Increasing Broadband Internet Penetration

In the OIC Member Countries

127

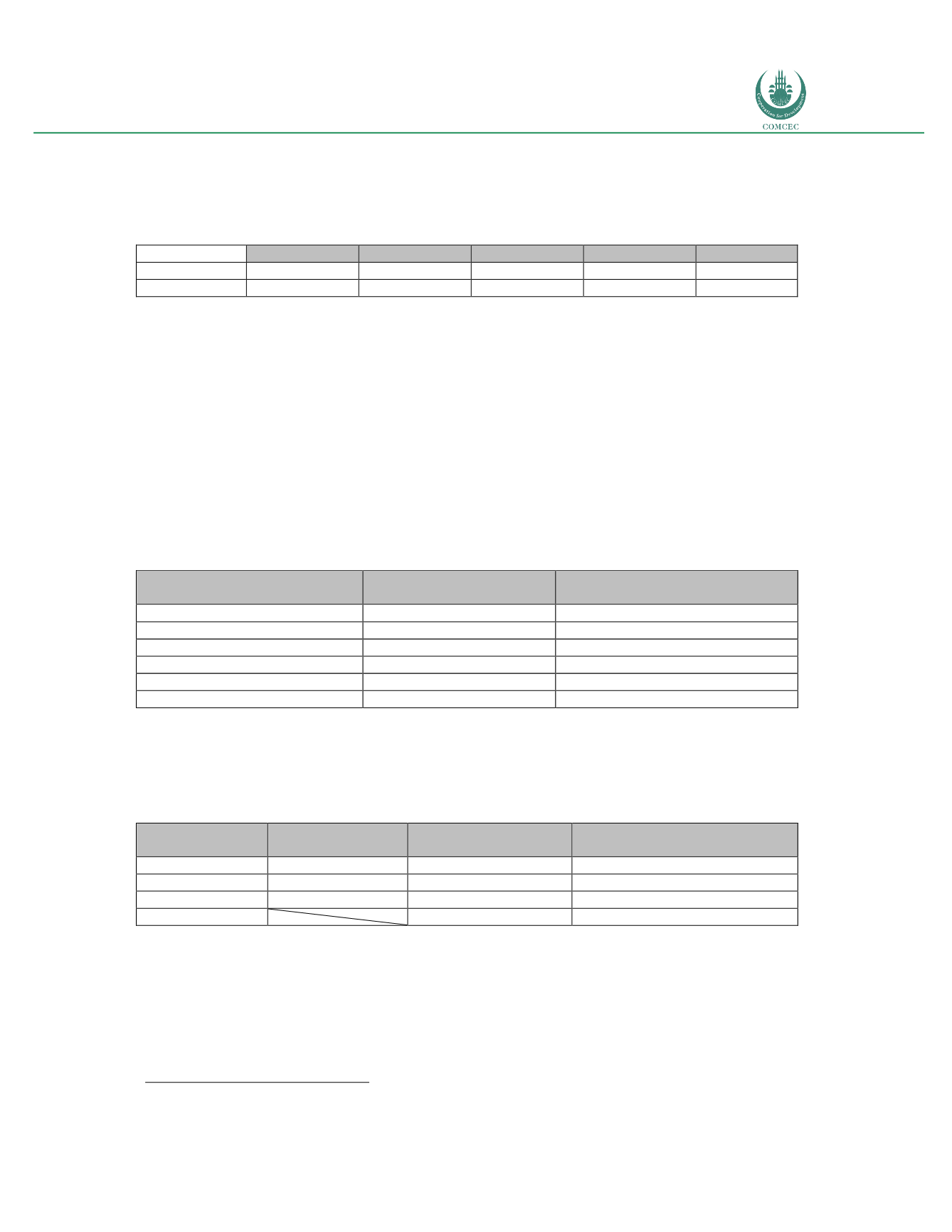

constantly growing since 2011, reaching 98% in the case of 3G and 90% for LTE technology

(see table 63).

Table 63: Saudi Arabia: Evolution of mobile broadband service coverage (2011-2015) (%)

2011

2012

2013

2014

2015

3G

94

95

97

97

98

LTE

40

65

76

85

90

Source: GSMA

Comparatively speaking, a 97% coverage level for 3G is equivalent to that of OECD countries,

and significantly higher than the average for all OIC Member Countries (64.16%), and even

Arab OIC Member Countries (74.30%)

75

.

These high levels of service coverage can be

explained by the incentive resulting from industry competition, which will reviewed in the

next section.

Broadband market structure

The Saudi fixed broadband market is serviced by several players, but dominated by two

operators: Saudi Telecom Company and Mobily (see table 64).

Table 64: Saudi Arabia: Fixed broadband market structure (2Q2016)

Number of Subscribers

Market Share

(by Subscribers) (%)

Saudi Telecom Co.

2,190,960

71.60

Mobily (Bayanat al Oula)

679,300

22.20

Etihad Atheeb (GO Telecom)

79,560

2.60

Integrated Telecom Co.

15,300

0.50

Other minor players

94,800

3.09

Total

3,060,000

100

Source: Telegeography; CITC; Telecom Advisory Services analysis

On the other hand, the mobile broadband market is served by Saudi Telecom Company and

two subsidiaries of Middle Eastern regional players (see table 65).

Table 65: Saudi Arabia: Mobile broadband m rket structur (2Q2016)

MNC

Number of Subscribers

Market Share

(by Subscribers) (%)

Saudi Telecom Co STC (Saudi Arabia)

13,310,000

50.00

Mobily

Etisalat (UAE)

7,719,800

29.00

Zain

Zain Group (Kuwait)

5,856,400

22.00

Total

26,620,000

100

Source: CITC; GSMA Intelligence; Telecom Advisory Services analysis

In the 2012-13 time period a fourth wireless operator, Wataniya Telecom, entered the Saudi

market. However, it never gained traction and in October 2013, it was acquired by STC. Its exit

triggered a moderate increase in consolidation.

75

Source: International Telecommunications Union.