Increasing Broadband Internet Penetration

In the OIC Member Countries

132

Pricing of mobile broadband plans is currently more advantageous than fixed broadband,

thereby creating an additional incentive to fixed mobile substitution (see table 69).

Table 69: Saudi Arabia: Fixed – Mobile Plan Pricing (2016)

Prepaid Large Screen

Mobile Broadband

Packages

70 SAR 3GB (1 month)

130 SAR 10 GB (4 months)

300 SAR Unlimited

(3 months)

Postpaid Fixed

Broadband Packages

99 SAR 2 Mbps

SAR 149 4 Mbps

SAR 199 20 Mbps

Source: Operators websites

Investments in fixed and mobile broadband infrastructure

The annual infrastructure investment in Saudi telecommunications was US$ 2.169 billion in

2014. However, total investment has been consistently declining since 2011 (see table 70)

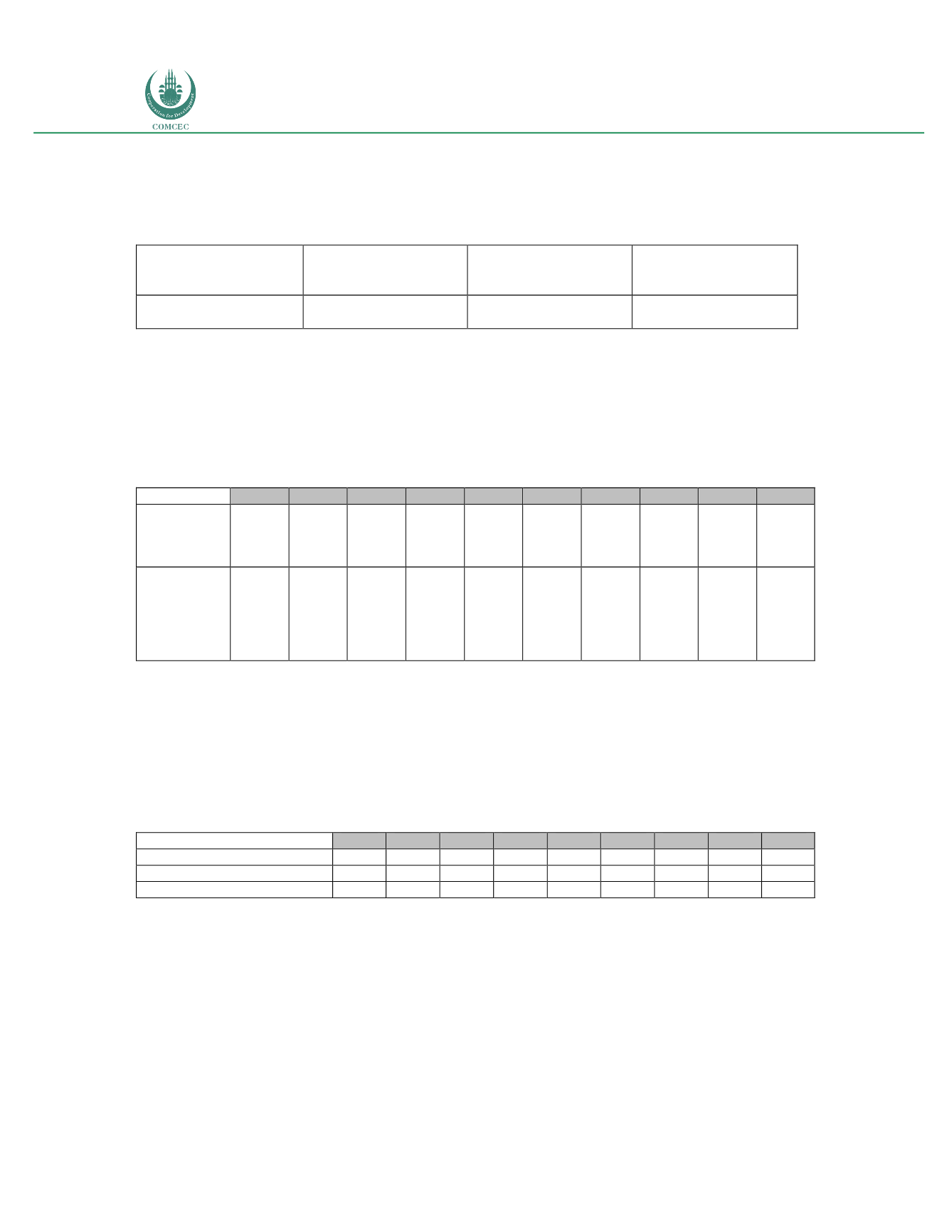

Table 70: Saudi Arabia: Annual telecommunicatio s Inv stment (2005-2014)

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Annual

Investment

(US$ ‘000’000)

1,927 1,928 2,107 3,031 3,105 3,105 3,372 2,674 2,314 2,169

Annual

Investment

per broadband

subscriber

(US$ PPP)

230.06 207.00 208.65 253.72 303.19 255.54 239.11 181.17 157.54 150.17

Source: International Telecommunications Union; Telecom Advisor Services analysis

As table 70 indicates, the total annual investment per broadband subscriber has been

decreasing from a high point of US$ 303 in 2009 to US$ 150 in 2014. The total investment in

telecommunications infrastructure indicates a gradual shift from fixed telecommunications to

mobile (see table 71).

Table 71: Saudi Arabia: Annual telecommunications Investment (2006-2014)

2006 2007 2008 2009 2010 2011 2012 2013 2014

Fixed Telecommunications

1,850 1,807 2,262 1,367

- - -

- - -

- - -

- - -

- - -

Mobile telecommunications

78 300 769 1,738

- - -

- - -

- - -

- - -

- - -

Total

1,928 2,107 3,031 3,105 3,105 3,372 2,674 2,314 2,169

Source: International Telecommunications Union; Telecom Advisor Services analysis

The change in capital spending mix is driven by a shift in investment from FTTH to 4G. Due to a

slow-down in demand for high-speed fixed broadband (mentioned above), operators have

reduced their investment in FTTH and focused more on LTE deployment. For example, the

number of incremental homes passed by FTTH networks has declined for the first time in 2015

(see table 72).