COMCEC Financial Outlook 2018

7

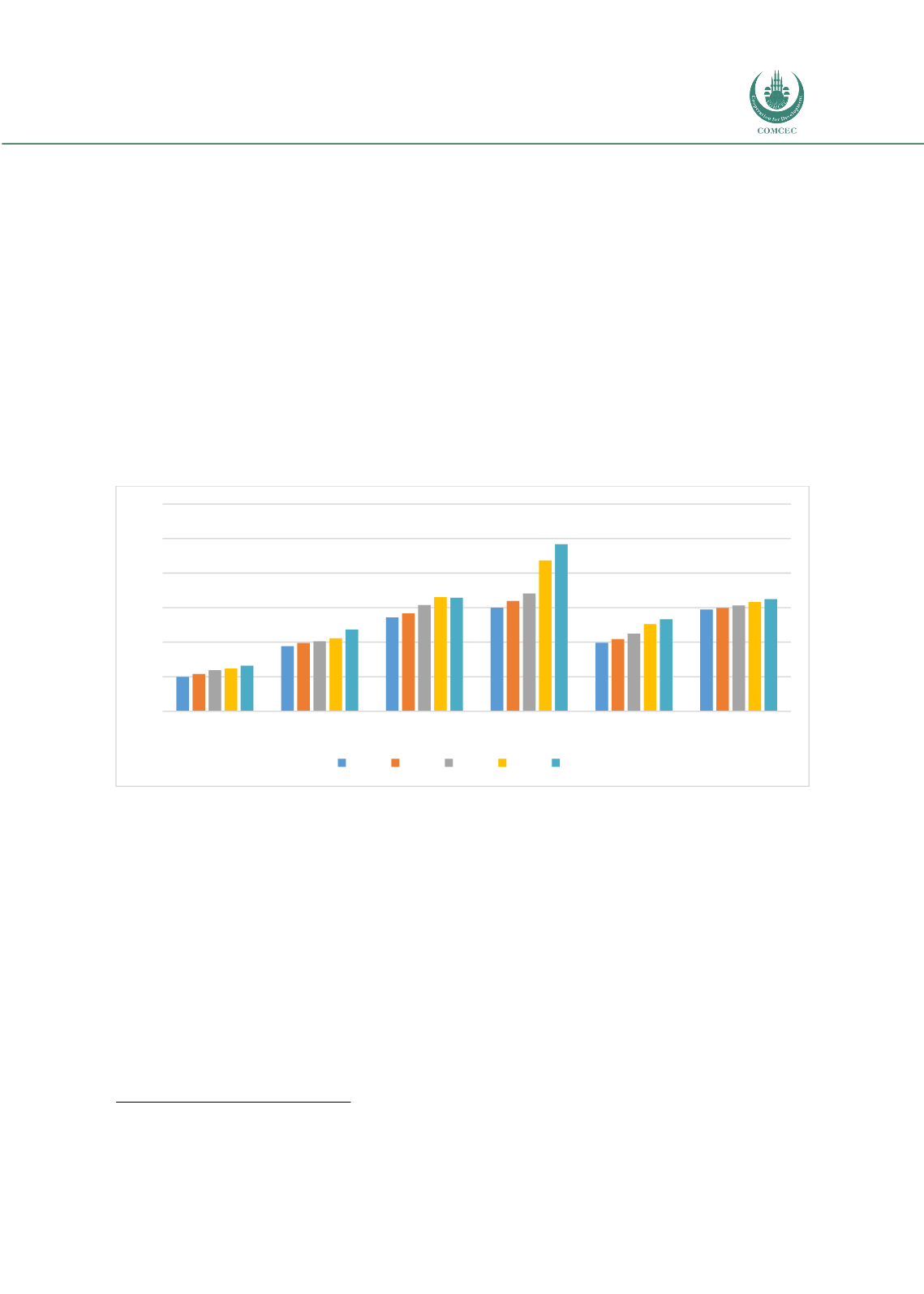

Another indicator used to measure the depth of the financial institutions andmarkets is

Deposit

money banks' assets as a share of GDP

. This measure refers to ‘total assets held by deposit

money banks as a share of GDP. Assets include claims on the domestic real non-financial sector

that includes central, state and local governments, non-financial public enterprises and the

private sector. Deposit money banks comprise commercial banks and other financial

institutions that accept transferable deposits, such as demand deposits’

11

.

Compared to private credit, this indicator also includes credit to government and bank assets

other than credit. The results for OIC average and various income groups are similar to the

previous indicator. As can be seen from Figure 2 below, OIC average regularly increased over

the years and closed to the world averages. On the other hand, the results for the OIC-UMIG and

OIC-HIG groups have surpassed the world averages in recent years. Since this indicator includes

the claims of the banks on government, the results for these two groups indicates the increasing

role of the government to use financial markets more compared to the low-income groups.

Figure 2: Deposit Money Banks' Assets to GDP (%)

Source: Authors’ calculation from the World Bank Database

In order to measure depth in the financial markets size of the stock and bond markets could be

used as an indicator. To approximate the size of the stock markets, the most common choice in

the literature is stock market capitalization to GDP

12

. This indicator refers to the total value of

all listed shares in a stock market as a percentage of GDP.

11

World Bank, Global Financial Development Report, June 2018.

12

Benchmarking Financial Systems Around the World 2012, World Bank

0

20

40

60

80

100

120

OIC-LIG

OIC-LMIG OIC-UMIG

OIC-HIG OIC-Average World Average

2012 2013 2014 2015 2016