Islamic Fund Management

127

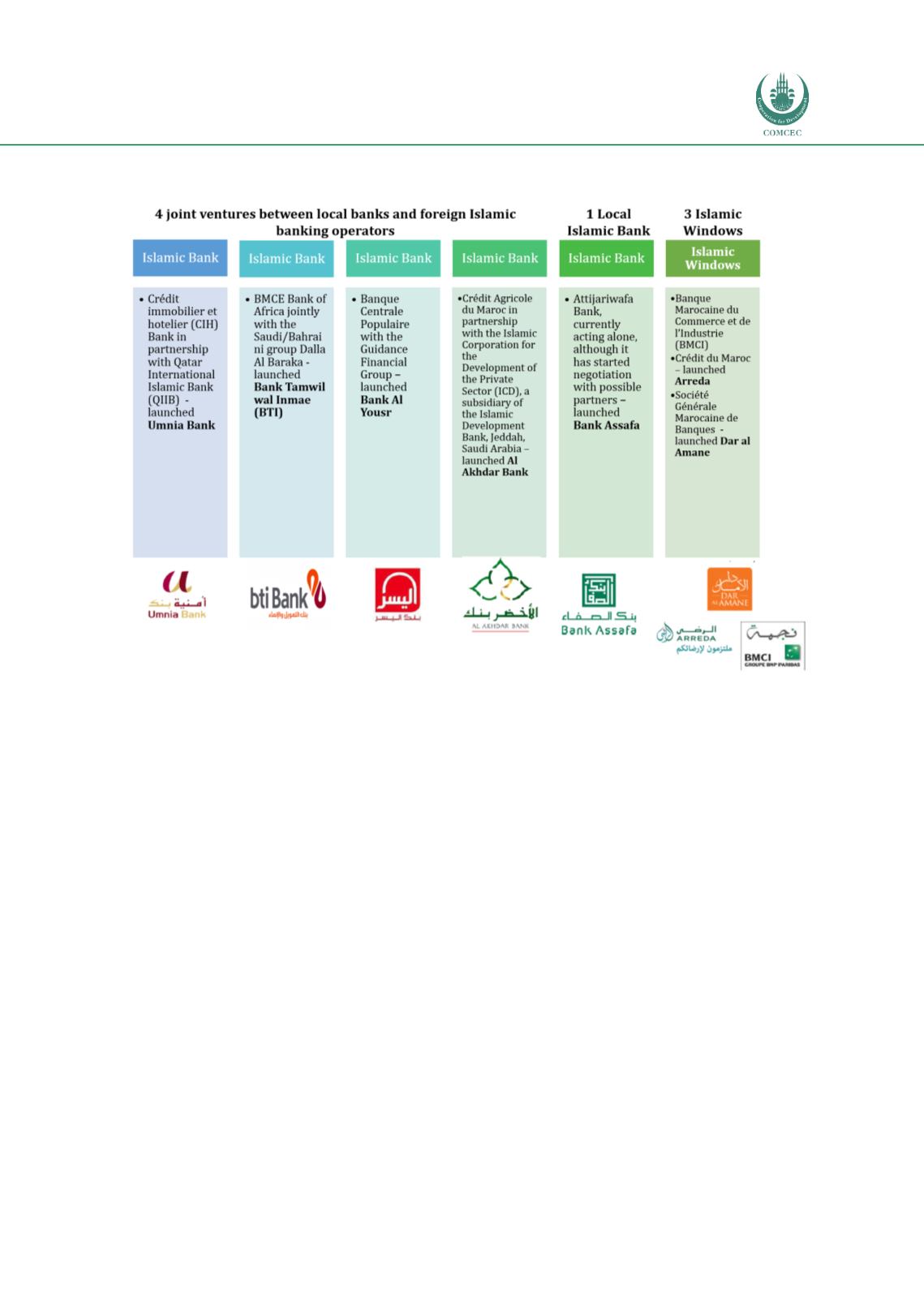

Figure 4.15: Participation Banks in Morocco – 5 Full-Fledged Banks and 3 Windows

Sources: Rodríguez and Bensar (2017), Tantaoui (2017), Jouti (2017)

The current banking products approved by the Council of Scholars, a specialised committee in

Islamic finance set up by the Higher Council of Ulemas, are:

Deposit investment products.

Financing products, notably

murabahah

for vehicles, homes and real estate.

Global and Domestic Market Shares of Islamic Finance Assets

With the launch of participation banks in Morocco, Fitch Ratings (2017) estimated that the

growth of Islamic banks in the initial years of development would be strong, similar to

countries such as Turkey and Indonesia. Thereafter, the growth potential may be limited by

the rapidly expanding banking segment, where there are approximately 70 accounts for every

100 Moroccans. According to Fitch Ratings, this suggests that Muslims in Morocco have not

shied away from the conventional banking system based on their faith. It is therefore unlikely

that participation banks would wrest significant market share from the existing and well-

established conventional banks. The deposit bases of banks could increase by 5% to 10%.

Nonetheless, two market surveys have found substantial interest from the population in

Morocco in participation banking. A survey by the Casablanca Stock Exchange (2017), which

interviewed 1,003 individuals aged over 18 years from 12 urban and rural areas, revealed that

there was interest from 34% of the sampled population in Islamic banking products from

participation banks. An earlier survey conducted by Islamic Finance Advisory and Assurance