Risk Management in Transport PPP Projects

In the Islamic Countries

193

While the choice of the procurement strategy is presented straightforwardly in the national PPP

guidelines, this choice appears to be less univocal in Aqaba. In fact, the choice of the procurement

strategy by ADC varies and depends on the single transport PPP project. Not only open tenders

are used, but also restricted procedures and negotiated processes, following internal practices

and the advice of international consultants.

PPP contractual arrangements

As already seen, BOT is the most common PPP scheme for transport PPP projects in Jordan.

The rationale of

risk allocation

in PPP contracts, according to the country’s PPP Program, lies

in assigning each risk to the party best able to manage it, thereby maximizing Value-for-Money,

protecting public interests and preventing the government frombeing allocated risks associated

with design, financing, construction, operation and maintenance. The following Table

summarizes the usual allocation of the risks between the public and the private sector in

transport PPPs.

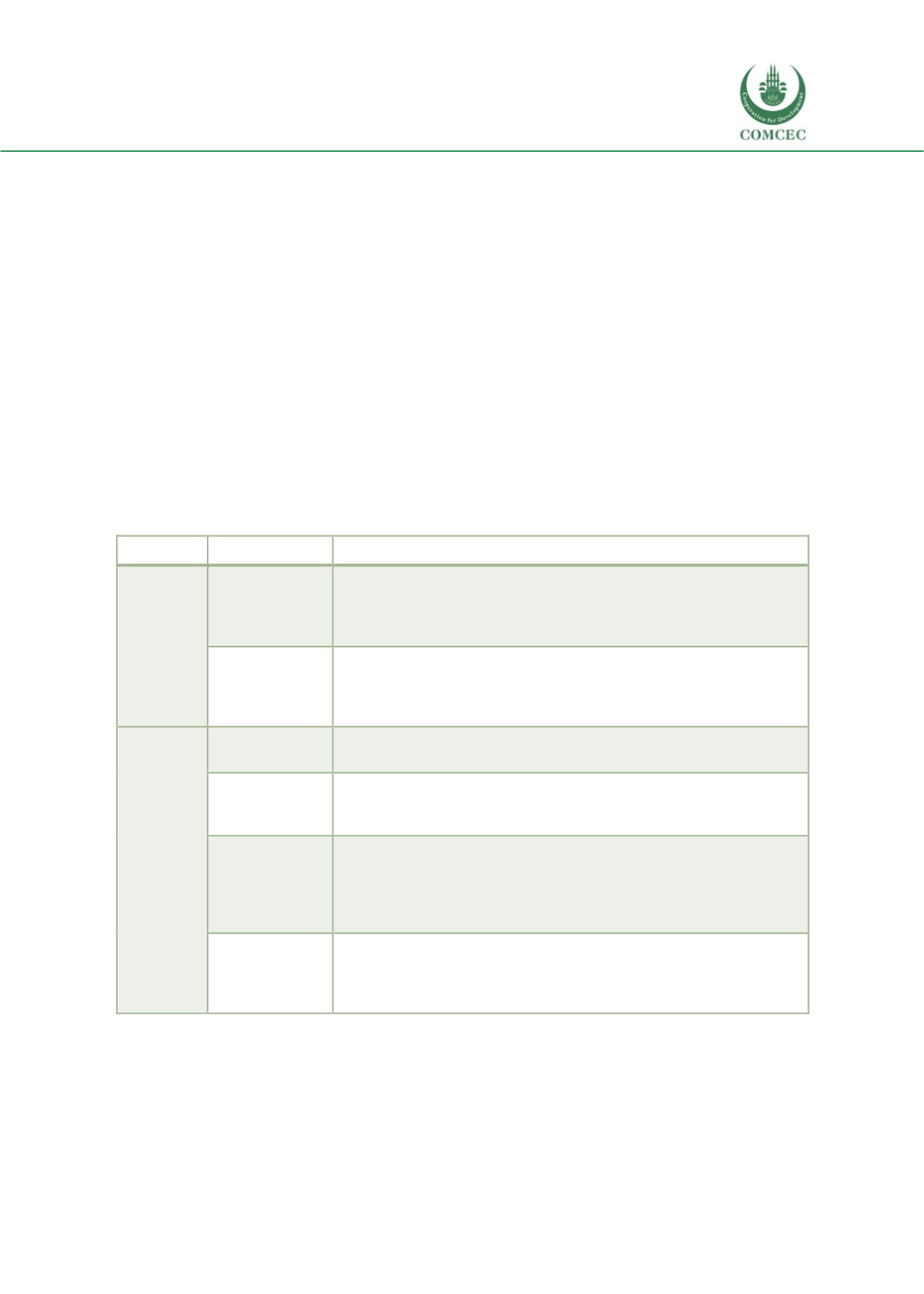

Table 36: Indicative risk matrix in transport PPPs in Jordan (by risk category)

Risk type

Risk category

Usual allocation of risks (public/private/shared)

Context-

related

risks

Political and

legal risks

Political and legal risks are generally retained by the

public sector

. As

these risks could reduce the profitability of the project for the private

party, the latter may require compensation payments from the

contracting authority for lost revenue, increased costs or lost profits.

Macroeconomic

risks

While the risk of interest rates on the loans increasing falls mainly on the

private sector, the exchange risk is mostly

shared

. On the one side, the

project’s profitability would decrease. On the other side, the public sector

may be required to pay higher debt service return.

Project

risks

Financial credit

risks

Credit risks fall on the

private sector

, as it has the responsibility to

contribute to the financing of the project.

Design,

construction and

operation risks

The

private sector

is generally responsible for these risks. Land

availability and unsuitability represent exceptions, being borne by the

public sector.

Financial

sustainability

risks

While the private sector is responsible for management risk, demand and

revenue risks are generally

shared for airports and terminal projects

(no demand guarantees are foreseen in these projects).

For public

transport and rail projects, the demand is subject to guarantees which

partially limit the risk of the private sector.

Other risks

(force majeure

and early

termination)

Force majeure and early termination risks are

shared

,

since

if they

materialize, the project is unable to perform.

Source: Authors.

Performance Metrics

The PPP Regulation establishes that the contracting authority shall, supported by the PPP unit,

monitor and audit the private operator’s execution of his contractual obligations. In addition, it