Islamic Fund Management

157

5.2

General Recommendations for Improving Islamic Fund Management

A broad set of recommendations has been proposed to address the inherent challenges faced

by each country. Depending on its stage of development, the recommendations are envisaged

to accelerate or jump-start the country’s developmental efforts.

Matured Market

Based on our analysis of Malaysia, its level of maturity is depicted by its well-developed

architecture as defined through its robust legal, regulatory and Shariah frameworks, and

strong ICM ecosystem that promotes the sustainability of Shariah assets. These factors

facilitate the development of a stable Islamic fund management industry. Nonetheless, there is

still room for further improvement, as defined by the SC’s

Islamic Fund and

Wealth

Management Blueprint

. In accordance with the five core pillars, the recommendations i

n Table 5.2are proposed for consideration.

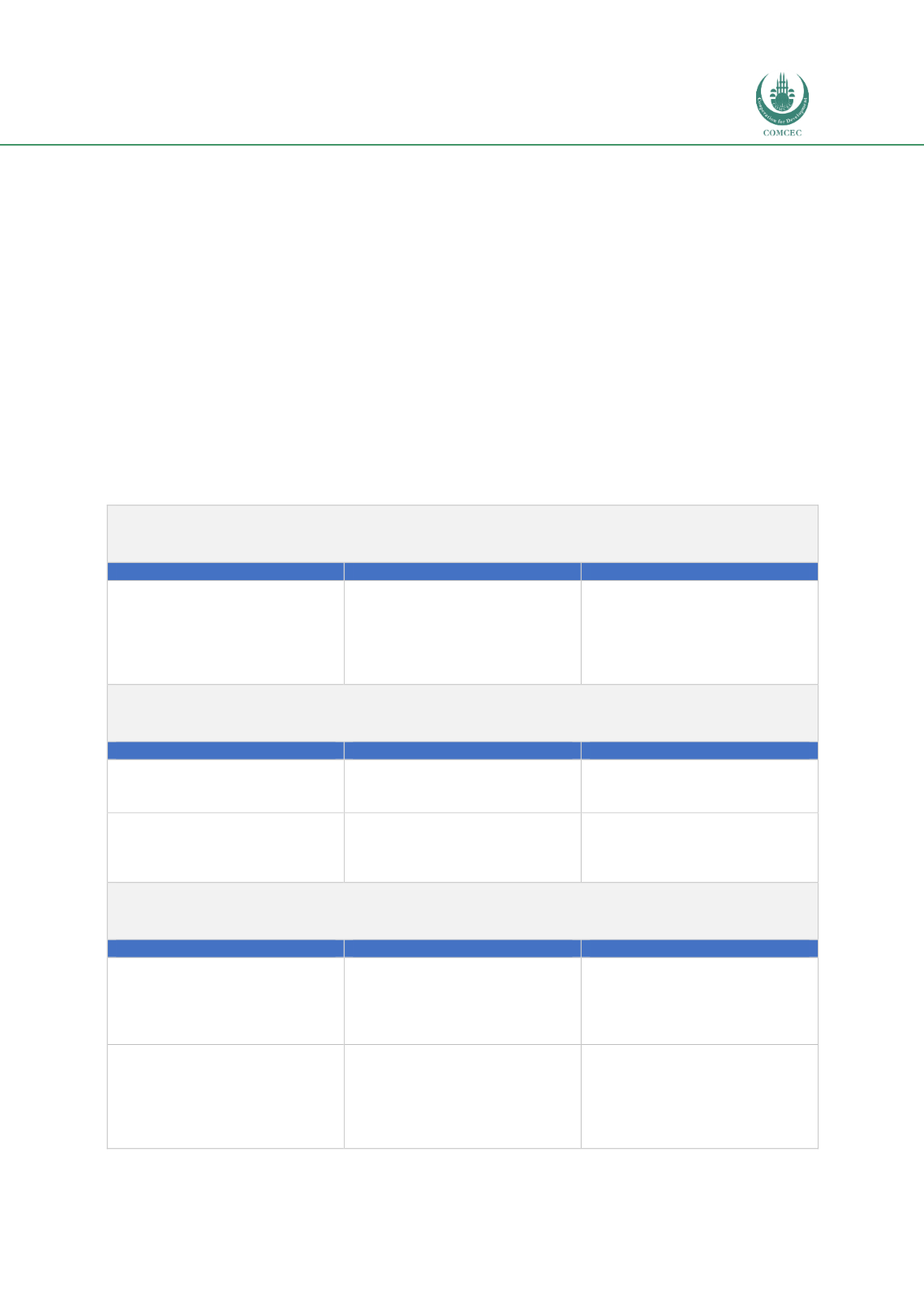

Table 5.2: General Recommendations for a Matured Market

Pillar 1 – Legal, Regulatory, Shariah Frameworks and Market Supervision

Thrusts

Issues and Challenges

Key Recommendations

Provide enabling frameworks to

support

fintech

and

attract

international SRI investors.

The choice of which international

SRI standard to adopt will have a

bearing on market activities.

Adoption of an open architecture

will facilitate business activities.

Proactive

engagement

with

market players on which route to

adopt will help in the decision-

making process.

Pillar 2 – Development of Institutional Funds

Thrusts

Issues and Challenges

Key Recommendations

Development

of

institutional

investors with a focus on investing

in Islamic funds.

Some institutions are concerned

about the performance of Islamic

funds.

Realign values with beneficiaries

and manage the perception of

market performance

.

Streamline religious beliefs with

investment behaviour.

Muslims are unaware of their

responsibilities

in

money

management.

The same values adopted by a

Muslim in his or her way of life

should restrict investors to only

choosing Islamic funds.

Pillar 3 – Liberalisation of Policies and Guidelines

Thrusts

Issues and Challenges

Key Recommendations

Enhance market access and

international connectivity.

Based on industry feedback, there

are still gaps in the system which

could lead to a slower turnaround

in the launch of funds and

insufficient market involvement.

Regulators to proactively engage

with domestic and foreign fund

managers

to

seek

practical

solutions to closing the gaps.

Enhance market position as an

international fund centre.

Bilateral

and

multilateral

regulatory

cooperation

arrangements with international

jurisdictions exist, although more

can be done to further expand

market linkages and connectivity.

Cooperate with other jurisdictions

to promote Malaysia as a

passporting centre for global

Islamic funds.