Risk Management in Transport PPP Projects

In the Islamic Countries

191

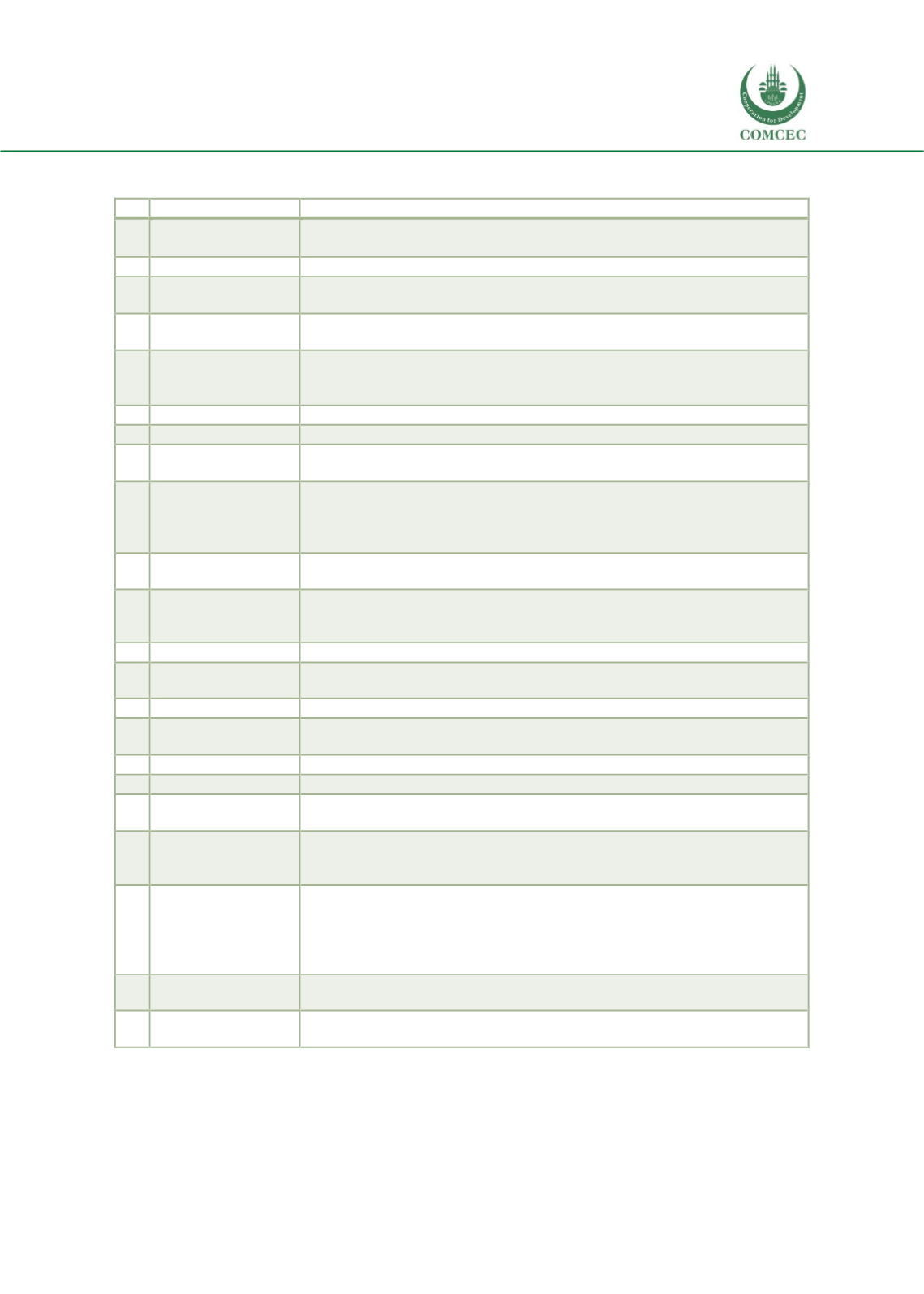

Table 35: Risks to consider for risk identification, based on PPP guidelines

Risk

Description

1

Land availability

and acquisition

Land needed for the project is unavailable;

There is uncertainty over the cost to acquire the needed land and its timing.

2

Land unsuitability

Unanticipated adverse ground conditions are discovered.

3

Environmental risk

The project causes major environmental impacts on surrounding natural

resources.

4

Health, safety and

permits/licenses

Regulations or standards on health, safety, permitting, licenses, etc. are not

respected.

5

Currency

availability and

transferability

Foreign currency is unavailable to transfer funds from local to hard currency;

Profits earned by the project inside the country cannot be repatriated to its

owners outside the country.

6

Operating costs

Operating costs are higher than expected.

7

Interest rate

Interest rates on the loans used for construction increase.

8

Exchange rate

Local currency depreciates relative to the hard currencies in which the

project’s loans and equity investments are denominated.

9

Market

The quantity of outputs or services demanded by users or the off-taker is less

than expected;

The PPP project’s tariffs or prices are not adjusted according to the escalation

formula agreed upon.

10

Responsibility of

design

The government provided a faulty or inappropriate design.

11

Detailed design,

specifications and

standards

The project’s performance standards or design specifications are

inappropriate for the project’s needs.

12

Design data

Wrong or inaccurate data has been used during construction.

13

Procurement and

construction

Completion of the project construction was delayed.

14

Construction cost

Total construction cost was more than anticipated.

15

Program

Project completion is delayed or there is a cost over-run due to faulty work

scheduling.

16

Operation

The project is unable to function and operate as fully as had been anticipated.

17

Maintenance

The project’s assets are not properly maintained.

18

Ancillary features

Ancillary infrastructure services that the project needs (e.g. approach-roads,

interconnection facilities, etc.) are not provided and completed on time.

19

Transfer

The condition of the assets at the end of the contract term when they are

transferred back to government shows no compliance with the PPP

contract’s maintenance & performance standards.

20

Regulatory risk

Terms and conditions of the PPP contract regarding the operator’s ability to

collect revenues and seek reasonable tariff increase according to the

contract’s price escalation formula are not fulfilled;

New laws or regulations are passed, increasing the costs or reduce the

revenue of the PPP contractor without fair compensation.

21

Political/sovereign

risk

The government nationalizes the project.

22

Force majeure

The project is not able to perform due to natural catastrophes (earthquakes,

flooding, etc.).

Source: PPP unit, Ministry of Finance (2019).