The Role of Sukuk in Islamic Capital Markets

30

the interests of the sukuk holders. Therefore, the trustee must always exercise reasonable

diligence to ascertain whether the issuer has committed any breach of the terms and

conditions of the sukuk, or the provisions of the trust deed, or whether an event of default has

occurred. In such an event, proper notice should be given to the beneficiaries. The trustee may

extensively cover the role of an intermediary or caretaker that manages the entire transaction

of the sukuk until maturity, or may serve as an arbitrator when necessary (Hasan et. al, 2012).

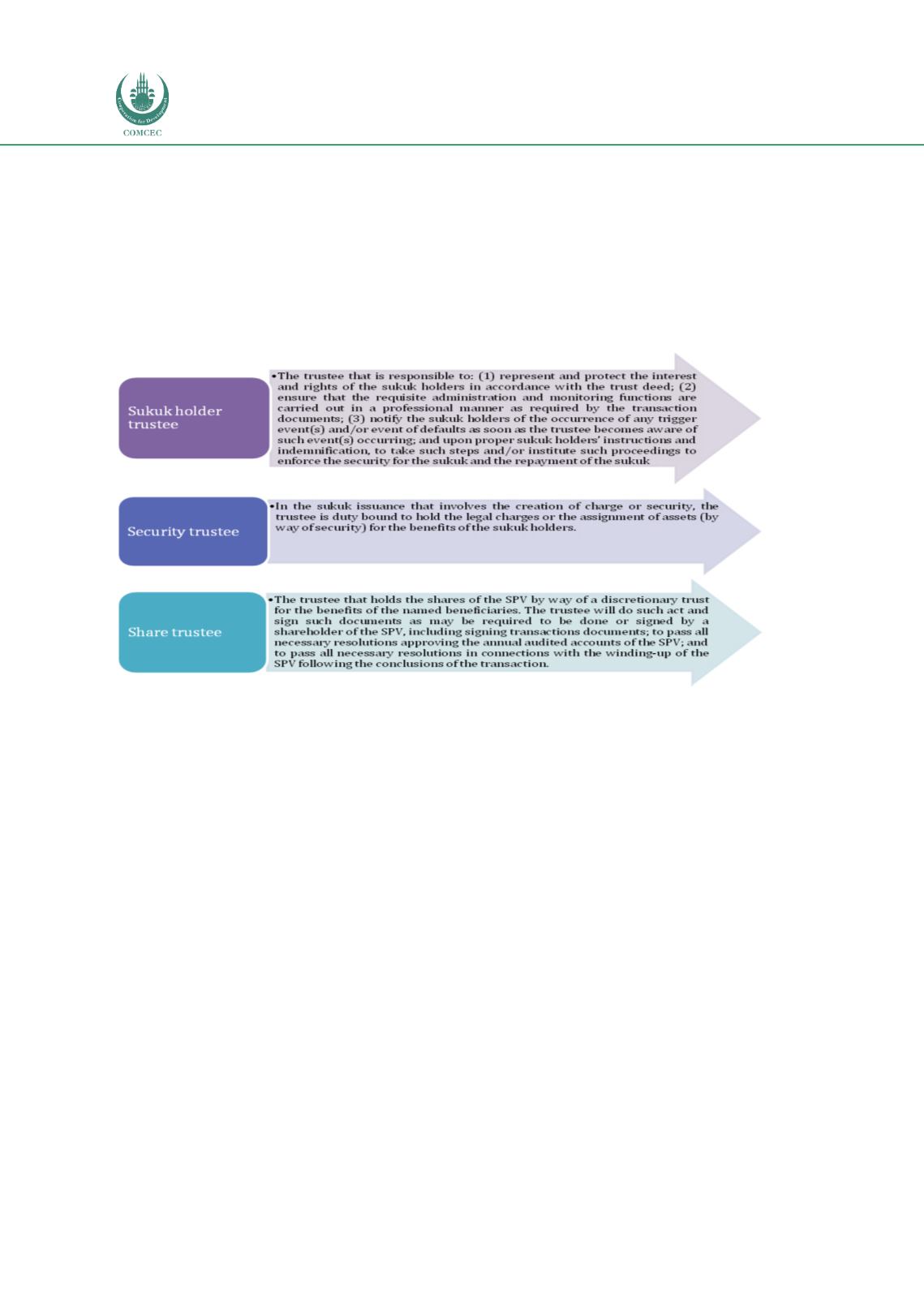

The trustee can be categorized into 3 types, depending on its function, as described in Figure

2.10.

Figure 2.10: Types of Trustee

Source: Hasan et al. (2012)

2.6.2

REGULATORY

In general, there are 3 broad approaches to a regulation adopted by different legal systems to

various degrees. These are: (i) the fraud and abuse inhibition approach, which inhibits fraud

and related abuses in the market; (ii) the merit approach, where the regulator intervenes to

warn investors about the relative merits of an investment; and (iii) the fair dealing approach,

which reflects fair dealing in market transactions (ISRA, 2015). Most jurisdictions seek to

regulate ICM transactions premised on these principles-based approaches. These are in line

with IOSCO’s core principles for securities regulation, i.e. the protection of investors; ensuring

markets are fair, efficient and transparent; and the reduction of systemic risk - all of which are

also applicable to the regulation of Islamic securities. The IOSCO’s (2004)

Islamic Capital

Market Fact Finding Report

does not specify separate regulation for the development of an

ICM, as delineated in Box 2.2. It does, however, recommend the establishment of an

appropriate Shariah governance framework that would regulate the Islamic capital market.