COMCEC Financial Outlook 2018

24

several member countries such as Indonesia, Malaysia, and UAE, have been giving attention to

green sukuk and the sukuk issuance is expected to increase in the near future significantly.

Islamic Funds

Islamic funds are investment vehicles that take the form of equal participating shares/units,

representing the shareholders’/unitholders’ share of the assets and entitlement to profits or

losses. There are many types of Islamic funds such as Islamic index funds, Islamic hedge funds,

Shariah private equity funds, Sukuk funds, Islamic equity funds, etc.

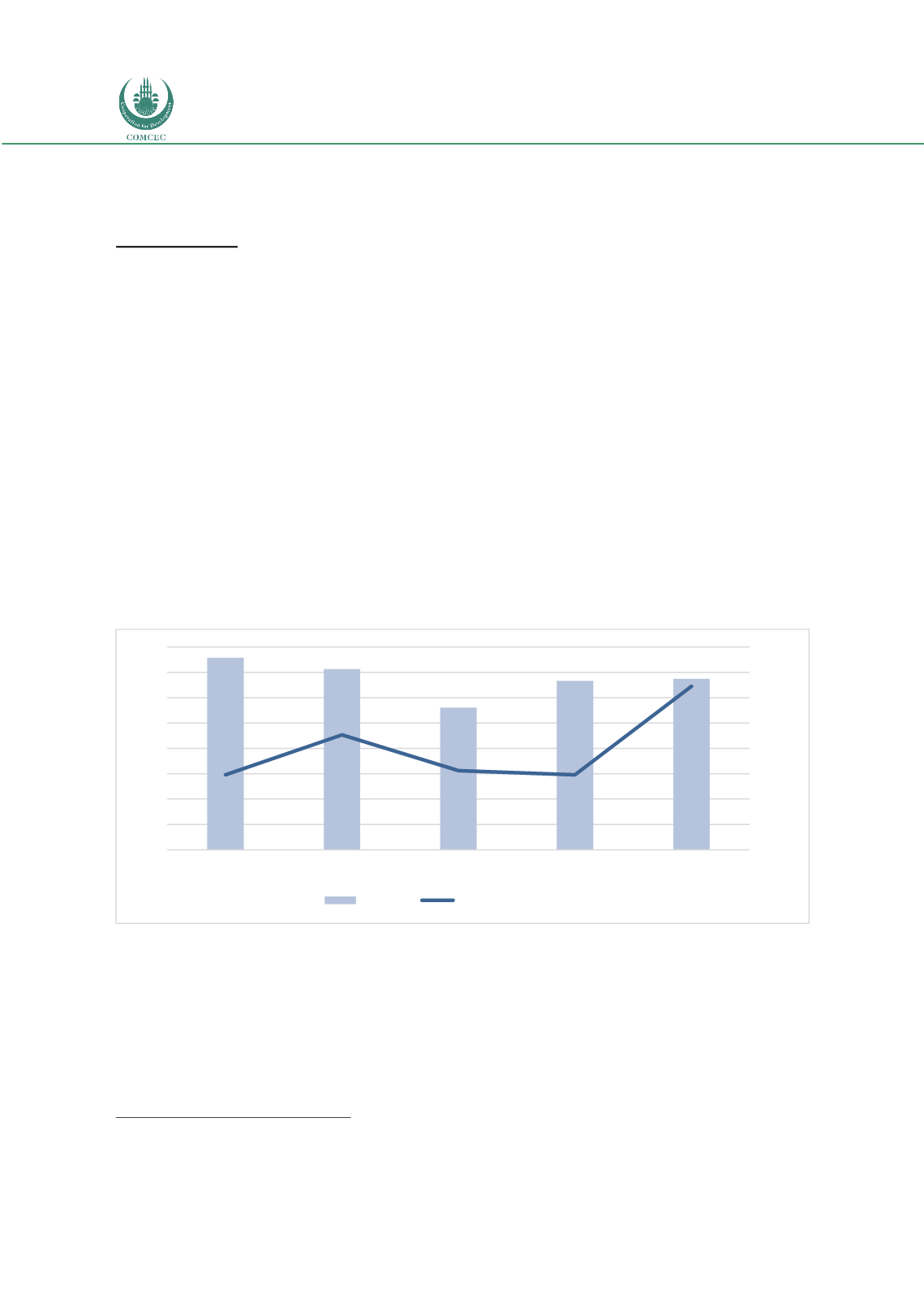

Despite the significant increase in the number of Islamic funds in 2018 [1,292], assets under

management (AuM) almost kept steady and reached USD 67.4 billion

24

. The top five

jurisdictions, three of which are non-OIC countries, accounted for %85 [2017: 88%] of the

industry’s AuM as at the end of 2018, i.e. Saudi Arabia 34% [2017: 37.10%], Malaysia 32%

[2017: 31.66%], Ireland 9.0% [2017: 8.62%], the US 5% [5.25%] and Luxembourg 5% [2017:

4.76%]. This indicates that the operations of Islamic funds are still limited as key Islamic finance

jurisdictions have deep-rooted Islamic banking sectors (e.g., the UAE, Pakistan, Indonesia,

Kuwait, and Qatar). The remaining 15% [2017: 12%] of AUM, with a USD 8.4 billion value, is

distributed across 29 other jurisdictions (including offshore domiciles)

25

.

Figure 17: Assets under Management and Number of Islamic Funds (USD billion)

Source: IFSB 2019

24

Ibid.

25

IFSB, 2019.

75,8

71,3

56,1

66,7

67,4

1.161

1.220

1.167

1.161

1.292

1.050

1.100

1.150

1.200

1.250

1.300

1.350

0,0

10,0

20,0

30,0

40,0

50,0

60,0

70,0

80,0

2014

2015

2016

2017

2018

Assets

Number of Funds (RHS)