The Role of Sukuk in Islamic Capital Markets

7

interview questions on the core scope of the study, i.e. the development of the sukuk

market and its role in the ICMs, from various perspectives―issuances, structures,

investments, enabling infrastructure, issues and challenges. A series of interviews

have been conducted with various parties involved in the sukuk market, such as

issuers, lead arrangers, investment bankers, investors, legal advisers and regulators.

The results from the interviews provide some insights on the challenges faced and the

necessary improvements required to further develop the sukuk market, particularly in

countries in the infancy and developing stages.

The selection of subjects for case studies was based on the diversity of regions and the

different development stages of their sukuk markets in terms of their legal and regulatory

frameworks, size and segments.

Looking at historical trends and the study’s proposal to create

a development roadmap for sukuk markets, Table 1.1 lists the countries chosen as case studies.

Five OIC member countries have been selected along with Hong Kong―a non-OIC member

country, based on its developed capital markets and increasing importance as a sukuk issuer in

South East Asia.

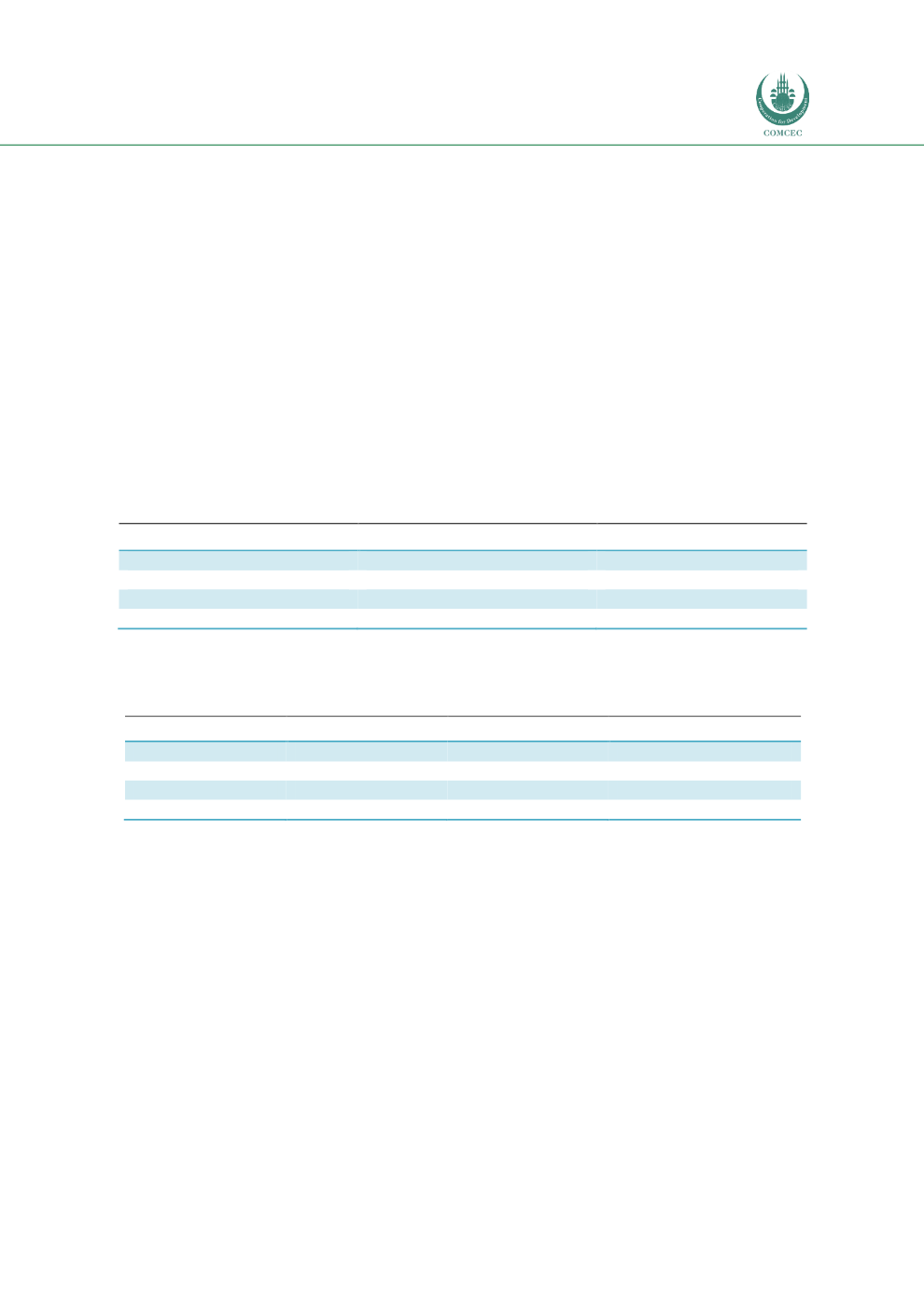

Table 1.1: Case-Study Countries by Category of Sukuk Market Development

Infancy

Developing

Matured

Nigeria

UAE

Malaysia

Indonesia

Turkey

Hong Kong

In terms of regional location, the selected countries are classified as per Table 1.2.

Table 1.2: Case-Study Countries by Regional Location

Region

Asia

Arab

Africa

OIC Countries

Malaysia

UAE

Nigeria

Indonesia

Turkey

Non-OIC Countries

Hong Kong

1.4

OVERVIEW OF THE STUDY

The study comprises 6 chapters and is organized according to the following topics:

Chapter 1: Introduction

This chapter provides a brief outlook on the sukuk market, sets out the research objectives and

explains the adopted research methodology.