Destination Development and

Institutionalization Strategies

In the OIC Member Countries

140

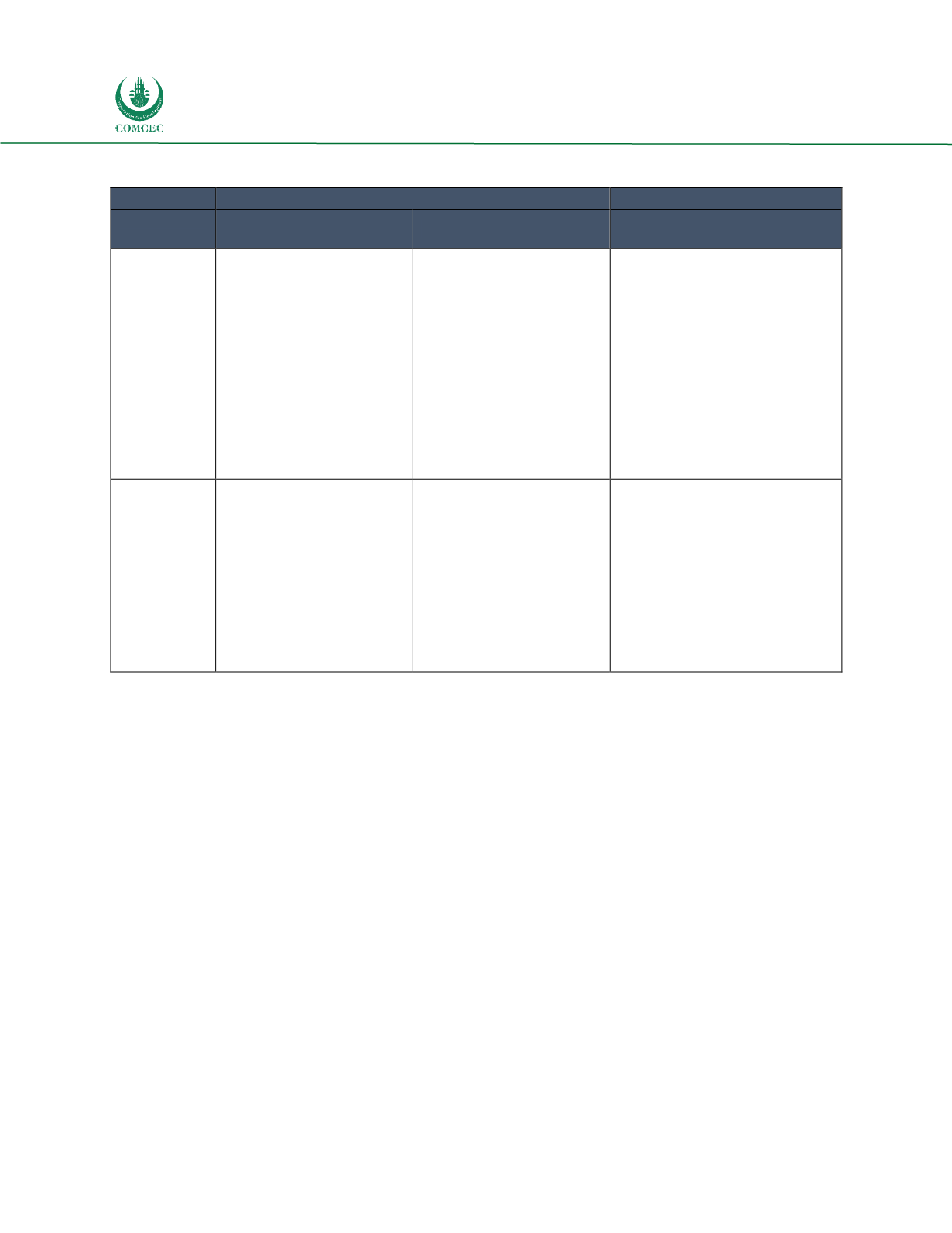

Table 28: The OIC Country Examples:

Phase

Discovery/ Exploration phase

Developed phase

Country/

Destination

Azerbaijan (National)

Nigeria (National)

Turkey (National)

Public

sources:

In Azerbaijan, only public

funds are available for

destination development

by theMinistry of Tourism.

In Nigeria, the Cross-River

Tourism Bureau relies on

government grant funding,

totaling $1.3 million for

cultural tourism sectors in

the nation in 2017.

There is also a 3% tax

levied

on

consumer

spending, but admittedly,

this

tax

has

been

challenging to collect.

Overall: Turkey does not use

city taxes to fund DMOs,

however, direct funding from

government

and

local

Chambers

Private

sources:

Government plans to enact

a new law to encourage

public-private partnership

funding.

Private sponsorships from

industry stakeholders to

fund

operations.

In

addition,

the

tourism

board has issued licenses

and

memberships

to

tourism operators.

Turkey’s DMO membership

fees support the local DMOs

operating costs. For example,

Belek DMO is funded by 47

private hotel members with an

annual budget of over $350,00.

ICVB

example:

Direct

Contribution from the Istanbul

Chamber of Commerce.

Source: DinarStandard Analysis

5.6 How the OIC Countries Compare in Terms of Legislation

In the tourism sector, government regulations are developed to ensure best practice and protect consumers

or develop sustainable resources. Regulations are typically developed by national tourismbodies and agencies

and DMOs are typically established through legislation. Legislation regarding tourism typically entail

destination’s entry visa requirements and taxation regulations, which have a major impact on DMO

capabilities and activities. Visa requirements impact accessibility and tourist taxes impact competitiveness.