Risk Management in Transport PPP Projects

In the Islamic Countries

45

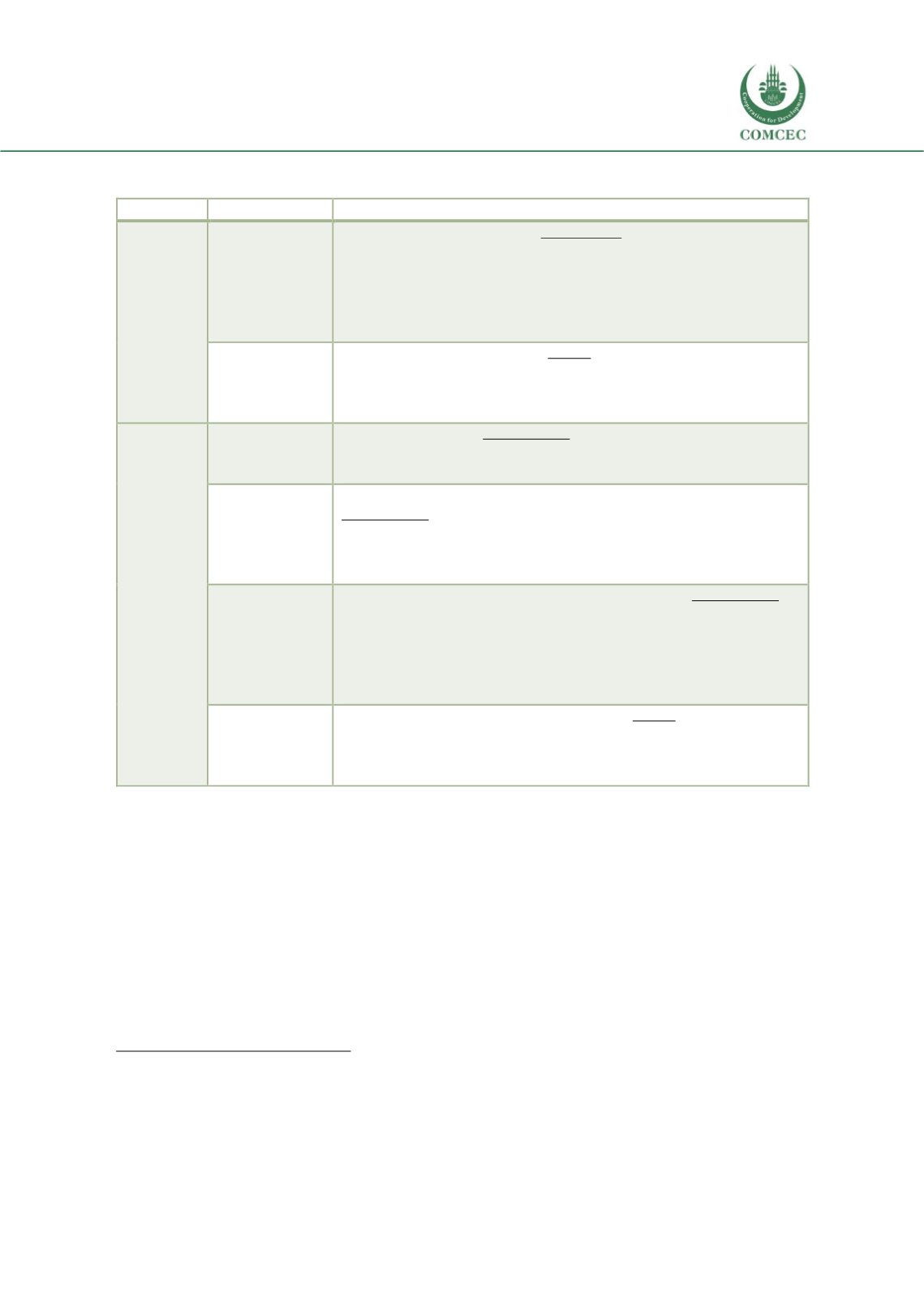

Table 12: Usual risk matrix in transport PPPs (by risk category)

Risk type

Risk category

Usual allocation of risks (public/private/shared)

Context-

related

risks

Political and

legal risks

Political risks fall mostly on the public sector: typically, the public party

bears responsibility for political events outside the control of the private

partner. The public party bears more responsibility for regulatory

changes as well, but there is a degree of risk sharing, as the private party

may not be compensated for changes in law that affect the whole market

equally (e.g. taxation).

Macroeconomic

risks

Macroeconomic risks are mostly shared. In particular, inflation risks

during construction are typically borne by the private partner, while

inflation risks during the concession term will typically be primarily

borne by the public authority.

Project

risks

Financial credit

risks

Credit risks fall on the private sector, as they are inherent in the strategic

decision to invest in a specific market or in the projects promoted by a

specific authority.

Design,

construction and

operation risks

Design, construction and operation risks are generally borne by the

private sector. A first exception is represented by the risk of damage to

the environment, which are generally shared by the private and the

public sectors. Second, land purchase and site risks are generally borne

by the public sector, which is best-placed to select and acquire land.

Financial

sustainability

risks

Financial sustainability risks are generally borne by the private sector.

For toll roads, in the past demand risk used to fall on the private sector

as well; however, in recent years and based on experience (traffic

forecasts falling short on expectations

7

), it has become common for

public authorities to retain demand and toll revenue risk, particularly in

the absence of in-depth traffic analysis.

Other risks

(force majeure

and early

termination)

Force majeure and early termination risks are shared. The ability of the

private partner to bear force majeure risk is limited, and the public

sector typically bears the risk after a certain period of time or level of

cost.

Source: Authors.

Performance metrics

PPPs, as already mentioned, have one defining feature in their focus on outputs (i.e. service

delivery) rather than inputs (e.g. technical requirements). As such, measuring their performance

is key to the management of PPP contracts, and setting clear

performance targets

or output

standards represents only part of the task. In fact, the PPP contract should also specify

how

the

performance will be monitored and assign clear responsibilities for that purpose. Performance

metrics, however, are hardly consistent across infrastructure projects, and this constitutes a

factor significantly hampering comparability and meta-evaluation of PPPs.

7

Forecasting future demand for transport infrastructures is a notoriously complex task influenced by numerous

interrelated factors (including competing modes of transportation, demographic shifts, economic conditions,

the cost of the services to the user, convenience, individual preferences and speed). This often translates into

overly optimistic demand leading to financial loss for the party managing demand risk (Delmon, 2010).