Improving Transport Project Appraisals

In the Islamic Countries

33

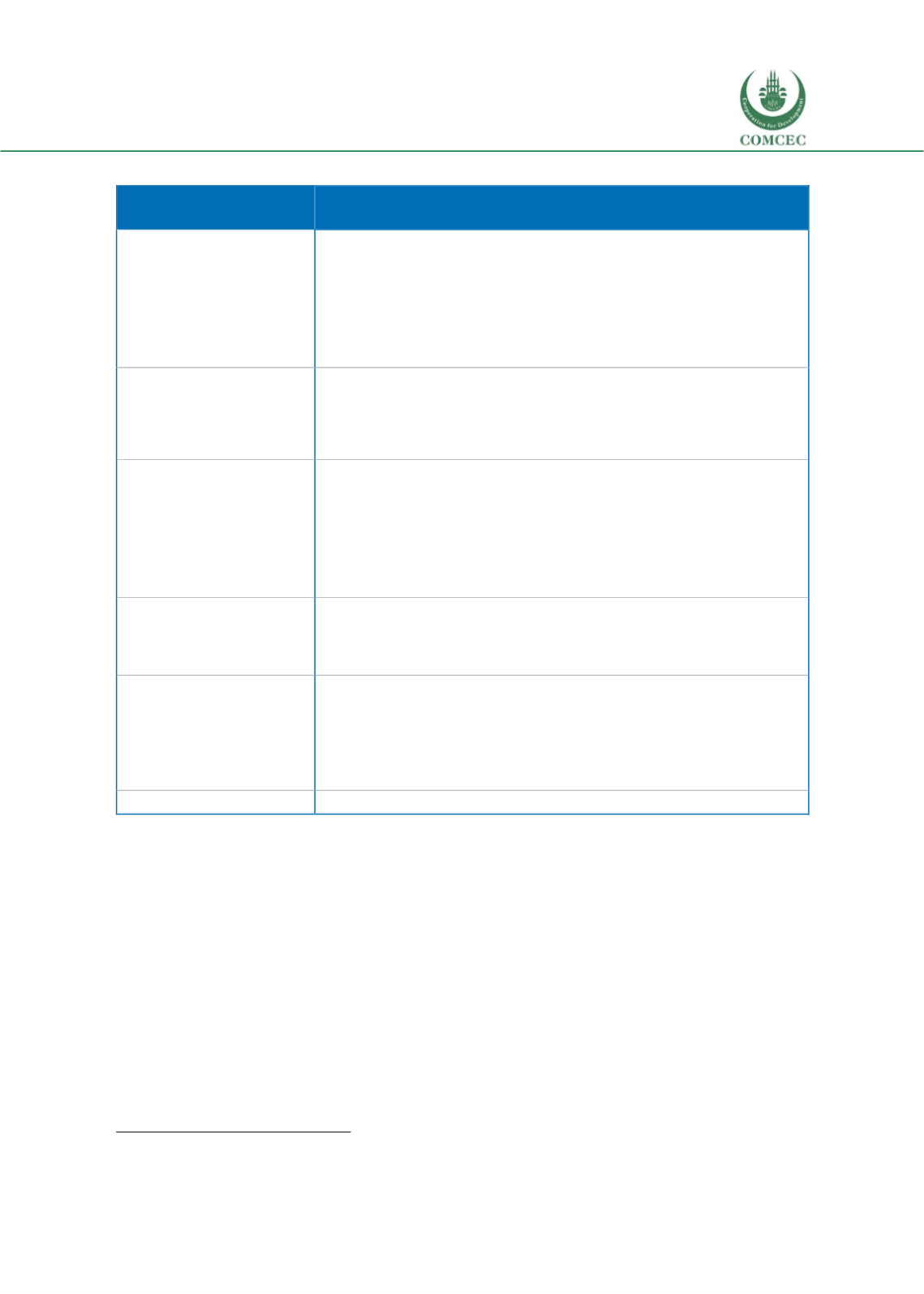

Table 1.6: Methodologies in use for transport project appraisal

Methodology

Output

Macroeconomic

simulation models

Variation of gross domestic product (GDP) growth and other

macroeconomic variables (inflation rate, employment rate,

wages, etc.) and productive factors

Variation of Human Development Index or other indicators

Variation of Environmental Performance Index or other

environmental indicators.

Input/Output models

Variation of GDP growth and other macroeconomic variables

(inflation rate, employment rate, wages, etc.) and productive

factors. They are not suitable for capturing the technological

change

Cost Benefit Analysis

Indicators at micro level, with a relation to economic the

dimensions: net present value (NPV), internal rate of return (IRR)

Willingness to pay for increased aesthetic value, hedonic price for

urban regeneration, social value of improved safety, etc.

Monetary value of environmental externalities using revealed or

stated preferences

Cost-Effectiveness

Analysis

Quantitative indicators on travel time savings

Quantitative indicators on safety: n. of avoided deaths and injured,

Quality Adjusted Life Year (QALY)

Information Elicitation

Techniques

Qualitative information on the project’s economic contribution

Quality of Life Index and other qualitative information on the

project’s environmental contribution

Environmental Impact Assessment (EIA) and other qualitative

information on the project’s environmental contribution.

Multi-Criteria Analysis

Qualitative impact score

Focus on CBA

Suggested methodologies can vary depending on the scale and typology of projects. Usually, for

major transport infrastructures, CBA is the most common recommendedmethodology, although

the way it is implemented can vary from one context to the other. Methodological guidelines

specific for transport are developed in many countries, for example in the UK, Spain, France,

Poland, the Netherlands, Denmark, Chile) and routinely updated

15

.

CBA is considered the most suitable technique for evaluating infrastructure investment

because of

its long-term, holistic, micro-economic and welfare-based nature. In CBA one tries to express all

socio-economic advantages or disadvantages of an investment decision in a long-term

perspective by systematically comparing its costs and benefits (including the externalities) in

order to estimate the net welfare change attributable to it. The basic idea of CBA is that the socio-

15

See also Section2.2.3 on standards and guidelines.