COMCEC Transport and Communications

Outlook 2019

33

2014, a 24% stake in CMA-CGM, the 3

rd

largest container shipping line. At the same time,

container liners in some OIC countries such as Indonesia and Malaysia are more focused on

domestic and regional trade, while other OIC countries still retain high public stakes in national

shipping companies.” (COMCEC, 2015)

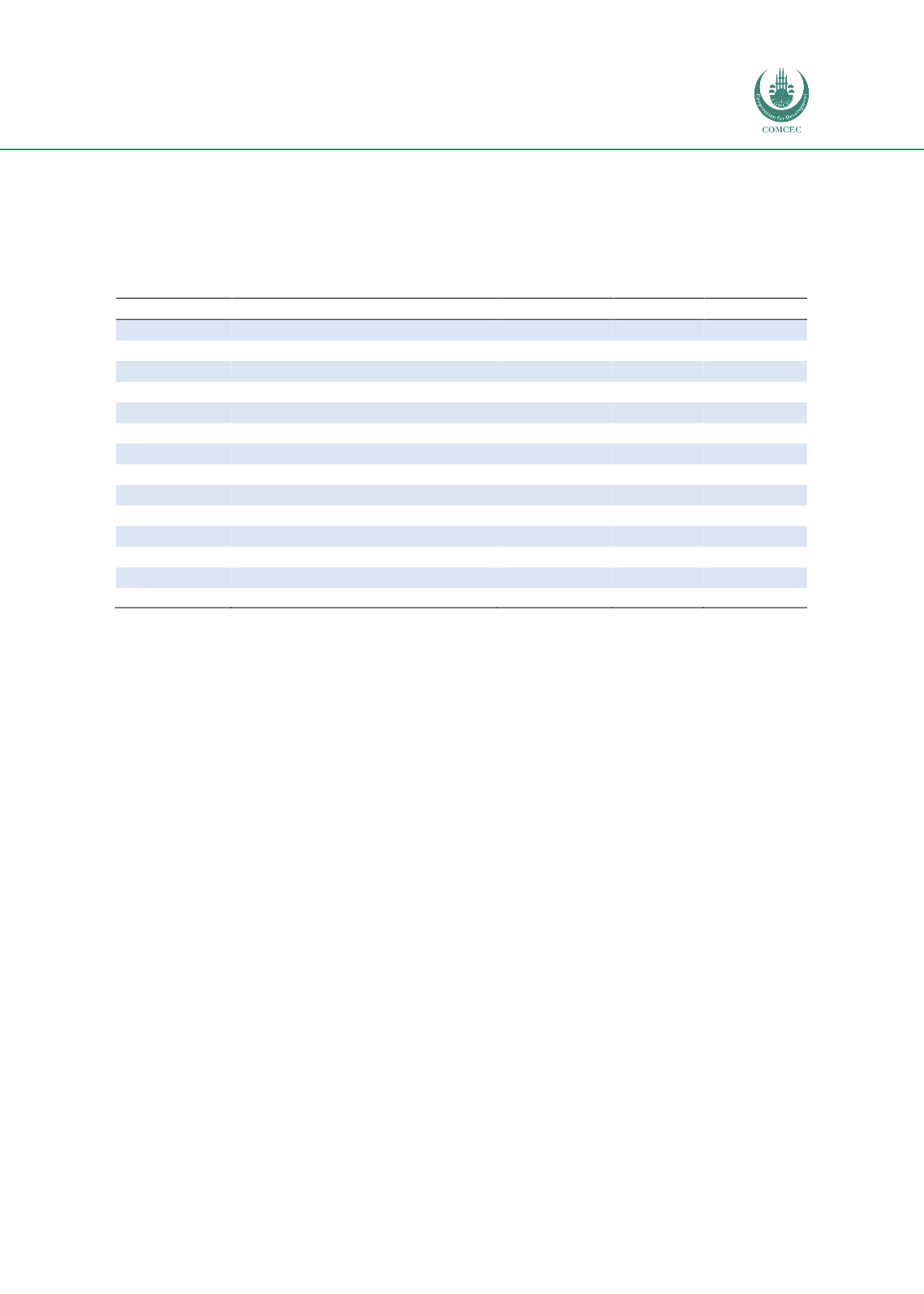

Table 8: Major container shipping companies in the OIC countries

Country

Operator

Global rank

TEU

Ships

UAE

UASC

18

338,872

53

Iran

HDS Lines

23

88,608

22

Turkey

Arkas Line / EMES

28

54,753

37

UAE

OEL / Shreyas (Transworld Group)

41

31,072

22

Indonesia

Salam Pacific

44

29,020

45

UAE

Meratus

45

28,789

49

Indonesia

Tanto Intim Line

46

27,310

47

UAE

Emirates Shipping Line

54

20,917

6

Turkey

Turkon Line

61

13,568

8

Indonesia

Temas Line

62

13,442

23

Malaysia

MTT Shipping

79

7,918

7

Qatar

Qatar Navigation (Milaha)

88

6,651

8

Indonesia

Caraka Tirta Perkasa

93

6,103

9

Algeria

CNAN

96

5,316

9

Source: COMCEC (2015) from Alphaliner (2015)

Ports are critical logistics infrastructure facilities and play a key role in the international trade.

There are over 200 OIC ports that serve as either gateway or transhipment facilities, and

sometimes as transit points to other landlocked OIC countries. Ports are of critical importance

for integration of the OIC countries into global markets as well as among themselves given that

some OIC countries have smaller economies located in remote locations. Indeed, some OIC ports

have a strategic importance for global trade due to their positions on the international maritime

routes or services to large hinterland markets. However, there are also many OIC countries that

are landlocked, i.e. Afghanistan, Azerbaijan, Burkina Faso, Chad, Kazakhstan, Kyrgyz Republic,

Mali, Niger, Tajikistan, Uganda, and Uzbekistan; while some others that are Small Island

Developing States (SIDS), i.e. Comoros, the Maldives, and Suriname.

The container throughput of the OIC countries has reached 119 million TEU in 2017 up from

85.2million TEU in 2010. However, the share of OIC countries in the global container throughput

has remained flat at around 15% in the 2010-2017 period. Both Malaysia and the UAE show high

volume throughput with 24.7 million TEU and 21.3 million TEU, respectively. On the other hand,

majority of the OIC countries couldn’t even reach the one million TEU threshold. In the Maldives,

Mauritania, Albania, and Brunei, very low container throughput volumes reflect the small size

of the port sector in those countries.