Islamic Fund Management

160

Infant Market

Markets that fall under the ‘infancy’ stage have the advantage of learning from the experience

of advanced markets, to determine their overarching framework and roadmap for the Islamic

fund management industry. Each jurisdiction evolves differently, taking into account inherent

market conditions and which route to adopt to facilitate successful inclusion. The

recommendations in

Table 5.4set preliminary proposals. Since it is a new market with very

little experience, issues and challenges are not applicable.

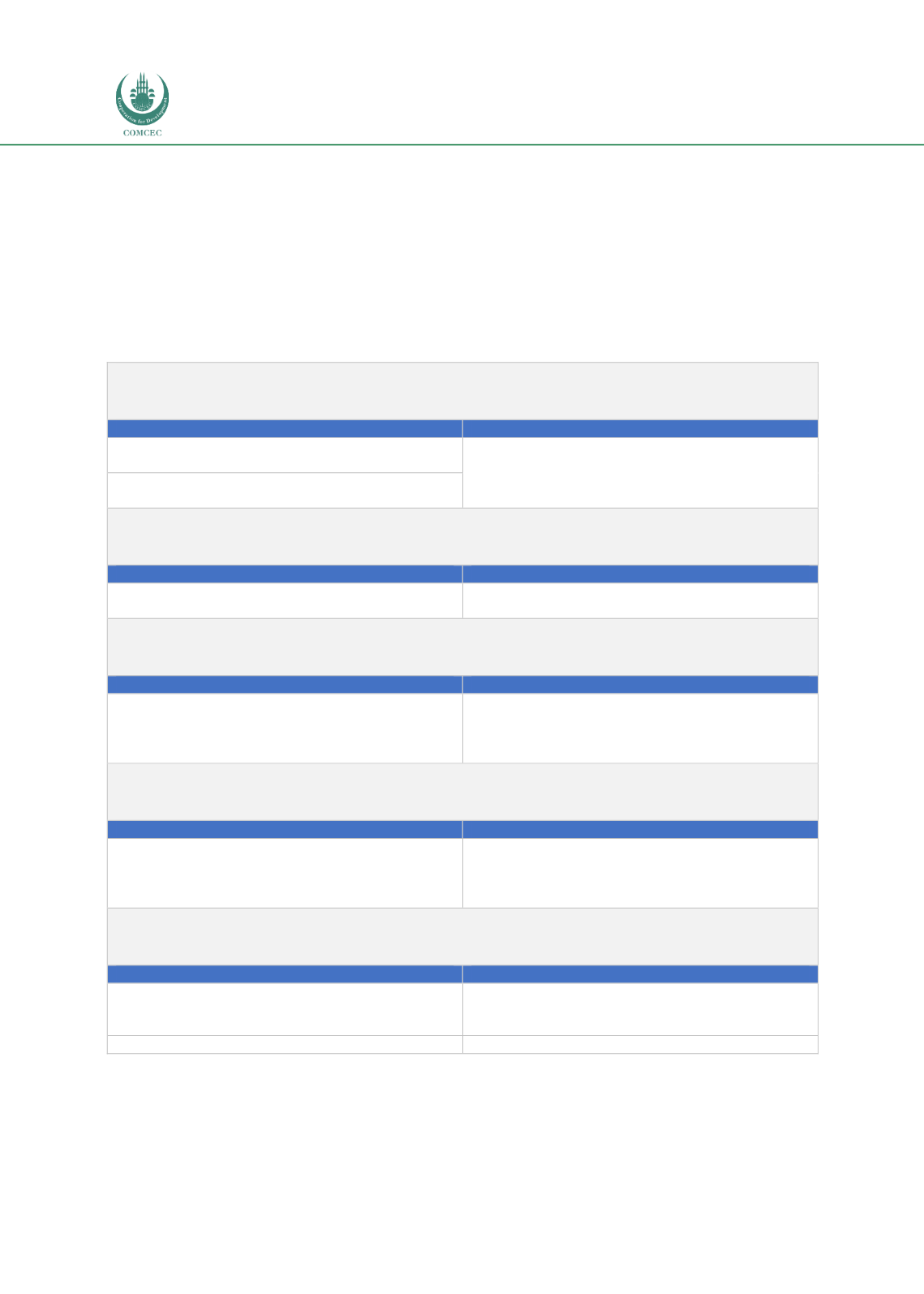

Table 5.4: General Recommendations for an Infant Market

Pillar 1 – Legal, Regulatory and Shariah Framework

Thrusts

Key Recommendations

Develop investors’ trust and confidence in products

and services.

Enforcement of governing rules and regulations to

speed up market development, including the launch

of guidelines on Islamic fund management and the

setting up of policies for investor protection.

Establish comprehensive legal, regulatory and

Shariah frameworks.

Pillar 2 – Development of Institutional Funds

Thrusts

Key Recommendations

Facilitate the involvement of institutional funds from

the outset.

Identify institutions as catalysts in promoting

investments in Shariah assets.

Pillar 3 – Liberalisation of Policies and Guidelines

Thrusts

Key Recommendations

Promote the liberalisation of policies and guidelines.

Institute policy liberalisaton in the roadmap for the

establishment of the Islamic fund management

industry.

Pillar 4 – Tax Framework

Thrusts

Key Recommendations

Inculcate fiscal stimulus to incentivise the

involvement of market players (demand and supply)

and accelerate growth.

Amend tax regime to first create a level playing

field.

Tax rebates are the quickest route to attracting

retail investments.

Pillar 5 – Market Infrastructure

Thrusts

Key Recommendations

Establish a vibrant and effective ecosystem for the

deployment of Islamic funds.

Develop market platforms and infrastructure to

enable the efficient provision of products and

services.

Promote free flow of capital.

Liberalisation of capital controls.

Sources: RAM, ISRA