The Role of Sukuk in Islamic Capital Markets

20

Prominent International Institutions

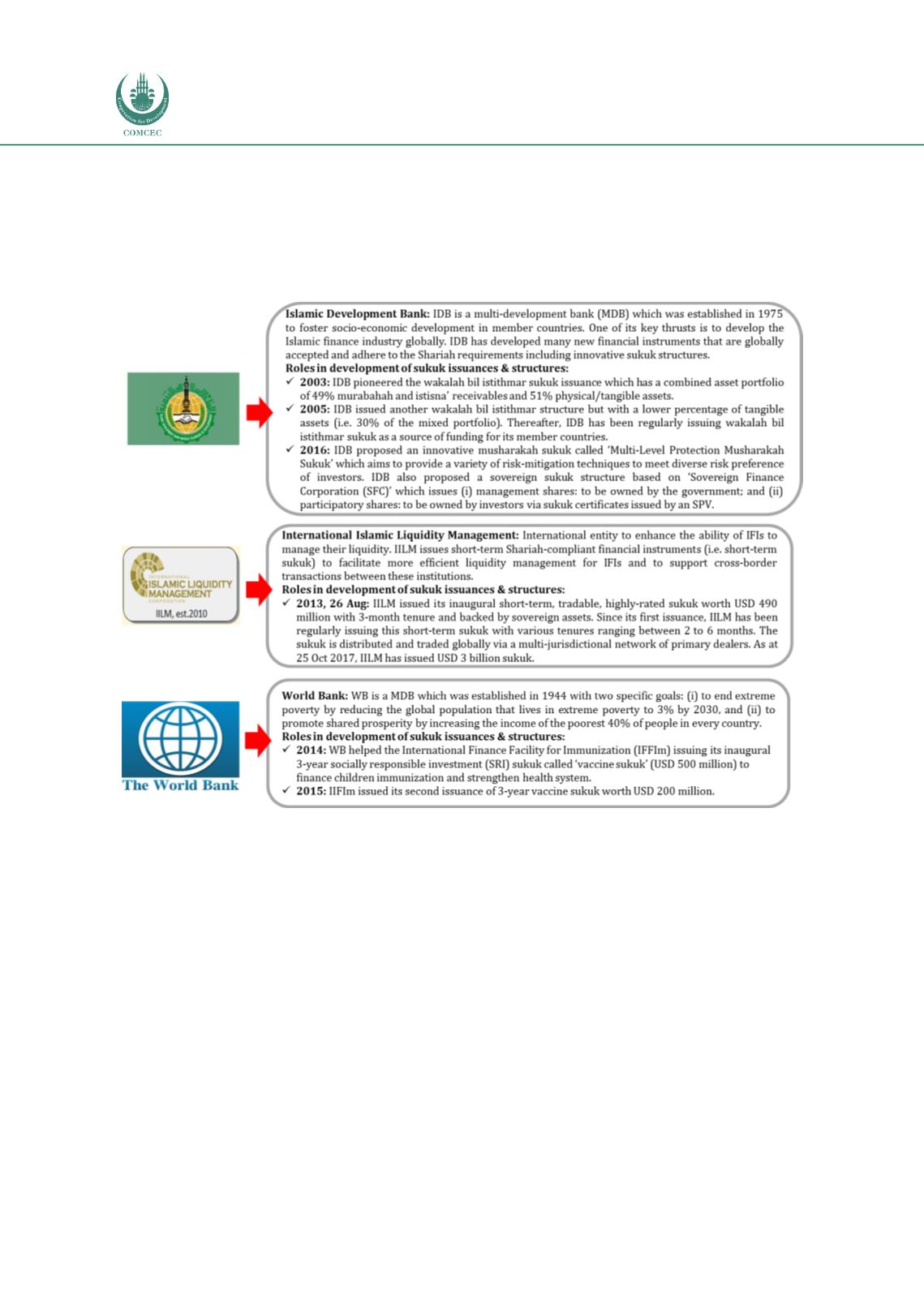

Many international institutions have played instrumental roles in the institutional

development of sukuk structures and issuances. Classic examples of these key institutions are

summarized in Figure 2.4.

Figure 2.4:

International Institutions in the Development of Sukuk Structures and Issuances

Source: ISRA

The IDB is a regular issuer and the most prominent institution that has driven the global sukuk

market to its current position. Its contribution is not limited to sukuk issuance but includes

innovating new structures that fully comply with the tenets of Shariah. Besides funding its

operational businesses, IDB sukuk issuances also aim to achieve the following objectives:

Expand the IDB sukuk yield curve.

Enhance its profile in the international capital markets and reach out to new investors.

Establish a benchmark in the supranational market.

Undertake issuance in or linked to different currencies.

As of June 2017, the IDB had issued all its sukuk under an MTN programme, except for its

debut sukuk in 2003,

which was registered and approved by the Financial Services

Authority/United Kingdom Listing Authority (UKLA). The IDB sukuk is currently listed on the

London Stock Exchange, Bursa Malaysia (Exempt Regime), Nasdaq Dubai and Borsa Istanbul.