The Role of Sukuk in Islamic Capital Markets

11

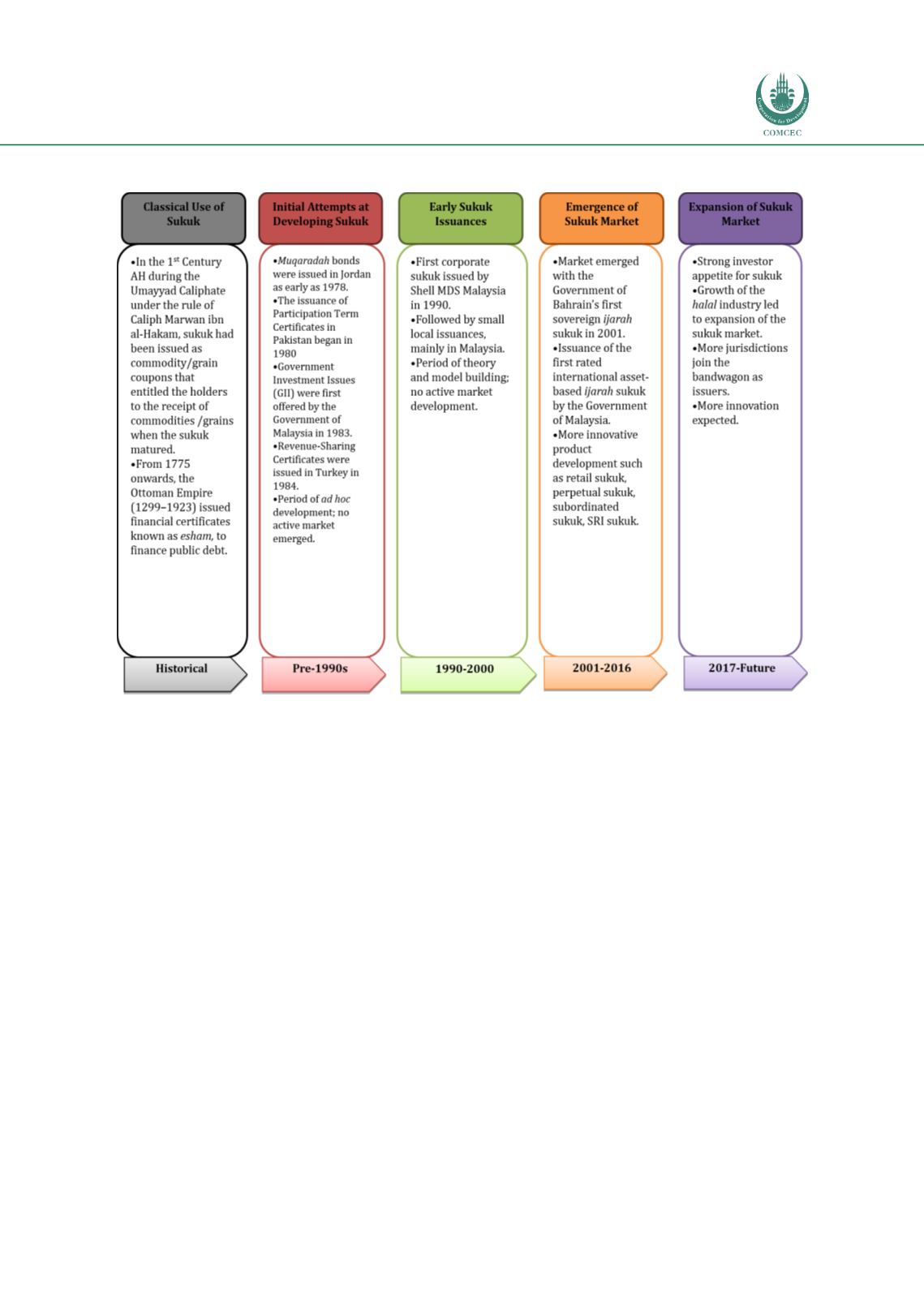

Figure 2.1: Main Phases of Sukuk Development

Source: ISRA (2017)

2.1.2

GENERAL PRINCIPLES, MILESTONES AND KEY TRENDS

Unlike conventional securities, sukuk must adhere to Shariah rules and principles, including its

structuring, the underlying assets that back the sukuk issuance, the investment of sukuk

proceeds, as well as its trading and rescheduling/restructuring.

A number of Shariah-compliant contracts are used to create financial obligations

between the sukuk issuers and sukuk holders, including sale, lease, partnership, agency

and a combination of contracts.

Wakalah

contracts have been increasingly used in recent

years.

The underlying assets of the sukuk structure must be Shariah-compliant and may

include tangible assets, usufructs, income-generating services, intangible assets,

receivables from Shariah-compliant commodities, and the assets of particular projects or

investment activities. The underlying assets of sukuk have further developed to include a

mix of both debts (e.g. receivables from Shariah-compliant sales of commodities) and

non-debt assets (e.g. tangible assets comprising lease assets and Shariah-compliant

shares) to form a blended portfolio.