The Role of Sukuk in Islamic Capital Markets

29

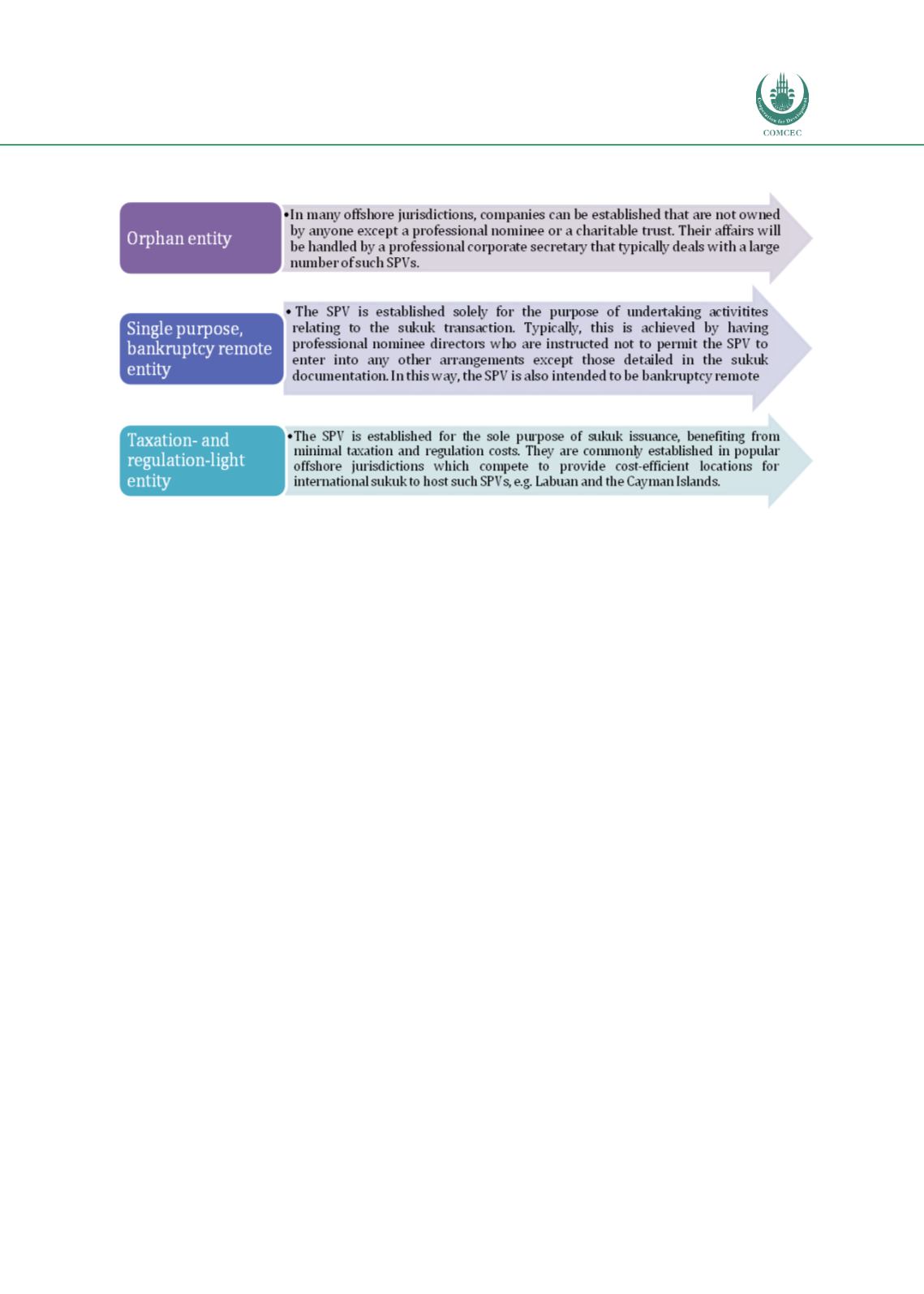

Figure 2.9: Characteristics of SPVs

Source: ISRA (2017)

As mentioned in the earlier sub-section, the predominant structures of sukuk issued in

common law jurisdictions have been based on a trust arrangement via the establishment of an

SPV. Unlike the common law that recognizes the concepts of trust and beneficial ownership,

thus allowing ownership to be held by more than 1 party (legal and beneficial), civil law only

recognizes ownership by 1 party. In such jurisdictions, sukuk, therefore, tend to be issued

through several alternative structures facilitated by the promulgation of local legislation.

Turkey, for example, has passed specific laws that allow the formation of asset-leasing

companies, which are a form of SPV regulated by the Capital Markets Board of Turkey. These

asset-leasing companies are specifically incorporated to enable the issuance of certificates

under the

ijarah

structure to investors which allows the asset-leasing companies to finance the

purchase of the assets and lease them back to the obligor.

Oman is another example, which introduced the concept of financial trust, which is akin to the

common law concept of trust. Under this regulation, a financial trust, created through a trust

instrument, transfers legal ownership of the trust property to the trustee, hence allowing the

SPV to hold the property in trust for the benefit of the sukuk investors (Curtis, 2013). In other

Gulf countries, mechanisms have been developed to replicate security via contractual

arrangements with a ”local security agent”. These agents are usually reputable local financial

institutions but do not have the fiduciary responsibilities required of trustees. Such agents are

also important when purchasing local assets: in many jurisdictions, these assets cannot be sold

to non-nationals (Howladar, 2006).

The Role of the Trustee

As mentioned earlier, the concept of trust has become an important element in sukuk

structuring. The trust in sukuk structures is typically administered by a duly registered trustee

body or corporation, although the sukuk issuer/SPV can appoint itself as the trustee in the

sukuk structure. The trustee’s powers, rights and responsibilities are normally documented in

a trust deed; hence it is the duty of a trustee to use a reasonable degree of skill and diligence in

exercising such rights, powers and responsibilities. The trustee's main function is to protect