Islamic Fund Management

138

Issues and

Challenges

Demand (Buy Side) Opportunities

3.

Develop a

national savings

strategy

To heighten the appeal of Islamic funds, the government can launch a

national savings and investment strategy, with incentives that

encourage people to invest through responsible investments that create

a social impact. This will in turn expand demand for SRI Shariah funds

while boosting the impact on society and the environment.

Islamic funds can also be promoted as an alternative avenue of

investment, with better risk-adjusted returns than bank accounts.

Source: ISRA

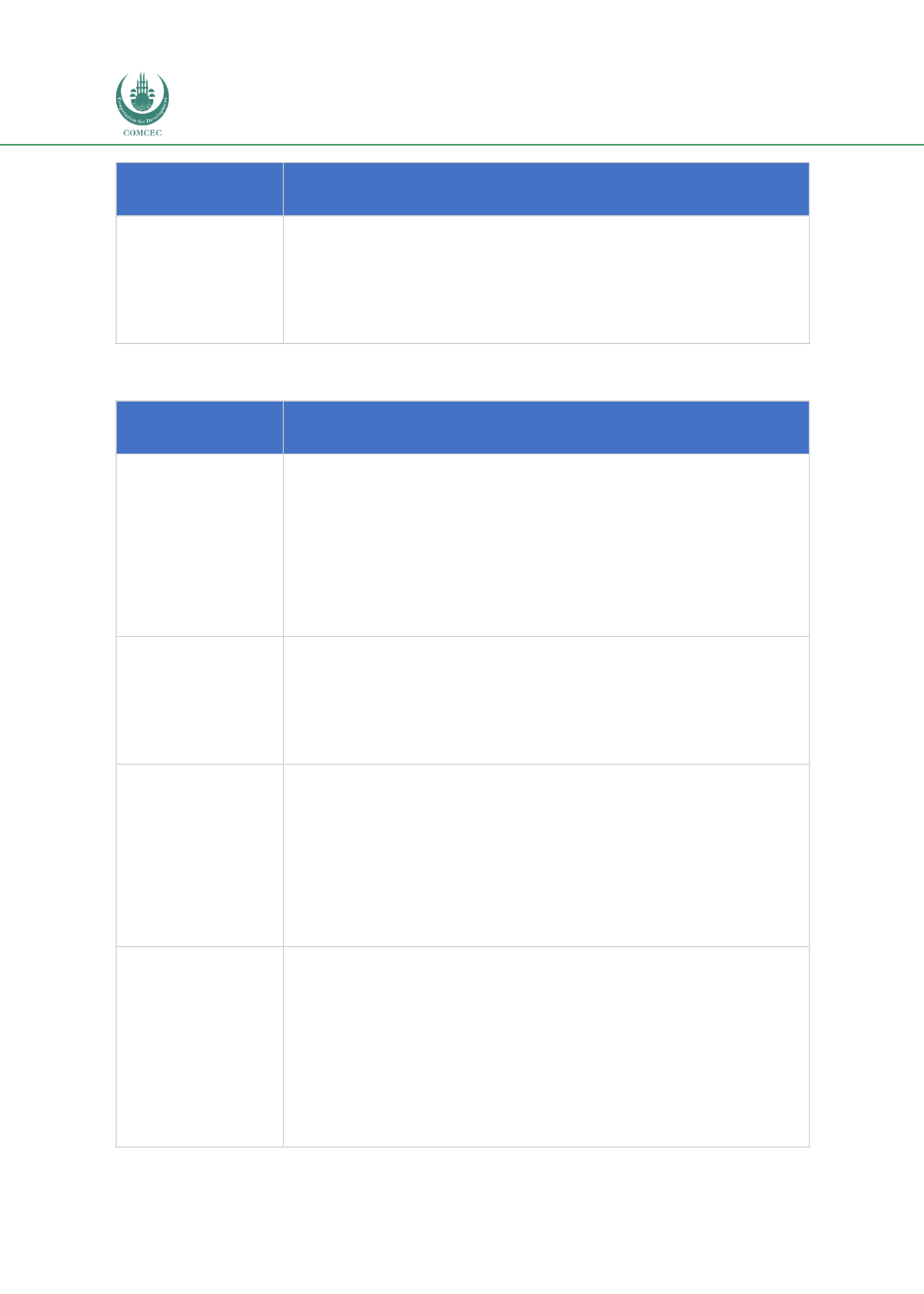

Table 4.19: Recommendations on Improving Supply (Sell Side)

Issues and

Challenges

Supply (Sell-Side) Opportunities

1.

Shariah

approval

At present, it takes time to obtain

fatwas

from the CSO as the CSO has to

deal with many issues arising from the various market segments. A

possible strategy could be to create two sub-committees: (i) one that

works on Islamic banking and

takaful

issues; and (ii) another that works

on Islamic capital market issues (i.e. sukuk, Islamic fund management,

REITs, equity market).

This will help to reduce the time taken to secure Shariah approval and

Shariah advice on issues. A similar approach is adopted by jurisdictions

such as Malaysia, which has two SACs (at the levels of the central bank

and the SC).

2.

Shariah

governance

While internal Shariah compliance has been instituted at the level of

participative banks, there is currently no guidance on external Shariah

audits and reviews. The roles of the parties involved in Shariah audits

and reviews within the different components of the Islamic finance

market (e.g. for sukuk,

takaful

, Islamic funds) need to be properly

defined to ensure effective Shariah governance of products and

procedures.

3.

Developing

industry

standards on

Shariah

screening

approaches,

income

purification and

zakah

processes

To develop the Islamic fund management industry, there is a need to

develop industry standards by the CSO on Shariah screening of stocks,

income purification and

zakah

payment. This will enable the creation of

a list of Shariah-compliant securities, the publication of such a list on a

regular basis, and the development of an Islamic index as the list of

Shariah-compliant securities grows over time. This approach was

followed by Malaysia when it first issued its list of Shariah-compliant

securities in June 1997. The number of Shariah-compliant securities had

been small initially, before rising to 686 as at 24 November 2017

(Securities Commission Malaysia, 2017).

4.

Roadmap for the

development of

the Islamic

finance industry

With a number of regulators involved in the financial sector, there is a

need to establish a coordination committee to oversee the development

of the entire sector. One of the responsibilities of such a committee

would be to develop a blueprint that maps the development of a

harmonised Islamic finance ecosystem in Morocco and defines its vision,

objectives, implementation targets and timeline for the development of

the various components of the ecosystem. This will enhance

transparency and strengthen the coordination efforts of the different

stakeholders in the industry.

There is also a role in developing new institutions within the industry to

promote the further progress of the Islamic finance industry. Examples: