Islamic Fund Management

129

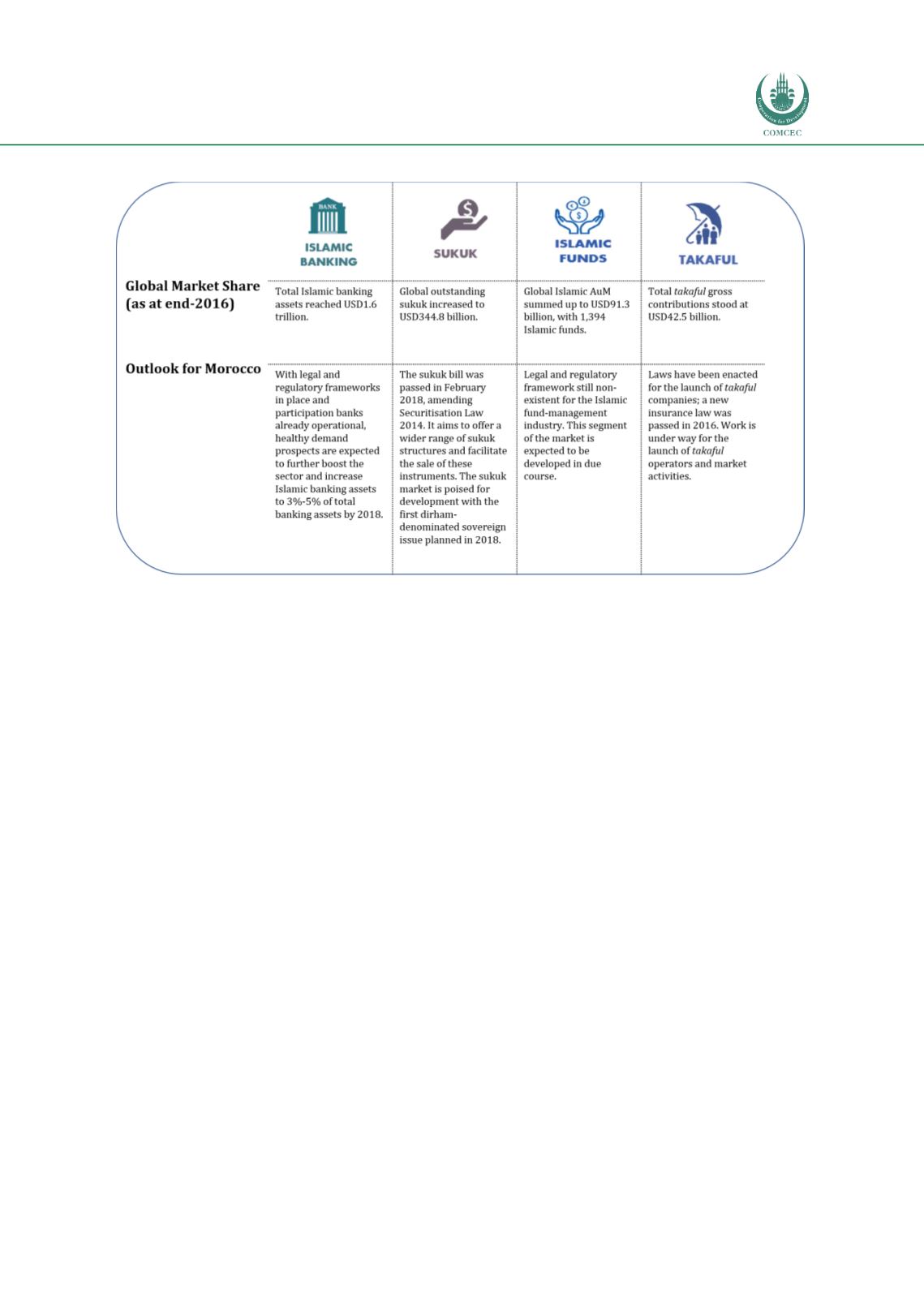

Figure 4.16: Global Market Shares of Islamic Finance and Outlook for Morocco

Source: ICD-Thomson Reuters (2017), ISRA

4.4.2

Evolution of Morocco’s Islamic Finance and Islamic Fund Management

Industries

Morocco’s attempt to introduce Islamic finance started in 2007, under the appellation of

‘alternative finance’ (Thomson Reuters, 2013). The development was on a small scale and

drew little response from most of the population. A study by Soudi and Cherkaoui (2015)

reports the following:

The central bank developed a regulatory framework allowing local banks to offer

ijarah

,

murabahah

and

musharakah

products through their own distribution networks or the

creation of dedicated subsidiaries.

The authorised products only concerned financing and not deposits, as the central bank

allowed customers to deposit their money in the form of ‘non-productive deposits’

accounts.

Four of the 19 local banks offered Islamic banking products, notably Attijariwafa Bank,

Banque Populaire, BMCE and BMCI. The focus was more on

murabahah

products rather

than

ijarah

, while

musharakah

was not offered. Transactions had yet to exceed 1 billion

Moroccan dirhams by 2012.

Constraints faced included taxation issues, the high cost of the products, marketing

issues and market participants’ weak commitment.

Enactment of the New Banking Law 2014 had revived the development of Islamic banking in

Morocco. Project Law 103-12 on Credit Institutions and Similar Bodies (Banking Law)

provides a revised legal framework to regulate the activities of banks and similar organisations

conducting business in Morocco, and

includes a chapter on participation banks (Jouti, 2017).

The new wave of development, backed by strong political support, lends consideration to the

building of a robust legal and regulatory framework for the development of a comprehensive