Improving Customs Transit Systems

In the Islamic Countries

106

the possibility by telephone or human contact only, and 2.2% of the countries don't give the

possibility to provide feedback. Regarding information published on the applicable duties,

53.3% of the countries have published information (or an electronic link) on the applicable rate

of duties and keep this information up to date, while 28.9% have the information, but they don't

keep it up to date. Still, there are 17.8% of the countries where it is not possible to find the

applicable rate of duties on the Customs website. When it comes to inquiries points for traders

regarding to customs issues including transit procedures, applicable rate of duties, fees and

taxes, laws, restrictions or prohibitions, penalty provisions, appeal procedures, and agreements

with third countries, almost all OIC MS (91.1%) have established such a points, but they are not

adapted to commercial needs, and there is not a standard time of response for the various means

of inquiry, taking into account their respective nature or complexity. Also, some but not all

documents and forms required for the procedures of border agencies are available online in

more than half of the analyzed OIC MS (57.8%). Even though the information about the

procedures is published in prior to entry into force in 46.6%OIC MS, still 35.6% of the countries

published only selected new or amended trade-related laws and regulations, and 17.8% don't

have an interval before entry into the force. 55.6% of the OIC MS don't have information on the

official Customs website about international agreements relating to importation, exportation or

transit, 42.2%have such information but not together with topic-specific annotations where the

most relevant parts of the agreements (related to export, import or transit matters) are

explained and highlighted. Also, regarding the information about appealing procedures, 42.2%

of countries have no information on appeal procedures provided online, while 44.4% of

countries have such information displayed online, but without guidance on how to undertake

these procedures on an individual basis. Traders can find the relevant legislation on the Customs

website in 73.3% of the countries, but there are not quick references among the different pages

of the website or user-friendly guidance on key issues. In 95.6% of the countries, no judicial

decisions on Customs matters are published. There is no designated interactive page for traders

/ customs agents that provide specific information and tools for electronic interfaces, 80% of

the MS have published downloadable forms, while 20% of MS have such a designated page for

traders or a “pro” version of the website. Near half of the MS does not have online manuals to

help users when a new procedure or changes in the current ones are implemented.

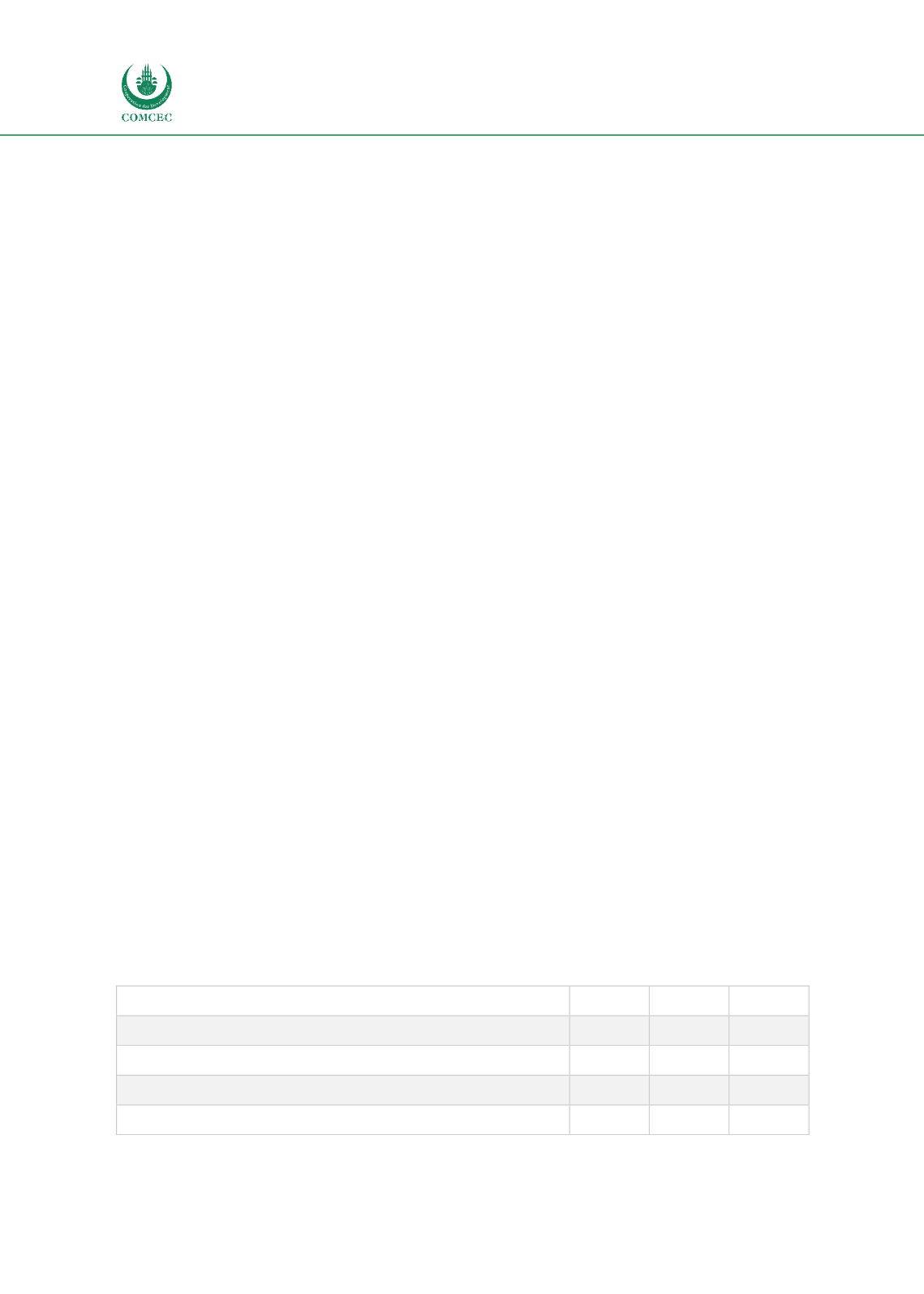

Table 37: TFI related to Information availability

Response

0

1

2

Establishment of a national customs website

6.70%

20.00%

73.30%

Possibility to provide online feedback to Customs

2.20%

31.10%

66.70%

Publication of rate of duties

17.80%

28.90%

53.30%

Establishment of inquiry points

8.90%

91.10%