Improving Transport Project Appraisals

In the Islamic Countries

21

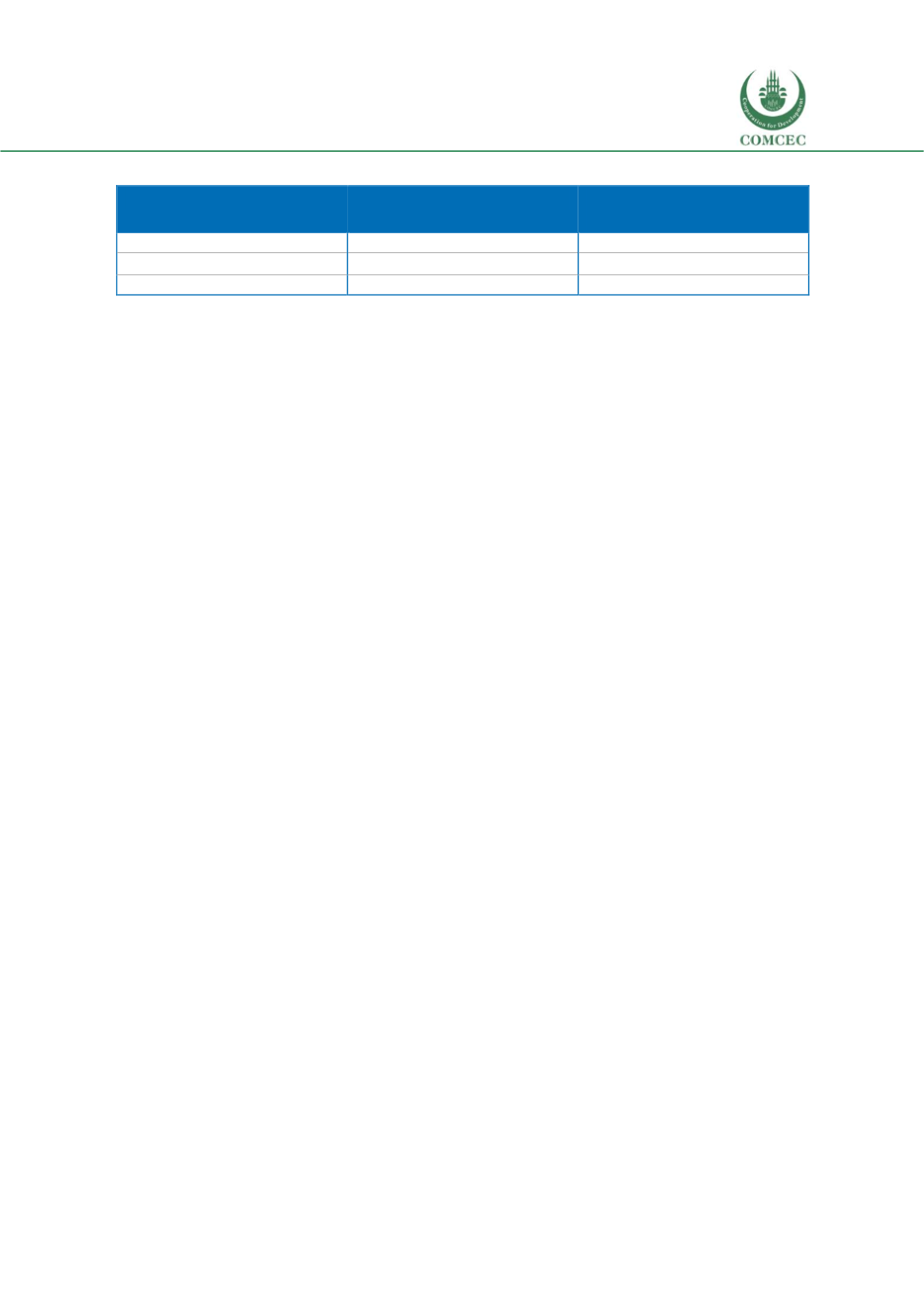

Table 1.2: Depth and cost of project appraisal

Phase or project cycle

Type of appraisal

Cost (% on total investment

costs)

Identification phase

Opportunity study

0.2-1.0

Formulation

Pre-feasibility study

0.25-1.5

Appraisal and selection

Feasibility study

0.2-1.0

Source: Own processing of UNIDO, 1991

A transport project appraisal can for instance be mandatory for all financially significant public

investments (with a precise definition of the financial threshold), or requiring different depth or

type of analysis depending on the financial scale, scope or sector (e.g. for rail, road, urban

transport). The proportionality principle is also implicitly recognised by the Chilean national

system which promotes a multi-stage evaluation. A large investment project such as a bridge or

a highway is evaluated at several stages of the project cycle. Instead, smaller, non-complex

investments do not have to undergo all stages of the project cycle (Gómez-Lobo, 2012).

The definition of scope in transport project appraisal is further complicated by the

network

character of this sector

. Typically, a transport project has complementary infrastructures linking

it to the rest of the network. Moreover, changes in traffic flows for one transport mode generate

effects across other different modes. This poses a significant challenge to the analyst and

requires to embed individual projects into comprehensive plans and strategies.

Hence, a problem arises as to

perform the appraisal on individual projects or at the strategic level

(or a combination). While individual project appraisal is a common practice, usually by means

of a CBA (see below on methodology), ranking projects in the same sector or subsector to build

a strategic project pipeline is less common.

Ad 3) Timing

The purpose and scope of project appraisal in the decision-making process has an implication

on its timing. In the same way,

the phase of the project cycle at which the project appraisal is

conducted has a significant impact on its role

in the public investment management system. If the

appraisal is used mainly in the preliminary phase by government to include or discard projects

from a list and eventually to prioritise them according to budget, the appraisal should be done

at a very early stage where different strategic solutions are still open to solve a given problem

(this can be referred to “strategic appraisal” or “opportunity studies”). If project appraisal is

required to assess an individual project and to eventually support its design, then the appraisal

should be “thorough appraisal” accompanying the decision-making of possible real alternatives

(Beria et al, 2012). On overview of when CBA is performed in the OECD countries is presented

i

n Figure 1.4.