues and Challenges

Key Recommendations

Implement measures to secure

commitments

from

targeted

segments (supply and demand

sides) to sustain the long-term

growth of Islamic funds.

Despite tax incentives, there are

still

more

opportunities

for

investments to grow.

Apart from providing tax rebates,

the government should also

consider

matching

individual

investments in Islamic funds (e.g.

the government to match every

USD1 saved in Islamic funds and to

introduce tax incentives for SRI

funds).

Pillar 5 – Market Infrastructure

Thrusts

Issues and Challenges

Key Recommendations

Facilitate new digital business

models to promote seamless reach

for Islamic funds.

Connectivity

to

the

masses

remains a challenge for regulators

and fund managers.

Leverage the use of mobile phones

to interface with applications such

as robo-advisors, to improve ease

of fund investment and market

education.

Promote merit-based fees and

transparency of costing structure.

High up-front transaction costs

deter

penetration

of

retail

investors.

Regulators

to

engage

with

developed

countries

and

implement

transparent

cost

structures, with the aim of making

transaction costs more effective.

Sources: RAM, ISRA

Developing Markets

The level of financial inclusion was a key concern during the review of Pakistan and South

Africa. The creation of a broader base of captive investors is important for the development of

the Islamic fund management industry, especially in developing markets. The sustainability of

ICM performance is the backbone to facilitating organic growth.

Table 5.3lists the common

issues and proposed solutions.

Table 5.3: General Recommendations for a Developing Market

Pillar 1 – Legal, Regulatory and Shariah Framework

Thrusts

Issues and Challenges

Key Recommendations

Develop investors’ trust and

confidence

in

products

and

services.

Lack of trust in the feasibility of

investments in Shariah funds.

Regulators and market players

work together to improve the level

of awareness and highlight the

governing rules for investor

protection.

Establish comprehensive legal,

regulatory

and

Shariah

frameworks.

Lack of effective implementation

and enforcement of laws and

regulations, giving rise to gaps in

the system.

Review existing policies and

guidelines and address the gaps.