The Role of Sukuk in Islamic Capital Markets

15

2.2

IMPORTANCE OF SUKUK IN DEVELOPING THE ISLAMIC FINANCIAL

MARKET

Sukuk represents the second-largest component of the Islamic finance industry, after Islamic

banking. Post-2000s, it has been championing the Islamic finance industry, capturing the

attention and interest of a wide range of issuers and investors. It has expanded the Islamic

financial market to far-off jurisdictions across the globe, with sukuk considered an important

fund-raising tool by both Muslim-majority and non-Muslim-majority countries.

2.2.1

ASSET DISTRIBUTION IN VARIOUS SEGMENTS OF ISLAMIC FINANCE

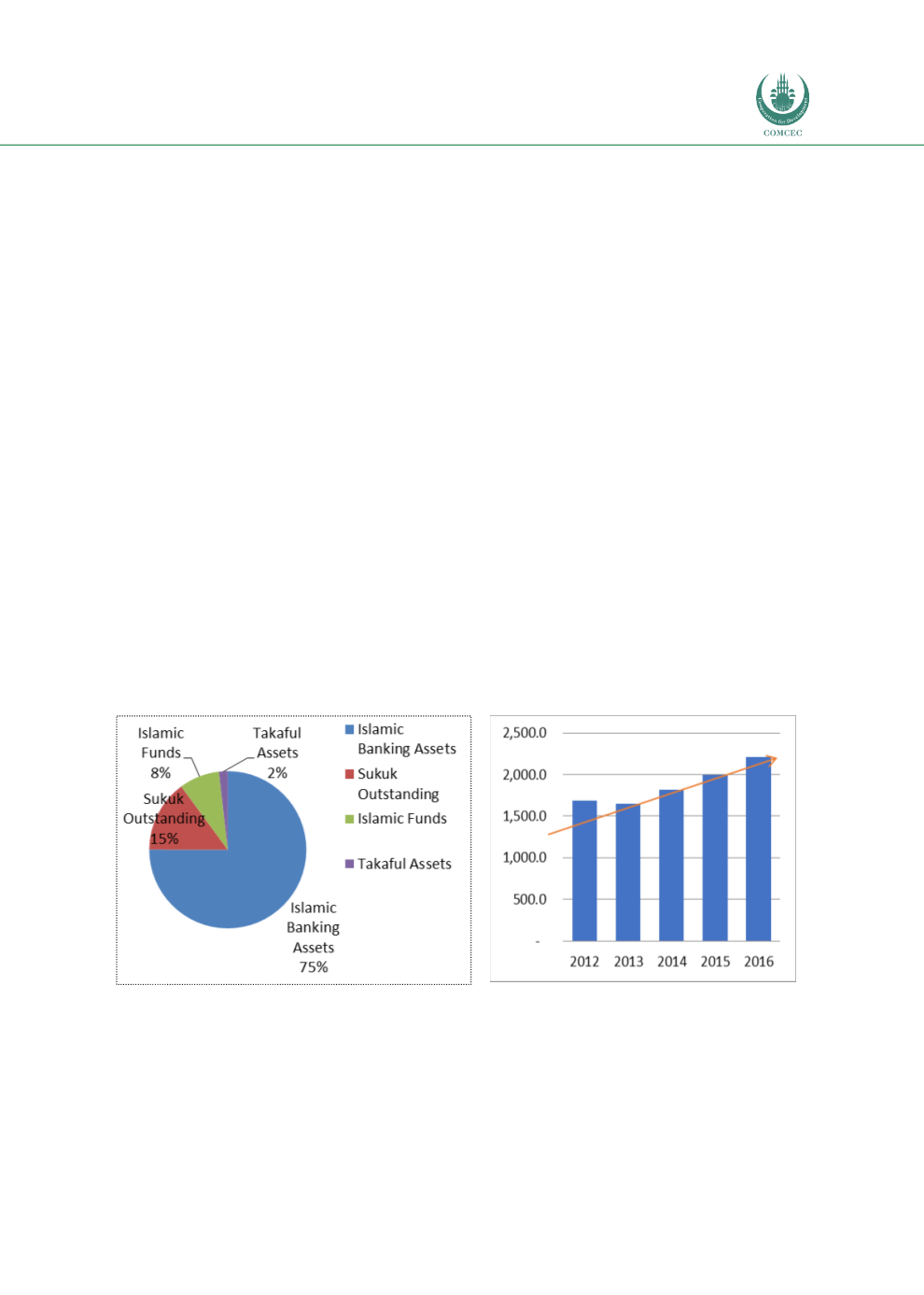

According to RAM, the global Islamic finance industry’s assets across its 4 main sectors (i.e.

Islamic banking, sukuk, Islamic funds and

takaful

) summed up to USD2.2 trillion as at end-

December 2016. The industry has been charting a CAGR of 5% since 2012. The ICM,

particularly sukuk, has been the fasting growing among all the asset classes in Islamic finance.

Islamic banking continues to dominate the industry, with USD1,657.0 billion of global assets as

at end-December 2016, representing 75% of the Islamic finance market. It was followed by the

sukuk market, with outstanding sukuk amounting to USD328.0 billion as at the same date,

accounting for 15% of the entire market. However, Islamic fund assets and

takaful

contributions still only represent a small percentage of the Islamic finance industry, with a

respective USD183.0 billion (8% market share) and USD40.0 billion (2% market share). Chart

2.1 shows the breakdown of Islamic finance assets by sector as at end-2016, while Chart 2.2

illustrates the growth of Islamic finance assets between 2012 and 2016.

Chart 2.1: Sectoral Distribution of the Islamic

Finance Industry (2016)

Chart 2.2: Growth of Islamic Finance

Assets (USD billion, 2012-2016)

Source: RAM