Improving Transport Project Appraisals

In the Islamic Countries

38

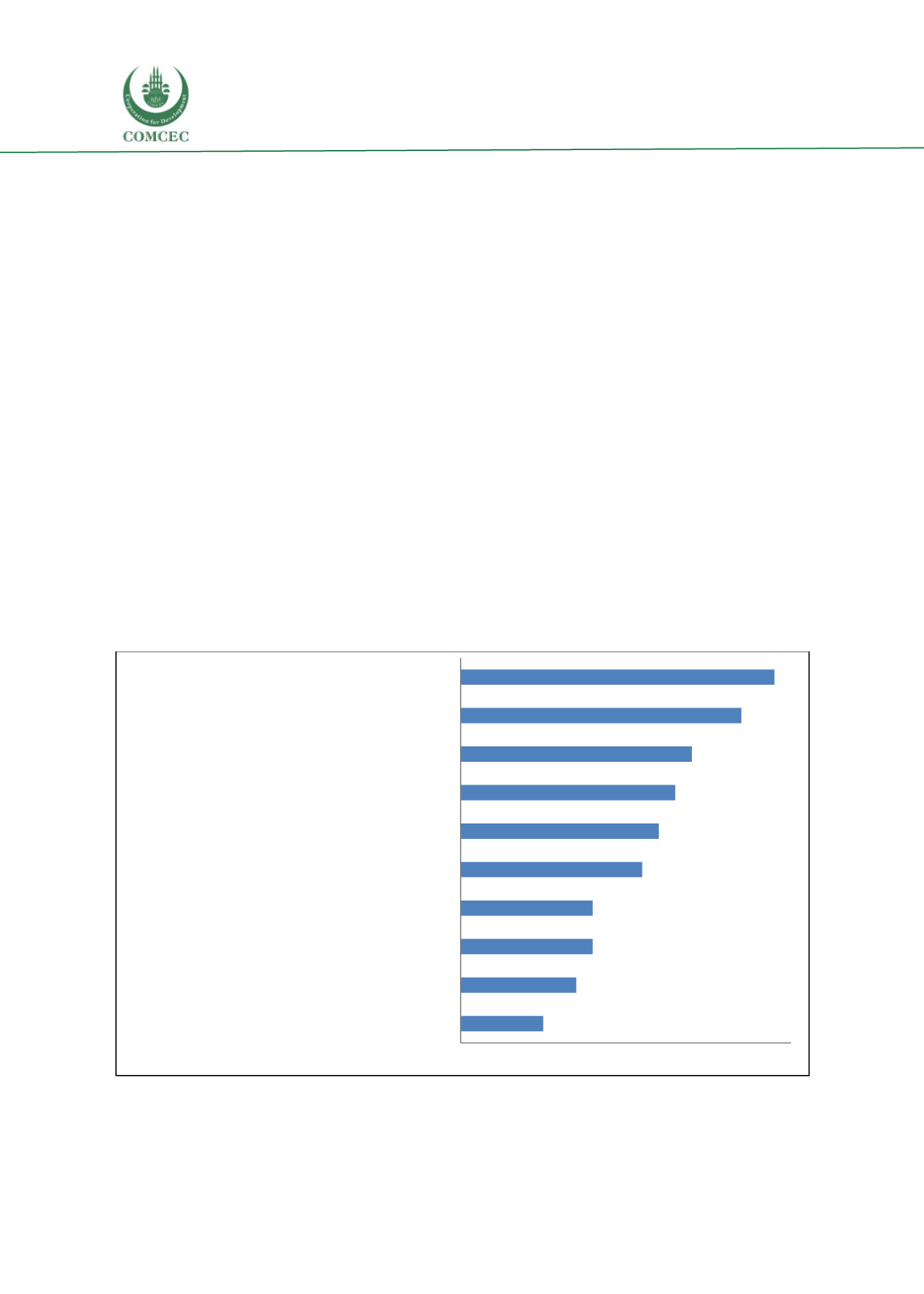

Another topic is the

list of effects that can reasonably be included in the assessment

,

as well as the

method for their assessment. Guidance documents may as well provide suggestions on the most

suitable methods to calculate the effects generated by the transport project. Ideally, the

appraisal should include all impacts of the investment. However, setting such a broad scope for

an appraisal will result in extensive and expensive data collection and analysis (TheWorld Bank,

2005). Given that the purposes of the appraisal are mainly to assess if a project is economically

beneficial and to aid the choice between alternatives, the scope of the appraisal is in practice

often narrowed by including a number of core effects.

A good practice is to define a

shortlist of typical benefits

that one may expect to have for

homogeneous groups of projects. At a minimum, for transport projects these should include

journey times, vehicle operating costs, safety, environmental effects, user charges and operator

revenues. In practice, a transport project must generally be justified by its direct benefits

(Beria et

al, 2012). This conservativeness principle, which is shared by a number of guidance documents

(e.g. the World Bank, the UK, the EU), prevents overly optimistic outcomes on borderline issues.

However, this approach does not mean that second order effects (such as agglomeration

economies, distributive effects, wider economic impacts) are neglected. Second order effects can

clearly make a project preferable over another, but they cannot make feasible an otherwise

unfeasible investment. An overview of typical items included in an economic analysis of the

OECD countries is presented i

n Figure 1.11 .Figure 1.11: Typical items that are included in the economic analysis

Source: CSIL processing OECD survey data

0 2 4 6 8 10 12 14 16 18 20

Border prices for tradable goods

Shadow wages

Hedonic prices

Conversion factors to convert market into shadow

prices

Willingness to pay by users

Other emissions types that are considered in the

environmental impact assessment

Social discount rate

CO2 emissions

Cost savings

Time saving