Risk Management in Transport PPP Projects

In the Islamic Countries

44

consideration how the incentive system inherent to each procurement route may influence

risk

allocation

in the concrete case.

PPP contractual arrangements

Depending on the needs addressed by the project and the functions the public authority intends

to transfer to the private party (following the appraisal phase), different PPP contract types can

emerge.

In order to categorize PPPs, two main nomenclatures are used. While the first one underlines

which functions PPPs perform, the second one stresses the element of ownership of the project

asset. The following Table summarizes the two contract nomenclatures.

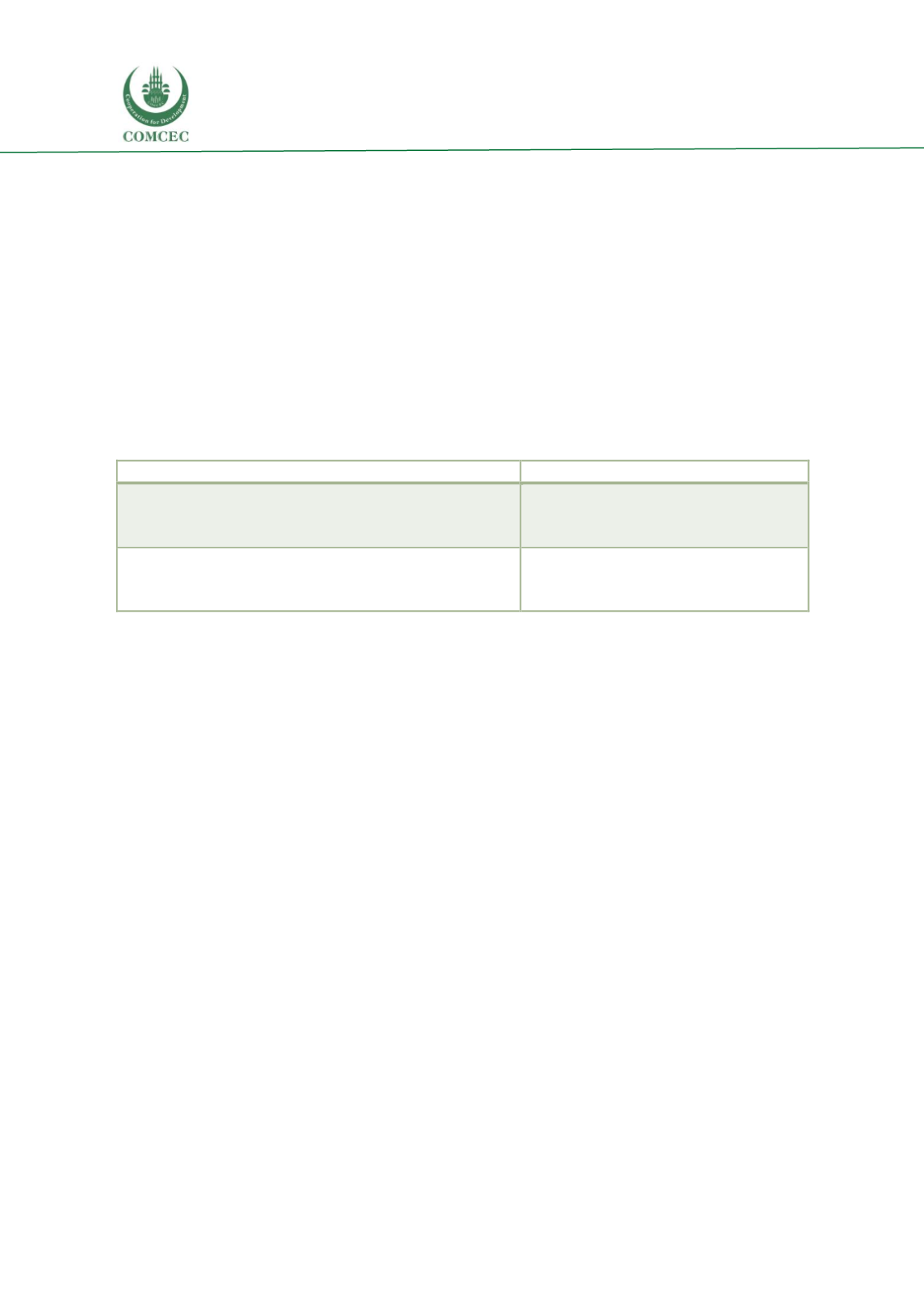

Table 11: The two main PPP contract nomenclatures

Contract nomenclature

Rationale

Design-Build-Finance-Operate-Maintain (

DBFOM

);

Design-Build-Finance-Operate (

DBFO

);

Design-Construct-Manage-Finance (

DCMF

).

The range of PPP contract types is defined

by the functions transferred to the private

sector.

Build-Operate-Transfer (

BOT

);

Build-Own-Operate-Transfer (

BOOT

);

Build-Transfer-Operate (

BTO

).

The range of PPP contract types is defined

by the legal ownership of the asset.

Source: Authors’ elaboration on The World Bank et al., 2017.

Irrespective of such categorization, the preparation of the PPP contractual arrangement

revolves mainly around

risk allocation

, i.e. the definition of which party is expected to assume

each risk.

Global Infrastructure Hub (2016) provides comprehensive risk matrixes for 5 transport

subsectors (toll roads, airports, light rail, heavy rail, ports), identifying for each risk which party

it is generally allocated to, and which are the relevant mitigation measures. Building on this

work on punctual risks, the following Table provides a general overview on risk categories

instead (based on the categories outlined at the beginning of this Chapter). In fact, for the

purposes of this study, establishing a

risk matrix

with risk categories and not individual risks

achieves two goals. First, it offers a wide-ranging view on the issue of risk allocation and allows

to make visible the rationale behind risk allocation, i.e. themanagement of a risk should fall upon

the party best positioned to assess and address it. Second, it provides an indispensable degree

of flexibility in the adoption of the framework in the country case studies (Chapte

r 5).