Improving Transport Project Appraisals

In the Islamic Countries

34

economic impact of an investment project is given by the difference over time of the benefits

accruing to different agents thanks to the project and the costs of producing such benefits, all

valued at their opportunity cost.

The key strength of this approach is that it produces information

in a quantitative form about the project’s net contribution to society

, summarized into simple

numerical indicators, such as the NPV of a project. The fact that CBA leads to a single outcome in

money units is a great advantage; this does not only make it possible to rank projects, but also

to reach conclusions about the social desirability of the project by itself.

CBA has a long and respected intellectual and practical history, especially in the transport sector.

As a matter of fact, the CBA theory was developed initially for transport infrastructures and then

extended to other fields. Governments and international institutions all around the world recur

to CBA in the process of transport infrastructure planning and appraisal in a variety of ways (see

e.g. Beria et al, 2012). The strong tradition of CBA in the transport sector of the OECD countries

is also reflected i

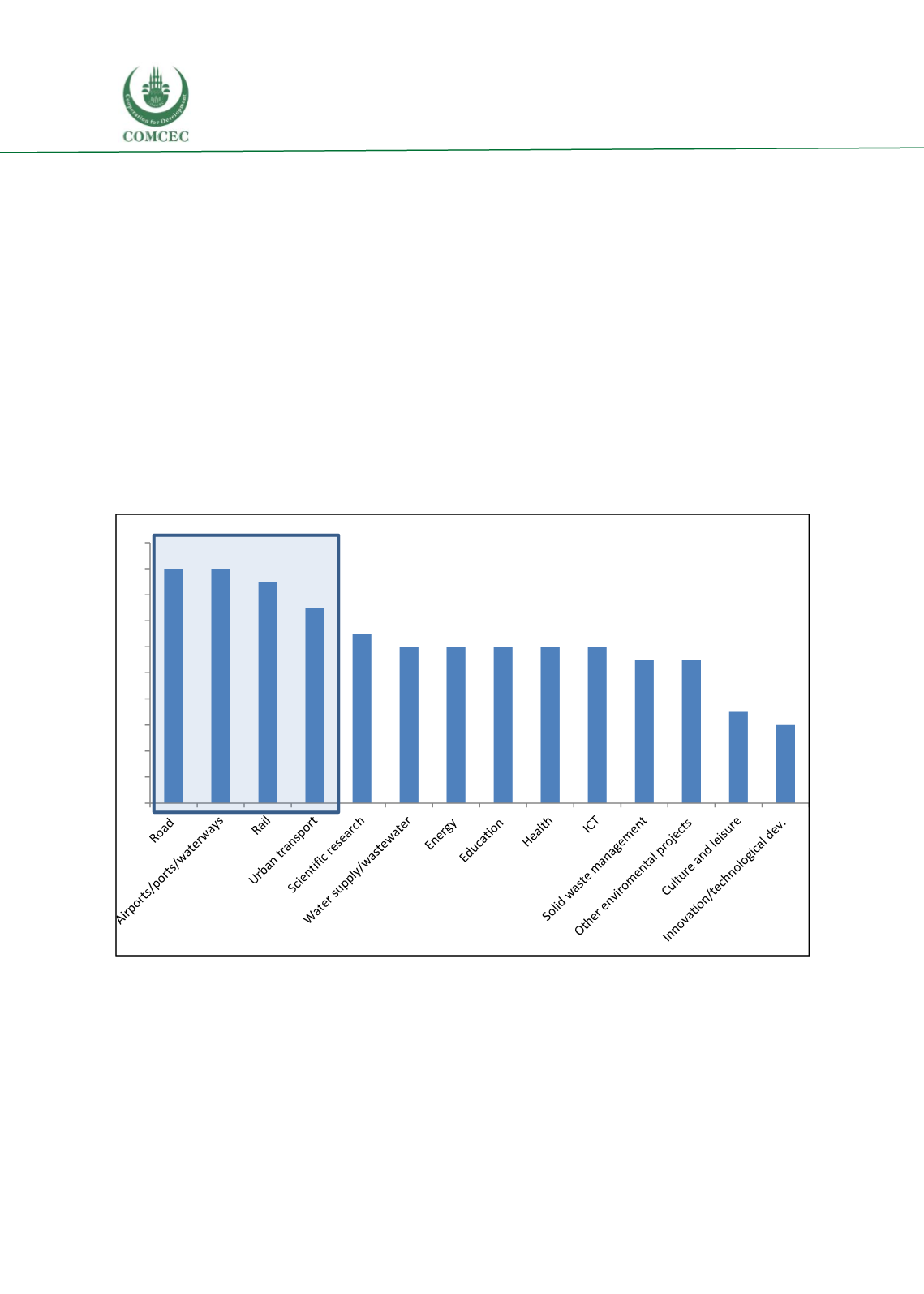

n Figure 1.8.Figure 1.8: CBA performed in various sectors

Source: CSIL processing OECD survey data

However,

since different CBA traditions developed over time and context, it is not trivial to specify

the way in which the CBA has to be performed

. For instance, a key methodological distinction is

between general equilibrium and partial equilibrium approaches. While there exist some theory

0

2

4

6

8

10

12

14

16

18

20

Transport