COMCEC Financial Outlook 2018

4

OIC-High income group

(12,376 USD or more)

Bahrain, Brunei Darussalam, Kuwait, Oman, Qatar,

Saudi Arabia, United Arab Emirates

7

Source: Composed by authors, according to the latest available classification of World Bank 2019,

https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups ,access date: 15 September 2019.

Since the previous COMCEC Financial Outlook for November 2018, the groups of the only two

OIC member countries, Senegal and Comoros were changed. Both of them upgraded from OIC-

low income group to OIC-lower middle-income group.

To measure and benchmark financial systems, the outlook utilizes several measures of following

four characteristics of financial institutions and markets:

(a) Financial Depth: Measures the size of financial institutions and markets,

(b) Financial Access: Measures the degree to which individuals can and do use financial

institutions and markets,

(c) Financial Efficiency: Measures the efficiency of financial institutions and markets in

providing financial services,

(d) Financial Stability: Measures the stability of financial institutions and markets in order to

measure and benchmark financial systems in the OIC region

7

.

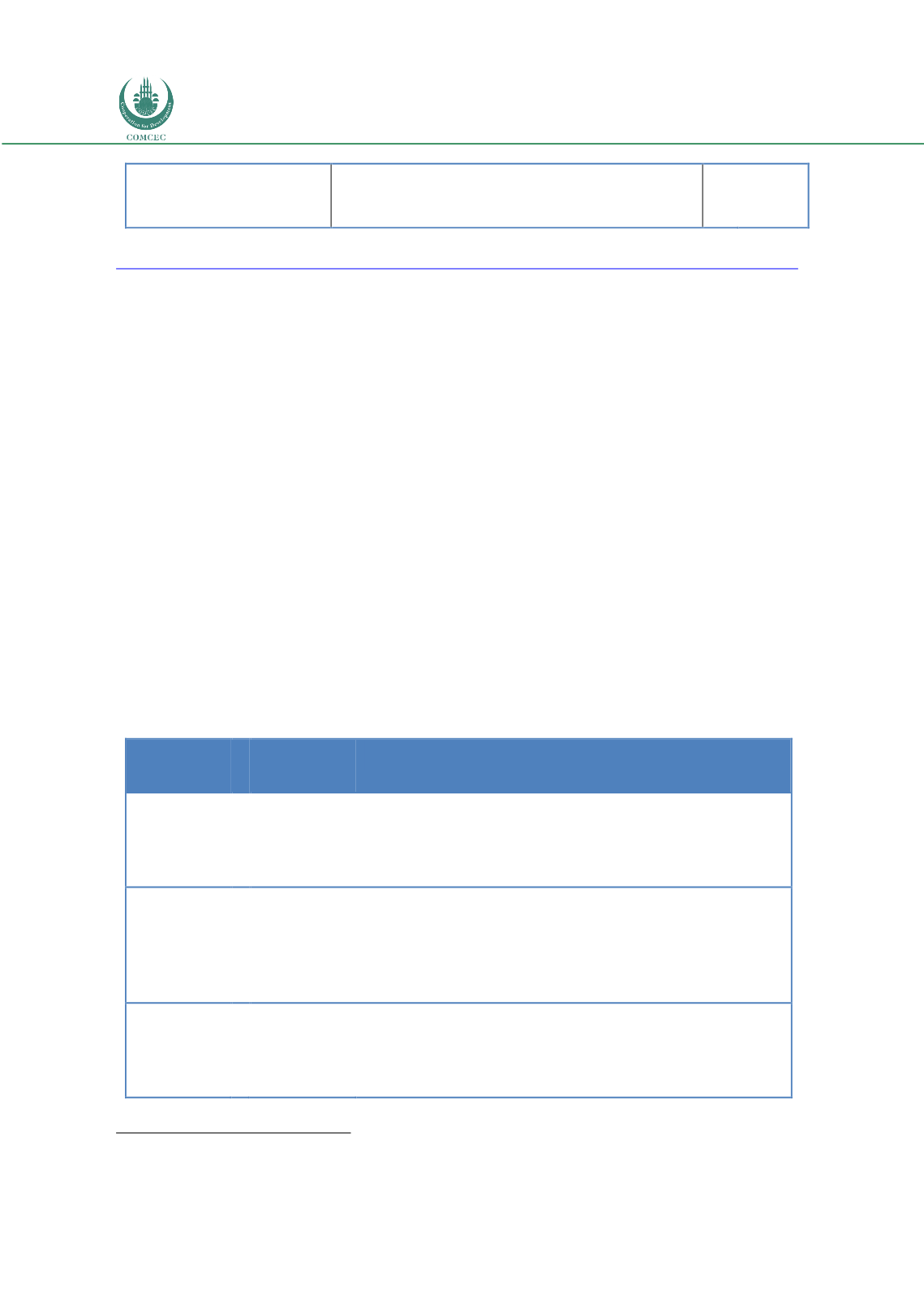

Although the above-referred study of the World Bank has developed several measures to

compare the characteristics of the financial markets, the following indicators are selected to

analyze the four measures of the financial markets in the OIC countries as depicted in Table-2.

Table 2: Selected Financial Data on the OIC Member States

Indicator

Code

Name of the Indicator

DEPTH

GFDD.DI.01

GFDD.DI.02

GFDD.DM.01

Private credit by deposit money banks to GDP (%)

Deposit money banks' assets to GDP (%)

Stock market capitalization to GDP (%)

ACCESS

GFDD.AI.01

GFDD.AI.02

GFDD.AM.02

Bank accounts per 1,000 adults

Bank branches per 100,000 adults

Market capitalization excluding top 10 companies to total

market capitalization (%)

EFFICIENCY

GFDD.EI.02

GFDD.EI.05

GFDD.EI.06

Bank lending-deposit spread

Bank return on assets (%, after-tax)

Bank return on equity (%, after-tax)

7

Cihak, M., Demirgüç-Kunt, A., Feyen E., Levine, R., 2012