Improving Customs Transit Systems

In the Islamic Countries

108

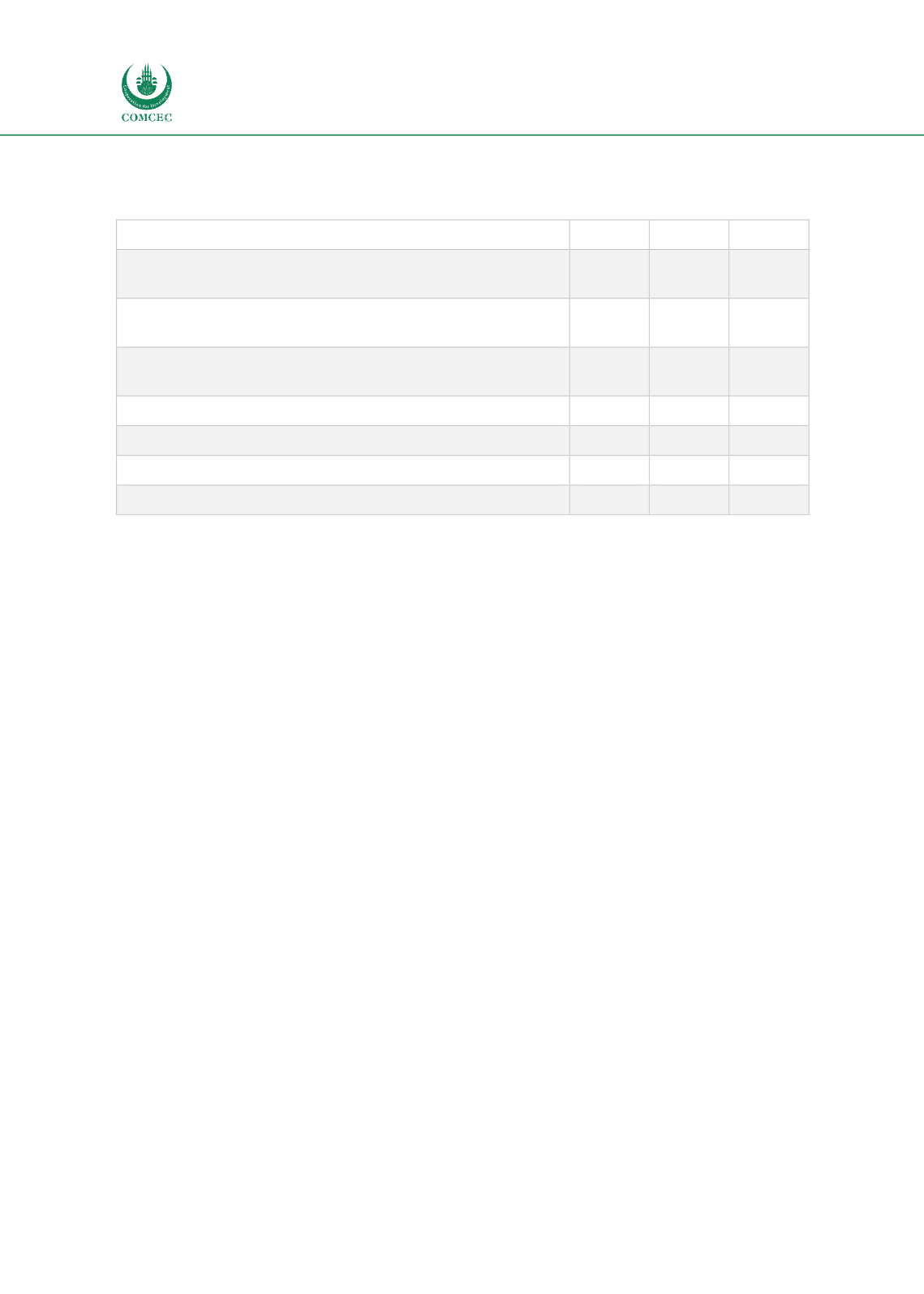

Table 38: TFI related to the involvement of the trade community and other interested parties

and government

Response

0

1

2

Public consultations between traders and other interested

parties and government

6.70%

40.00%

53.30%

General notice-and-comment framework procedures in place,

applicable to trade and border issues

28.90%

57.80%

13.30%

Are there established guidelines and procedures in place,

governing the public consultation process

55.6%

44.4%

Targeted stakeholders

20.00%

24.4

55.60%

Number of public consultations

91.10%

2.20%

6.70%

Drafts published prior to entry into force

44.50%

42.20%

13.30%

Public comments taken into account

28.90%

57.80%

13.30%

Source: WTO TFA indicators database

3.2.5.3

Fees and Charges

33.3% of MS publish the information for all fees and charges

(Table 39)other than import and

export duties and other taxes within the purview of Article III of GATT 1994, fees and charges

that will be applied, the reason for such fees and charges, the responsible authority and when

and how payment is to be made in paper publications like Gazette, Bulletin, Customs Code, and

22.2% not on relevant agencies’ website (on a dedicated page). Regarding fees and charges for

answering inquiries and providing required forms and documents 33.3% of countries are

limited to the approximate cost of services rendered, while 63.2% of countries don't have fees

for these subjects. 60% of the OIC MS doesn't make a periodic review of fees and charges; as

opposed to 22.2% of MS which do a periodic review, but don’t adopt them to changed

circumstances. On the other side, in 40% of the member states, fees and charges may be applied

even without being published or prior to their publication, while in 33.3% of the member states

new or amended fees and charges enter into force immediately upon their publication and there

is no time period accorded between the publication of new or amended fees and charges and

their entry into force. Still, there is a large number of member states that have fees for Customs

services during normal working hours. The rules, regulations or procedures regarding penalty

disciplines against breaches of import, export or transit formalities are publicly available in

57.8% of the countries, but they did not clearly specify the persons that can be held responsible

for such breach. In 35.6% of the MS, there is assessment and applied penalties regardless of the

circumstances and the severity of the breach, while 64.4% of countries depend on penalties on

the facts and circumstances of the case and are commensurate with the degree and severity of

the breach. 11.1% of the countries do not provide any written explanation on the basis for