The Role of Sukuk in Islamic Capital Markets

41

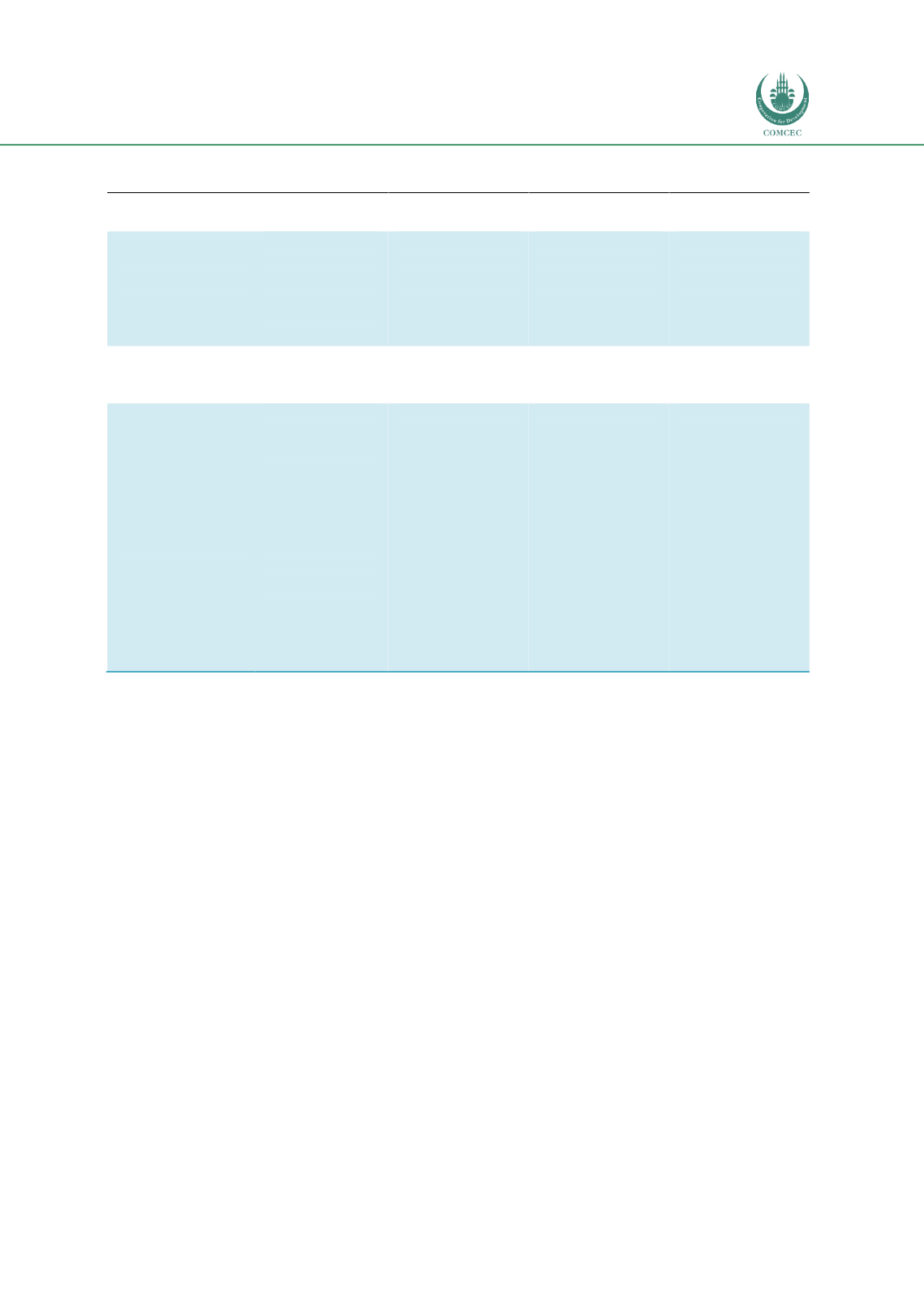

Table 3.2: Shariah Contracts under AAOIFI Shariah Standards on Investment Sukuk

Sale-based

Leased-based

Agency-based

Partnership-

based

Others

Murabahah –

Mark-up sale

Ijarah –

leasing of

property or

usufruct

pursuant to a

contract

Wakalah bil

istithmar –

investment

agency

Mudarabah

–

profit-sharing

and loss-

bearing

Muzara’ah

–

share-

cropping

Istisna’ –

manufacturing

sale

Musharakah

– profit and

loss sharing

Musaqah

–

irrigation

Salam –

forward sale

Ijarah

muntahiah bi

al-tamlik –

a

leasing

contract

which

includes a

promise by

the lessor to

transfer

ownership of

the leased

property to

the lessee

Mugharasah

–

agriculture

Source: AAOIFI (2015)

As part of a sukuk transaction, a

fatwa

(or legal pronouncement) is usually procured from

Shariah scholars, to provide issuers and investors with the comfort that a sukuk instrument is

indeed Shariah-compliant. However, these endorsements are subject to different

interpretations, and differences in opinion can create volatility. Since doubts about Shariah

compliance are likely to affect marketability, a guiding set of principles which the majority of

Shariah advisors can agree upon should be developed. On 7 February 2017, the AAOIFI

announced a new exposure draft for a centralized Shariah board. With industry practitioners

calling for greater standardization, this initiative marks another milestone in embracing a

centralized model, which will further strengthen the Islamic finance ecosystem and increase

consumer appetite fo

r Shariah-compliant products.

The Malaysian and Indonesian governments have progressed to address this problem at the

national level, by establishing a centralized Shariah supervisory board to ensure that every

sukuk issued fully complies with nationally accepted Shariah principles. In comparison, the

GCC operates in an industry-driven environment, where each Islamic financial institution is

guided by the views and opinions of its own Shariah advisory board. Based on market

feedback, approval of a sukuk structure may not necessarily be viewed the same way by

another Shariah scholar. Hence these differing interpretations and opinions have to some

extent affected the progress of sukuk issuance in the GCC. In 2016, the UAE Cabinet approved

the establishment of a Shariah authority to set the standards for Islamic finance products, as a

means of providing a standardized approach to product development and setting the rules and

principles for banking transactions.