Islamic Fund Management

161

6.

CONCLUSION

In lieu of our assessment of the case countries, the comparison is made between the ecosystem

for the Islamic fund management industry and the progress of a specific market in developing

its core pillars (refer to

Figure 5.1 ). Subsequently, policy recommendations have been

proposed for the different types of markets. As a market grows in maturity, greater emphasis

is given to strengthening the base of supply and demand as well as the overall development of

the Islamic fund management industry’s ecosystem. Compared to the developing stage, the

focus is now on the review of existing policies and guidelines, identifying gaps in the

framework and continuous expansion of products and services. For the infancy stage, the

setting up of a viable framework and roadmap goes a long way towards detailing the measures

that need to be taken. Ultimately, the level of cohesiveness between regulators and market

players in reaching out to potential investors is critical for any market development, as well as

enhancing market understanding of Shariah funds.

Table 6.1summarises the policy

recommendations for the development of the five core pillars.

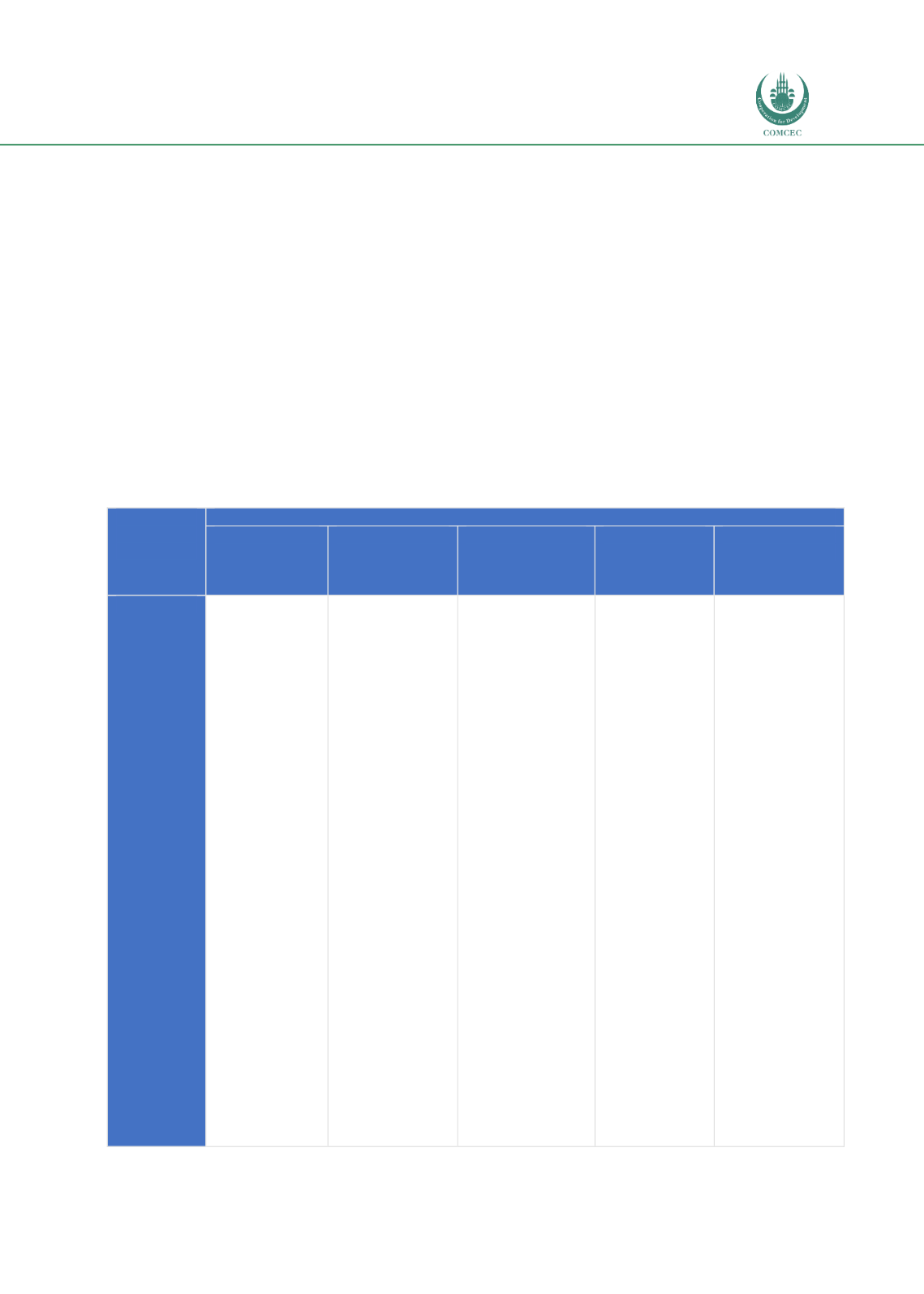

Table 6.1: Summary of Policy Recommendations

Type of

Market

PILLARS

Legal,

Regulatory and

Shariah

Framework

Development of

Institutional

Funds

Liberalisation of

Policies and

Guidelines

Tax

Framework

Market

Infrastructure

Matured

Adoption of an

open

architecture

will facilitate

business

activities.

Proactive

engagement

with market

players on

which route to

adopt will

help the

decision-

making

process.

Realign values

with

beneficiaries

and manage the

perception of

market

performance

.

The same

values adopted

by a Muslim in

his or her way

of life should

restrict

investors to

only choosing

Islamic funds.

Regulators to

proactively

engage with

domestic and

foreign fund

managers to find

practical

solutions to

closing the gaps.

Establish

cooperation with

other

jurisdictions to

promote

Malaysia as a

passporting

centre for global

Islamic funds.

Apart from

providing tax

rebates to

retail

investors, the

government

should

consider

matching

individuals’

investments

in Islamic

funds (e.g. the

government

will match

every USD1

saved in an

Islamic fund).

Leverage the

use of mobile

phones to

interface with

applications

such as robo-

advisors, to

improve

awareness and

market

education.

Regulators to

engage with

developed

countries to

facilitate

sharing of

knowledge and

explore the

viability of a

transparent

cost structure,

with the aim of

making

transaction

costs more

effective.