The Role of Sukuk in Islamic Capital Markets

25

2.5.1

SHARIAH GOVERNANCE FRAMEWORKS (SGFs) AND A CENTRALISED SGF

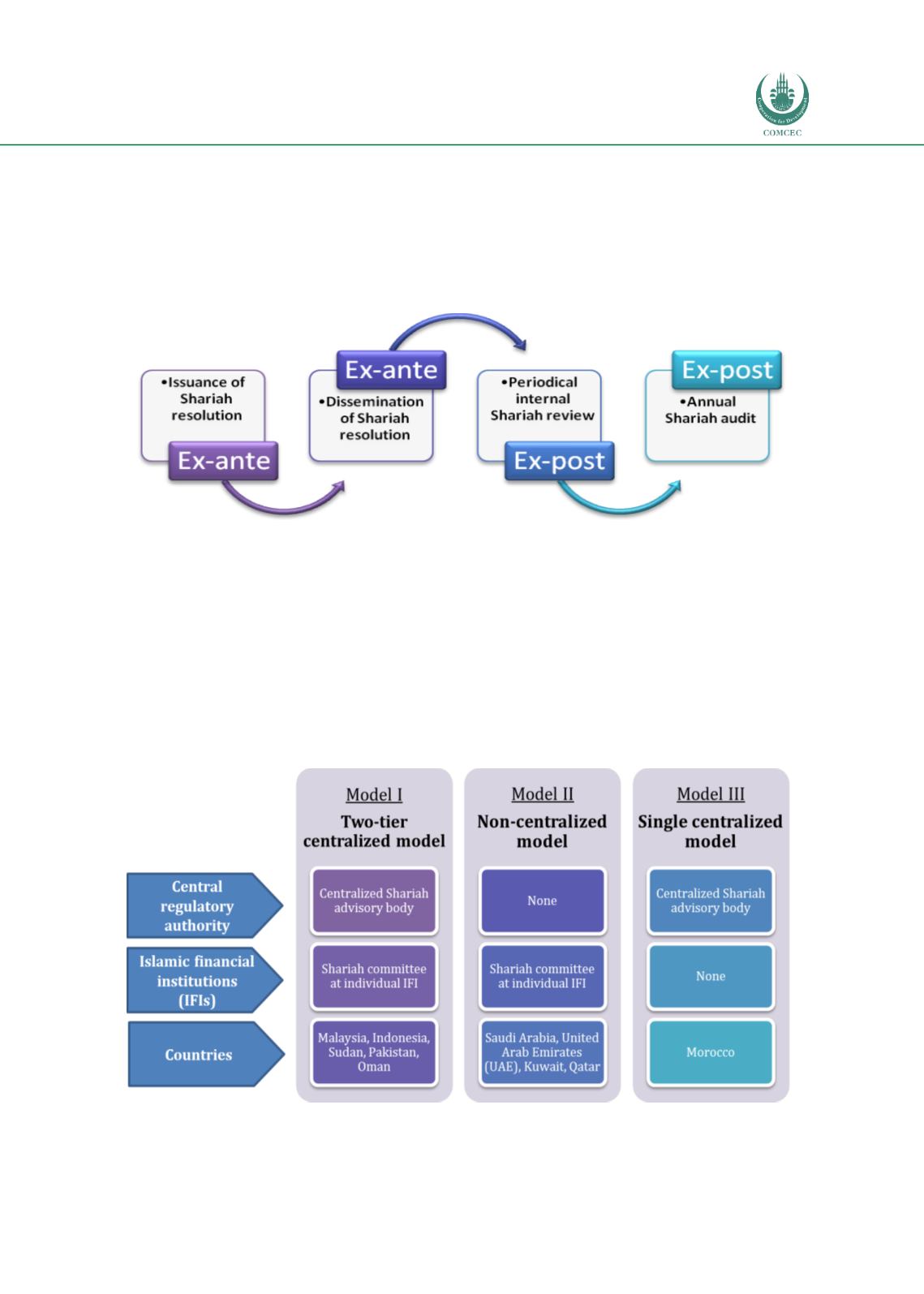

The IFSB defines Shariah governance as “the set of institutional and organizational

arrangements through which the IIFS ensures that there is effective independent oversight of

Shariah governance” over each of the processes described in Figure 2.6.

Figure 2.6: Shariah Governance Processes

Source: IFSB (2009)

Shariah governance is regarded as the backbone of the Islamic finance regulatory and

supervisory infrastructure since the industry’s adherence to Shariah largely depends on the

effectiveness of Shariah governance itself. A vibrant and efficient Shariah governance system is

central to guaranteeing the fair, competent and transparent operation of Islamic finance, as

well as to support investors’ interests. Different countries adopt different organizational

structures in Shariah governance. There are at least 3 models available across the various

jurisdictions, as explained in Figure 2.7.

Figure 2.7: Models of Shariah Governance

Sources: BNM, ISRA