The Role of Sukuk in Islamic Capital Markets

17

2.2.3

PIONEERING COUNTRIES IN THE SUKUK MARKET

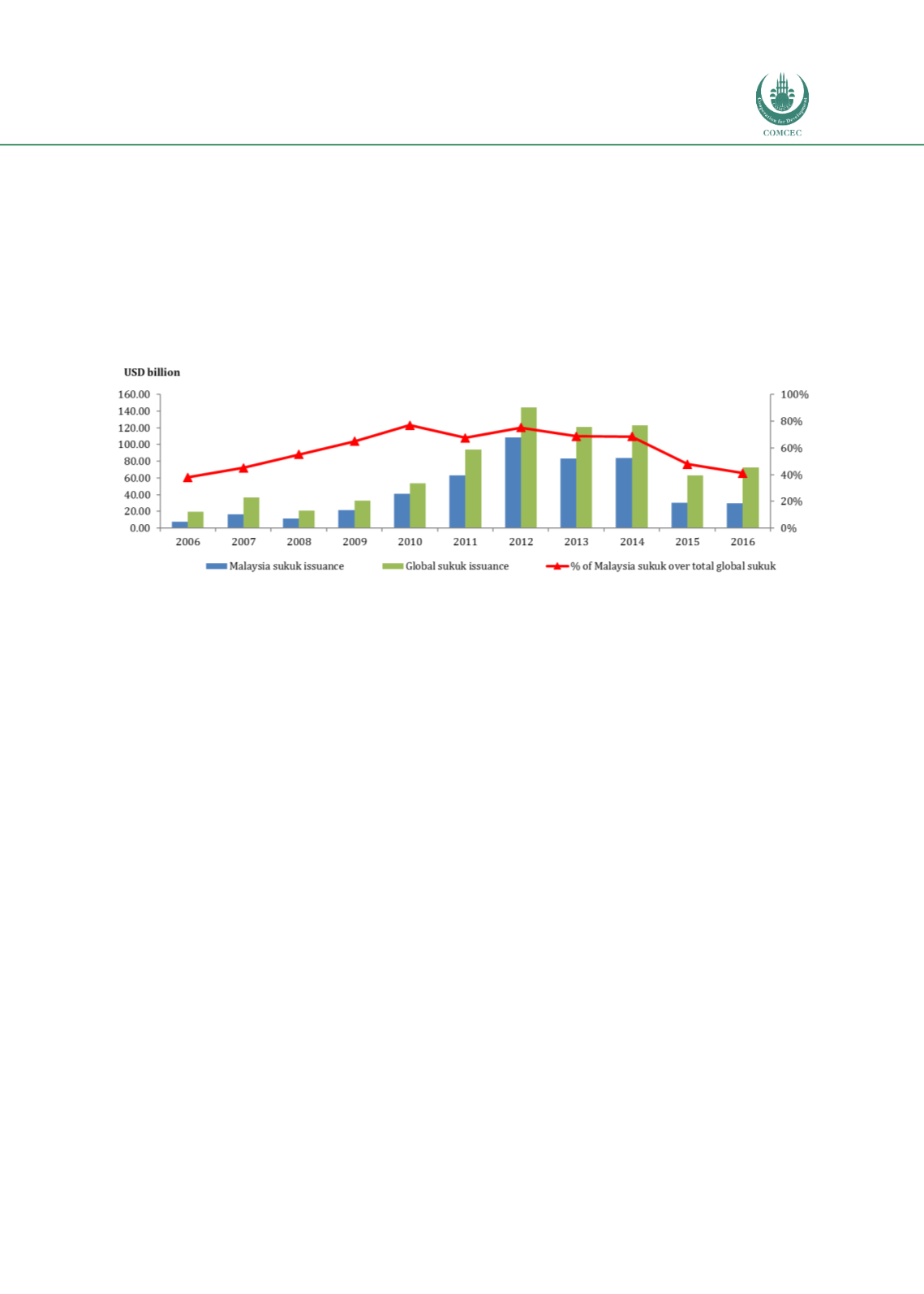

Shell MDS Malaysia Sdn Bhd’s sukuk issuance in 1990 is widely recognized as the market’s

pioneer sukuk. It was the first ringgit-denominated corporate sukuk and was issued by a non-

Islamic company in a Muslim-majority country, i.e. Malaysia. Over the years, Malaysia has

evolved into a leading centre for sukuk issuance accounting for a significant share global

issuance, as reflected in Chart 2.3.

Chart 2.3: Malaysia vs Global Sukuk Issuance

Sources: Eikon-Thomson Reuters, RAM

Sudan was another pioneer of sukuk issuances in the 1990s. The Sudanese government

developed sukuk as an alternative monetary policy instrument for open-market operations,

such as:

Shahama

Bonds or Government

Musharakah

Certificates (GMCs). These are short-term

securities issued since 1999, to raise short-term government financing to cover such

costs as civil service and defense expenses (Institute of Islamic Banking and Insurance,

2009).

Government Investment Certificates (GICs). These are medium-term securities,

whereby the Ministry of Finance is the originator and the money raised is invested in

specific projects financed by the government.

Central Bank

Ijara

Certificates (CICs), which are backed by the buildings owned by the

Central Bank of Sudan.

In recent years, some countries outside the key markets have launched some pioneering

issues. These debut sukuk reflect the positive market momentum at present. Some of these

ground-breaking issuances by the new entrants in the sukuk market are shown in Figure 2.2.