Islamic Fund Management

153

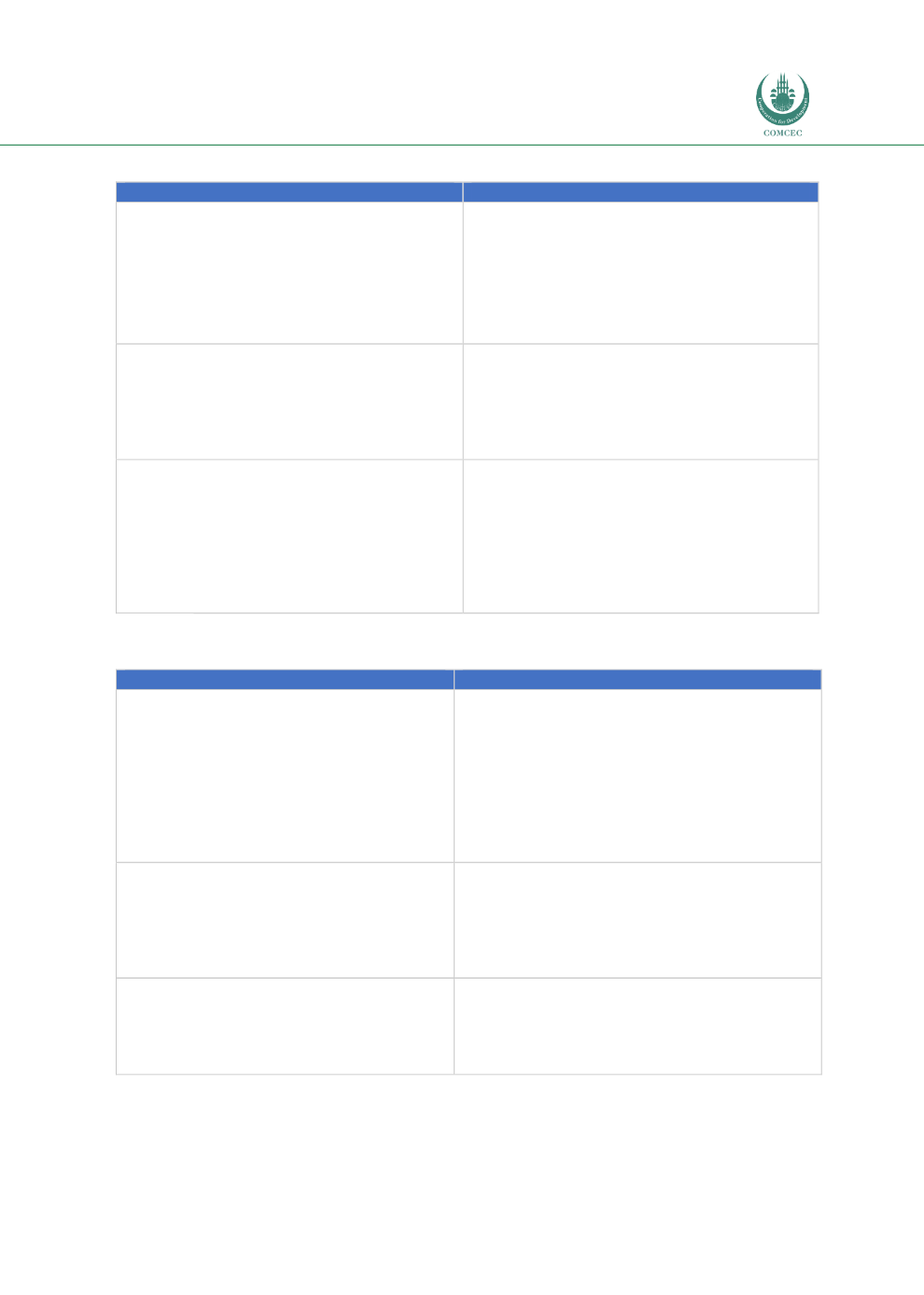

Table 4.25: Recommendations on Improving Demand (Buy Side)

Issues and Challenges

Demand (Buy Side) Opportunities

1.

Lack of market awareness and

understanding of Islamic finance

Concerted efforts by the Islamic finance

community to build understanding, awareness

and promote Islamic finance to Muslims and

non-Muslims. The setting up of a viable

proposition to attract corporate sector

sponsorship may provide opportunities to host

Islamic finance conferences/seminars/training.

2.

Government and private sector employees

are not given the flexibility to choose the

type of pension funds to invest in

Encourage the government and private sector

employers to allow employees to decide which

funds to invest in. This will facilitate

opportunities for Muslims or ethically-inclined

employees the option of investing in Shariah-

based funds.

3.

Lack of incentives to encourage Shariah-

compliant savings and investment

Provide tax incentives to investors to invest

in Shariah-compliant products and for

AMCs to establish Islamic funds.

Tap the potential wealth of

awqaf

funds,

high-net-worth Muslim individuals, and

other Islamic funds to create a base of

Islamic institutional investors that will spur

demand for Islamic fund products.

Source: RAM

Table 4.26: Recommendations on Improving Supply (Sell Side)

Issues and Challenges

Supply (Sell Side) Opportunities

Inadequate Shariah compliant asset

In line with the government’s efforts to

increase the number of green companies,

public awareness on the similarities of

Islamic finance and ESG/green finance should

be

emphasised.

This

will

encourage

companies to be listed as both Shariah-

compliant and ESG entities.

Develop an ICM masterplan to spur the

promote of Shariah-compliant assets.

Absence of a harmonised approach among

the Shariah advisor committee.

Create a task force that comprises industry

players and regulators, with representatives

from every company to develop a harmonised

Shariah governance framework. This will help

address disputes and promote transparency

in Shariah rulings.

Shortage of experts in Islamic finance

industry

Establish accredited Islamic education

institutions to offer Islamic finance training/

professional courses. Encourage local Islamic

finance talent from the corporate sector to

share their experience and knowledge.

Source: RAM