Islamic Fund Management

130

Islamic finance ecosystem; puts in place an appropriate Shariah governance framework;

adopts a progressive approach to developing the market with an initial focus on Islamic

banking,

takaful

and sukuk; and secures the commitment and collaboration of the market

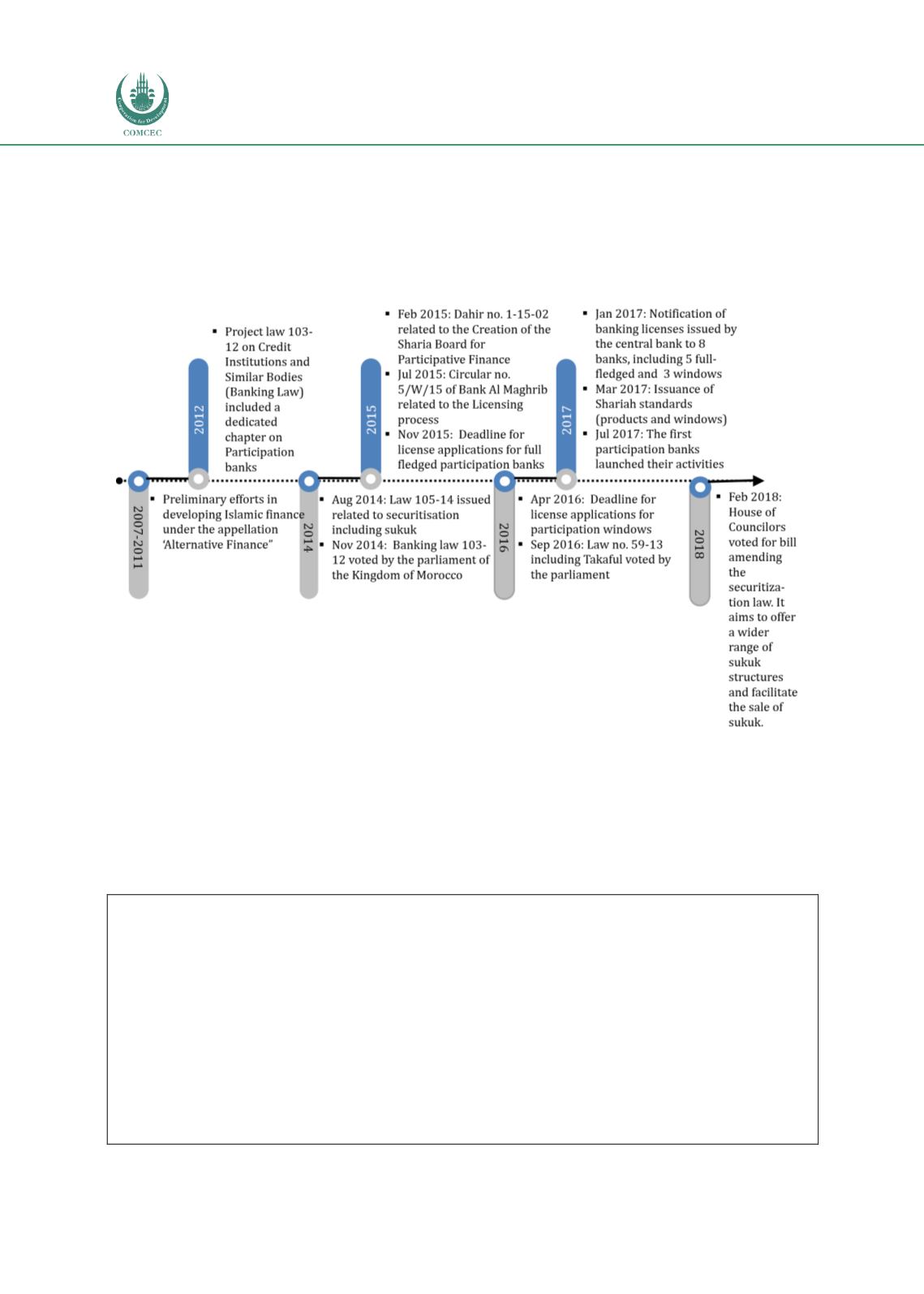

players to jointly build the Islamic finance ecosystem. The key milestones in the recent

development of the Islamic finance industry are detailed i

n Figure 4.17 .Figure 4.17: Key Milestones of Morocco’s Islamic Finance Industry

Sources: Jouti (2017), IFN (2018)

While the Islamic fund management industry is not regulated yet, there is some interest from

fund managers to manage Islamic funds. One of the fund managers that offers an ethical fund

(Shariah-compliant in principle) under its thematic funds scheme is Wafa Gestion.

Box 4.6provides some salient information on this fund.

Box 4.6: Wafa Gestion – Attijari Al Moucharaka Fund

Wafa Gestion was established in 1995. It is a subsidiary of Attijariwafa Bank (the Pan-African bank

listed on the Casablanca Stock Exchange) and Amundi (one of the world’s top 10 asset managers). It

was rated ‘Excellent (mar)’ by Fitch Ratings for its vast experience and skills in asset management,

leadership position in the Moroccan market, trained personnel and product offerings. It has 81

funds under management, with an estimated 110 billion dirhams of AuM. Its share of the asset

management market stands at around 27.11%.

Wafa Gestion launched two funds, not marketed as Shariah-compliant and without formal

endorsement by Morocco’s Council of Scholars, but specifically structured to be compliant in the

eyes of major investors. Its first ethical fund is named the Attijari Al Moucharaka Fund. It has a

retail focus and its AuM is approximately 430 million dirhams. The fund aims to provide capital

appreciation over a minimum investment period of 5 years, and has been specifically structured so

that its listed securities will outperform the MASI index over a 5-year period.