Islamic Fund Management

25

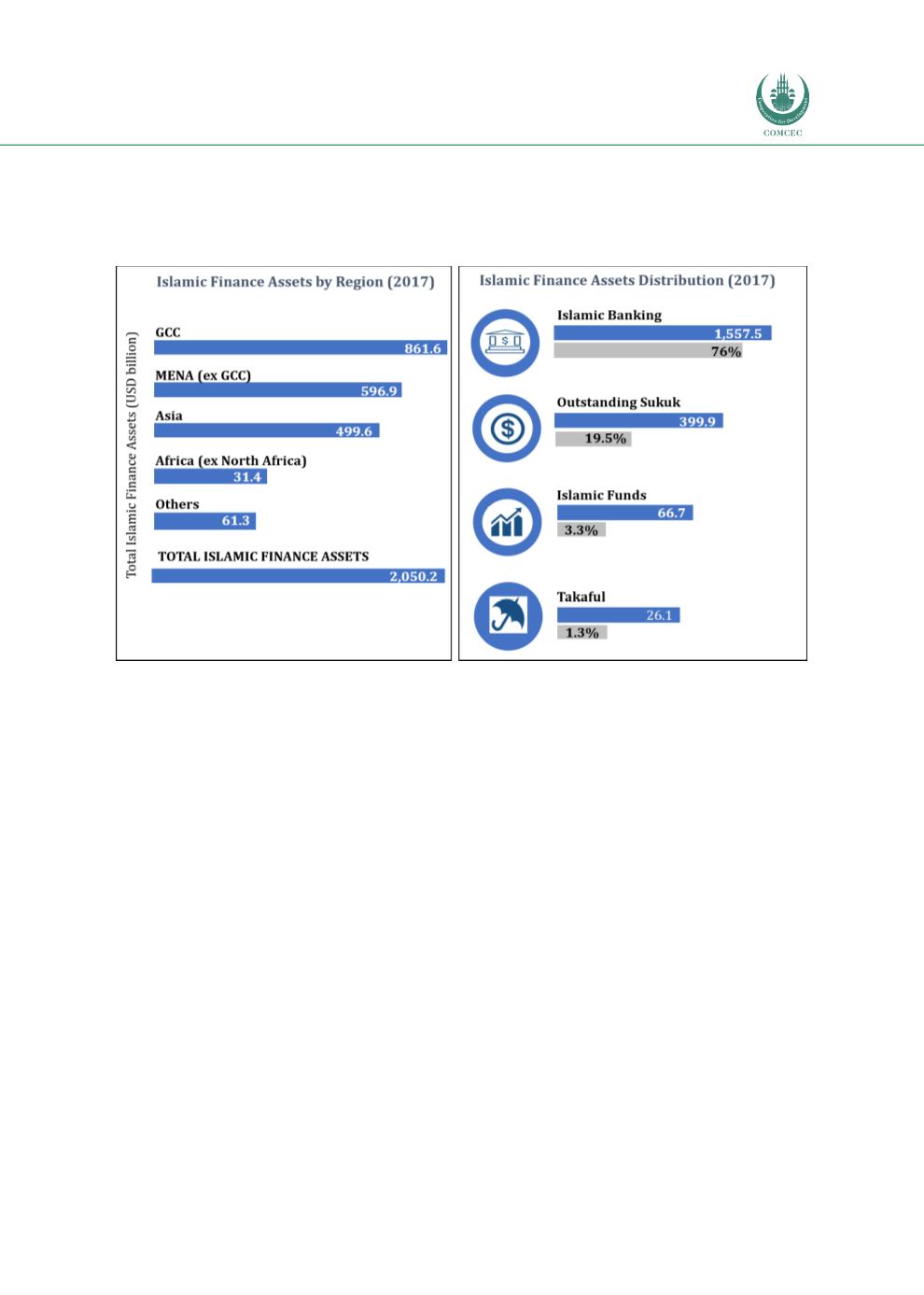

finance assets by region and sector as at end-2017. The ICD-TR (2017) expected the Islamic

finance industry to post an average annual growth of 9.5%, with total assets hitting USD3.8

trillion by 2022.

Chart 2.2: Breakdown of Islamic Finance Assets (2017)

Source: IFSB (2018)

The Islamic fund management industry (USD56.1 billion as at end-2016) represents only a

minor segment of the overall fund management industry (USD84.9 trillion as at end-2016),

reflecting substantial scope for further growth and expansion. Based on ICD-TR projections

(2017), the Islamic asset management sector has tremendous growth potential, reaching

USD403 billion by 2022. This corroborates the projection of Thomson Reuters (2015), which

indicates that demand for Islamic funds will far exceed supply by 2019, underlining the strong

growth potential of Islamic funds. This is expected to originate from the largest markets,

including OIC countries such as Malaysia, Saudi Arabia and Iran (ICD-TR, 2017).

At present, the Islamic fund management industry is still a niche sector. The top five

jurisdictions accounted for 88% of the industry’s AuM as at end-2017, i.e. Saudi Arabia

(37.10%), Malaysia (31.66%), Ireland (8.62%), the US (5.25%) and Luxembourg (4.76%), as

depicted i

n Chart 2.3 .This indicates that the operations of Islamic funds are still limited as key

Islamic finance jurisdictions have deep-rooted Islamic banking sectors (e.g. the UAE, Pakistan,

Indonesia, Kuwait and Qatar). The remaining 12%, with AuM valued at USD8.4 billion, is

distributed across 29 other jurisdictions (including offshore domiciles) (IFSB, 2018).