Islamic Fund Management

162

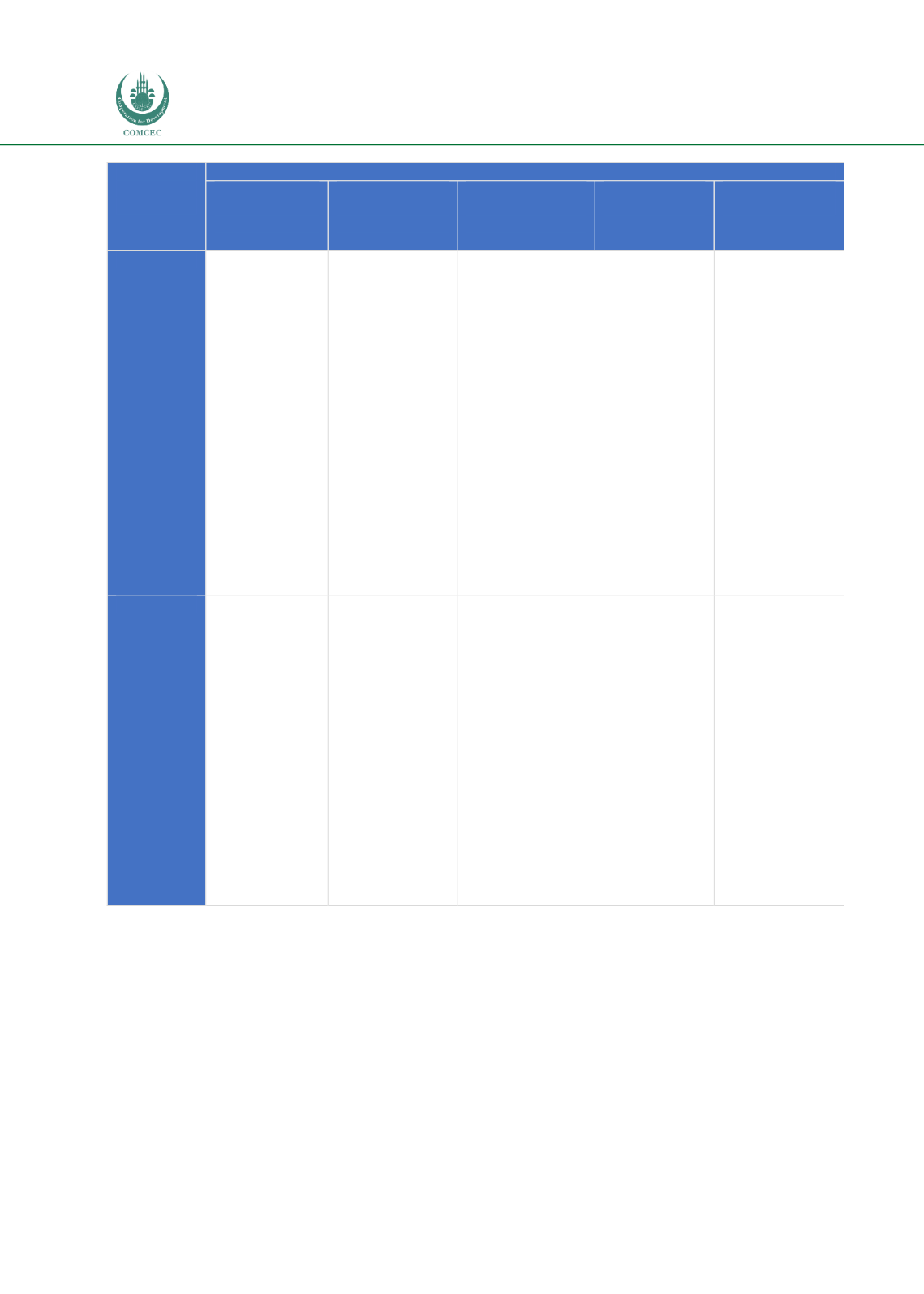

Type of

Market

PILLARS

Legal,

Regulatory and

Shariah

Framework

Development of

Institutional

Funds

Liberalisation of

Policies and

Guidelines

Tax

Framework

Market

Infrastructure

Developing

Regulators

and market

players work

together to

improve the

level of

awareness

and highlight

governing

rules for

investor

protection.

Review of

existing

policies and

guidelines and

address the

gaps.

Establish

specific policies

and guidelines

to regulate

investments

and

administration

of funds.

Regulators or

institutional

investors

provide seed

investment in

Islamic funds

to spur

performance

and build the

necessary

track record.

Government or

quasi-

government

sector to allocate

funds as an

incentive. In

return, the

foreign fund

managers must

bring a

minimum level

of foreign

investments

onshore. Rules

on foreign

ownership

should also be

liberalised.

Same as

above.

Development of

human capital

through

government

incentives to

increase

knowledge/tale

nt in Islamic

finance.

Infancy

Enforcement

of governing

rules and

regulations to

speed up

market

development,

including the

launch of

guidelines on

Islamic fund

management

and the

setting up of

policies for

investor

protection.

Identify

institutions as

catalysts in

promoting

investment in

Shariah assets.

Institute

adoption of

policy

liberalisaton in

the roadmap for

the

establishment of

the Islamic fund

management

industry.

Amend tax

regime to first

create a level

playing field.

Tax rebates

are the

quickest

route to

attracting

retail

investments.

Develop market

platforms and

infrastructure

to enable the

efficient

provision of

products and

services.

Liberalisation

of capital

controls.

Sources: RAM, ISRA

Knowing which phase of development an Islamic fund management industry is in will facilitate

the implementation of the right strategies. The Development-Stage Matrix has been designed

for this purpose and any jurisdiction may deploy the matrix for the purpose of market

identification. Factors influencing market development should also be monitored, with an

emphasis on improving demand (buy side) and supply (sell side), as these will affect the

sustainability of Shariah assets.

In conclusion, each country should adopt a viable framework and roadmap to progressively

develop its domicile Islamic fund management industry

. Figure 6.1provides a generic guide to

the critical success factors and phases of development vis-à-vis supporting a sustainable