Risk Management in Transport PPP Projects

In the Islamic Countries

168

A PPP contract standard model is not in use in Algeria

and all contractual elements shall be

detailed in the agreements specific to the individual Public-Private Partnership initiatives. This

also applies to the risks potentially affecting PPP projects throughout all phases of delivery of a

PPP contract, including project development, implementation, operation and closure. In fact the

existing Algerian Public Procurement Code does not include standard provisions relating to the

identification and allocation of risks and their management.

Notwithstanding the absence of such provisions, according to a study by the European

Investment Bank undertaken in 2011 it is possible to elaborate an

indicative allocationmatrix

of the main categories of risks

usually applying to PPP projects. The Table below provides a

summary of the allocation of the risks between the public and the private sector outlining the

underlying rationale, according to this study (EIB, 2011).

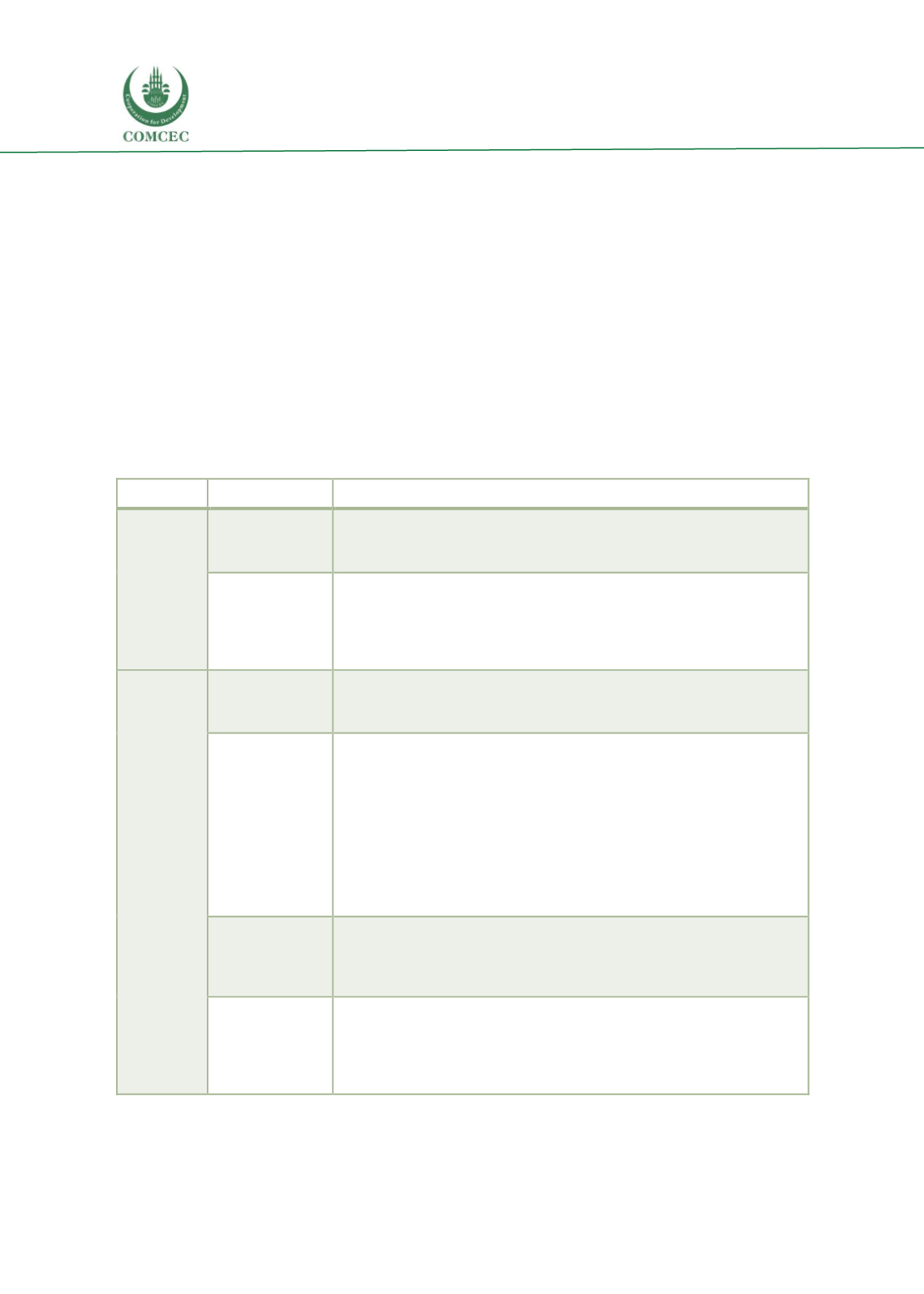

Table 33: Indicative risk matrix in transport PPPs in Algeria (by risk category)

Risk type

Risk category

Usual allocation of risks (public/private/shared)

Context-

related

risks

Political and

legal risks

In general terms these risks are borne by the

private party

, who is

responsible of the for changes in the contract that may derive from a

change in law and financing cost.

Macroeconomic

risks

Macroeconomic risks are under responsibility of the

public party

.

Inflation and exchange risks are mitigated by price inflation adjustments

by the public party and the risks associated with the management of the

liabilities and fiscal risks possibly applicable to the PPP contract is also

borne by the public party.

Project

risks

Financial credit

risks

The current legislative provisions require that lending shall be provided

by national banks. Financial credit risks are also generally retained by

the

public sector

.

Design,

construction and

operation risks

Depending on the structure of the project risks associated with the

conception and design of the project, as well as for engineering and

construction defects could be either on the

public or private

sides (for

instance in the above-mentioned BMT PPP project the public has been

responsible for the works concerning the basic port quay structure and

the private of the superstructure related infrastructure and equipment).

The

private

party is generally responsible for the management and

operation of the infrastructure. Depending on the project the

public

sector

may retain the risks related to urban and environmental permits,

whereas land concession related risks are borne by the public.

Financial

sustainability

risks

The

private sector

is also generally responsible for economic and

financial risks, business, commercial as well as management and

performance risks, including demand risks, except from those contracts

where subsidies are foreseen.

Other risks

(force majeure

and early

termination)

Force majeure and early termination risks are

shared

specified that

according to the

EIB, most contracts do not appear to offer adequate

protection of the private party investment in case of contract termination

(EIB, 2011). Cases of force majeure and early termination are to be

specified in the PPP contracts.

Source: Authors based on EIB, 2018.