Islamic Fund Management

132

Furthermore, opportunities exist for the development of a whole range of Islamic funds, from

Islamic UCITS to Islamic REITs and from commodity funds to

waqf

funds. There are already

several UCITS in Morocco, which have gained appeal among international investors because

they provide a certain level of investor protection and meet international regulatory

standards. Developing Islamic UCITS can attract funds from international Islamic investors. On

the other hand, currency convertibility and capital repatriation are likely issues, as with the

other countries in the case studies. There is also the potential for the development of

waqf

funds by encouraging public-private-philanthropic partnerships to develop

waqf

assets and

invest in social objectives.

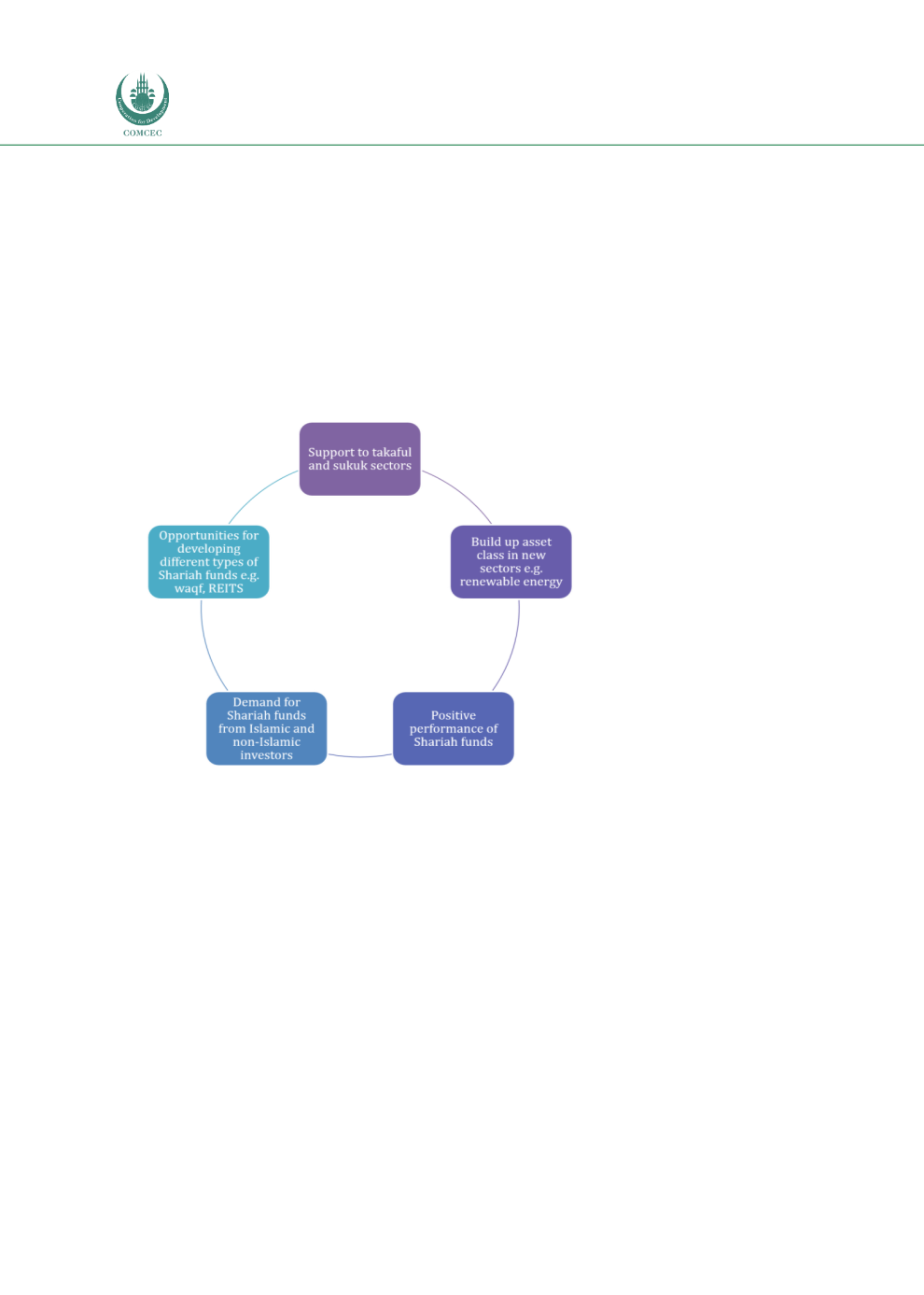

Figure 4.18summarises some of the investment and commercial

considerations for the development of the Islamic fund management sector in Morocco.

Figure 4.18: Investment and Commercial Considerations in Developing Morocco’s Islamic

Funds

Source: ISRA

Morocco is currently working on the launch of REITs. The legal structure of REITs in Morocco

is based on the Organismes de placement collectif en immobilier (OPCI) (or collective

undertaking for real estate investment), the laws of which were passed in August 2016. The

authorities are currently working on regulations/circulars, which are expected to be released

in 2018 following the approval of the Ministry of Economy and Finance. Investments in real

estate are one of the important asset classes in the Islamic finance industry; the OPCI Law is a

significant opportunity to align Shariah compliance with investments in real estate. They will

allow financial institutions in the participation finance sector to mobilise new resources by

transferring their real assets to REITs.

The OPCI Law allows REITs to issue sukuk, shares and other securities. A Shariah-compliant

REIT modelled on the

ijarah

contract only invests in real estate meet Shariah requirements

(representing at least 60% of investments), limits the extent of debt, avoids speculative

activities and specific Shariah non-compliant sectors. It is expected that REITs units can be

sold for as low as 100 dirhams so that it is accessible to retail investors and generate annual

returns of 6%-7%. REITs are expected to have a potential AuM of at least 200 billion dirhams,

according to the Moroccan Ministry of Economy and Finance.