Islamic Fund Management

128

Services (IFAAS) in June 2012 (Thomson Reuters 2014)

had sampled 813 individuals aged

between 18 and 55 years from a variety of socio-economic backgrounds from cities and the

surrounding rural municipalities of Casablanca, Rabat, Marrakech, Agadir, Fes, Tangier and

Oujda. It revealed that 79% of the respondents said they would be ‘very interested’ in

participation banking services once available, but that they were price-sensitive. A Thomson

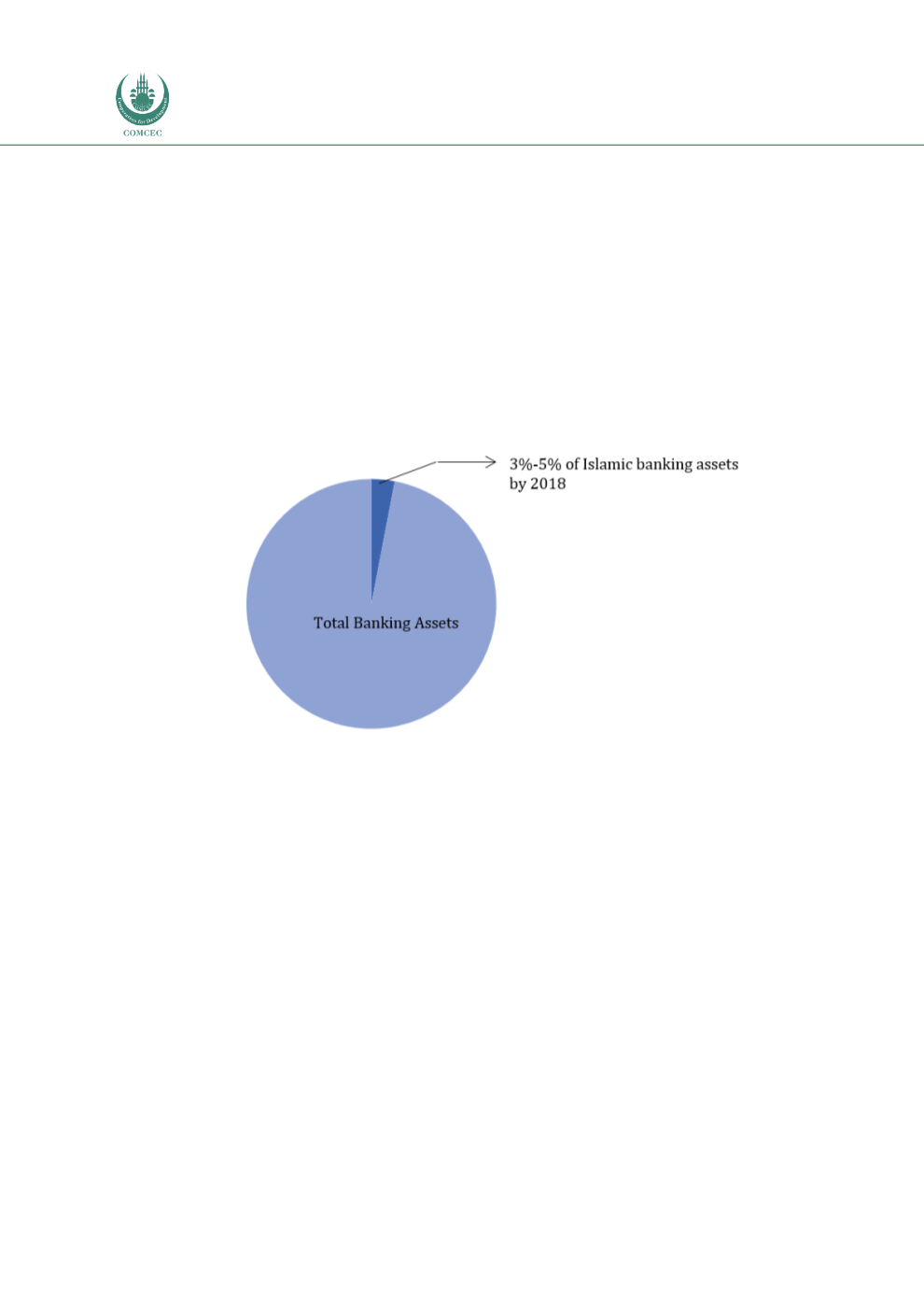

Reuters report (2014, p. 16) estimates that the participation banking sector could account for

3%-5% of Morocco’s banking assets by 2018, with participation banking assets making up

USD5.2−USD8.6 billion and generating USD67−USD112 million of profit to Islamic finance

providers (see

Chart 4.19 ). Nonetheless, with the current evolution of the Islamic banking

industry and still a lack of understanding and awareness on the industry among the Moroccan

population, this figure may be grossly overestimated. Updated figures from the Moroccan

authorities are not available.

Chart 4.19: Participation Banking Assets against Total Banking Assets

Source: Thomson Reuters (2014)

With regard to the development of the other sectors of the Islamic finance market, laws have

already been enacted for the launch of

takaful

companies under a new insurance law passed in

2016, and for the issuance of sukuk under a sukuk bill passed in February 2018, which

amended Morocco’s

securitisation law. However, no

takaful

company or sukuk has been

launched so far. Details of a sukuk issuance are currently being firmed up, with the first issue

expected in 2018. As regards Islamic asset management, there has been no development to

date in terms of a legal and regulatory framework. The global shares of the various segments of

Islamic finance assets and the development outlook for Morocco are discussed i

n Figure 4.16 .