The Role of Sukuk in Islamic Capital Markets

13

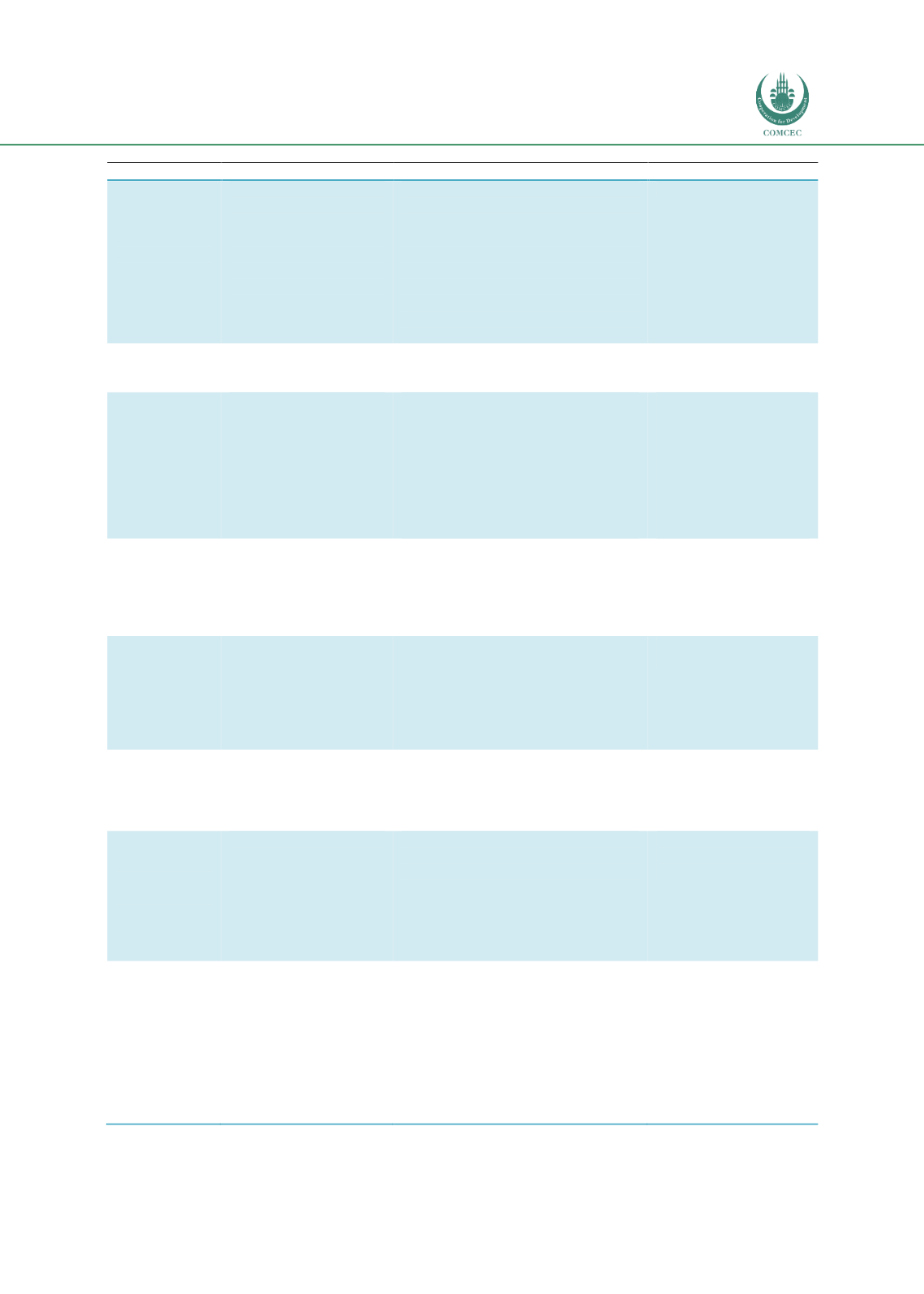

Bonds

Sukuk

Shares

Underlying

Assets

No asset is required for

unsecured bonds, i.e. the

bonds need not be backed

by any collateral. For

secured bonds, the

underlying assets backing

them may include non-

Shariah-compliant assets.

Underlying assets must comply with

Shariah requirements. Underlying

assets can represent both debt (arising

from Shariah-compliant activities) and

non-debt assets. Asset backing has

evolved from 100% of assets to

minimum levels of 51%, 33% or 30%.

In certain jurisdictions, it is acceptable

to have 100% of debt receivables and

no other asset.

Not required.

Asset-Related

Expenses

Bond holders are not

affected by asset-related

expenses.

Sukuk holders may be affected by asset-

related expenses.

None.

Status

Generally involves

unsecured creditors,

except if the bonds are

backed by specific assets.

Sukuk holders in asset-backed sukuk

have recourse to the assets in the event

of default, or if the issuers have

difficulty in repaying. They are ranked

senior to unsecured creditors. Holders

of asset-based sukuk are generally

ranked

pari passu

with other unsecured

creditors and have no recourse to the

assets.

Shareholders represent

the most junior in rank to

other classes of securities

with full or preferred

voting rights. Equity can

also be in the form of

preference shares, which

have near-senior claims

to dividends and capital.

Returns to

Investors

Coupon payments in the

form of interest

representing a

percentage of the capital.

They correspond to fixed

interest, connoted as

riba

.

Periodic payments represent a

percentage of actual profits (generated

from sale and partnership contracts)

and rental income (generated from

lease contracts).

Shareholders receive

dividend payments.

These are not guaranteed

by the corporation.

Principal

Repayment by

Issuers

Return of principal at

maturity is an irrevocable

obligation, irrespective of

whether the funded

project is profitable.

In principle, there is no

ex-ante

fixed

obligation of capital repayment for

equity-based contracts. There are

usually repurchase undertakings or

dissolution provisions to guarantee

capital repayment under

ijarah

and

other structures.

None, as shares represent

perpetual instruments.

Utilization of

Proceeds

No specific requirement.

Bonds can be issued to

meet any financing needs

that are legal in the

jurisdiction of the issuer.

Proceeds must be used to finance

Shariah-compliant activities.

Equity can be issued to

meet any financing need

of the corporation.

Tradability in

Secondary

Market

Selling bonds represent a

sale of debt.

Selling sukuk is basically the sale of a

share in an asset or a project. Shariah

standards at the global level (e.g.

AAOIFI) only allow the sale of tangible

assets, some intangible assets and

interests in ventures, whereas Malaysia

allows the sale of debt (for sale-based

sukuk).

Represents a sale of

shares in the company.

Pricing

Bond pricing is based on

the credit rating of the

issuer as well as terms

and conditions, usually a

spread over a reference

interest rate.

Sukuk pricing depends on the structure

of the sukuk. For non-recourse asset-

backed sukuk, pricing is based on the

asset backing the sukuk. For sukuk

structured based on fixed-income and

debt-creating contracts, their pricing is

typically similar to bond pricing, but

may be affected by factors that include

market depth/breadth, liquidity and

complexity.

Pricing is tied to the

performance of the

corporation.

Source: ISRA (2017: 31-33)