Improving Customs Transit Systems

In the Islamic Countries

109

assessing and applying the penalty, while 88.9% of the countries provide such an explanation to

the person, upon whom the penalty is imposed, specifying the nature of the breach and the

applicable regulation. Also, 24.4% of the countries use remuneration of customs officials based

on a fixed portion or percentage of any penalties or duties that they assess or collect, while in

75.6% of the countries the remuneration of customs officials is independent of any penalties or

duties that they assess or collect. More than half of the countries are not considering a mitigating

factor when establishing penalties for voluntary disclosure of the breach of customs regulation,

by the person responsible, prior to the discovery of the breach by the customs administration.

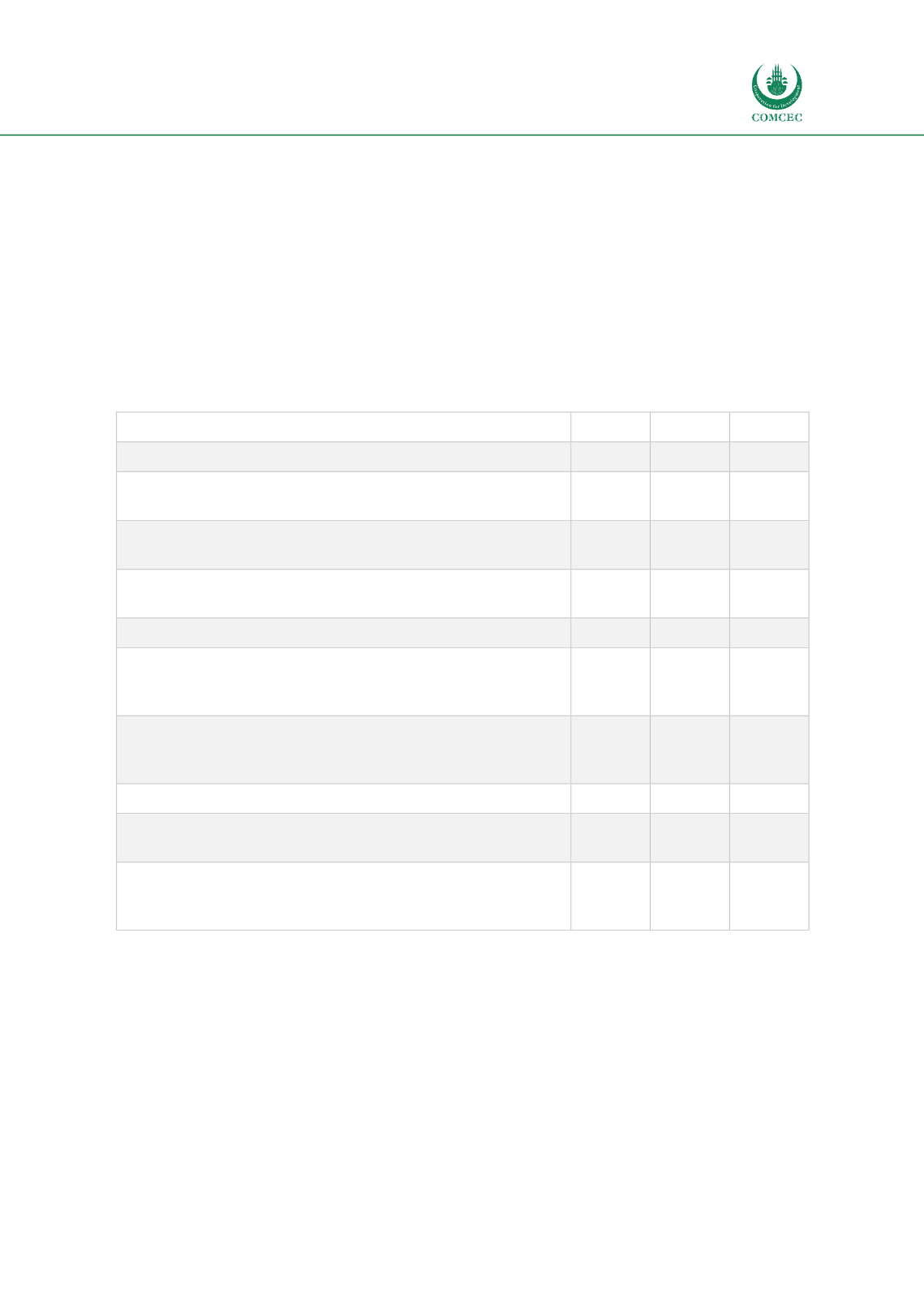

Table 39: TFI related to the fees and charges

Response

0

1

2

Information published on fees and charges

28.90%

48.90%

22.20%

Fees for answering inquiries and providing required forms

and documents

4.50%

33.30%

63.20%

Fees and charges periodically reviewed to ensure they are still

appropriate and relevant

60.00%

22.20%

17.80%

An adequate time period granted between the publication of

new or amended fees and charges and their entry into force

40.00%

33.30%

26.70%

Fees for Customs services during normal working hours

31.10%

68.90%

Implementation of penalty disciplines for the breach of

customs laws, regulations or procedural requirements -

transparency

17.80%

57.80%

24.40%

Implementation of penalty disciplines for the breach of

customs laws, regulations or procedural requirements -

proportionality

35.60%

64.40%

Procedural guarantees on penalties

11.10%

88.90%

Conflicts of interest in the assessment and collection of

penalties and duties

24.40%

75.60%

Is voluntary disclosure of the breach of customs regulation by

the person responsible for a mitigating factor when

establishing penalties

55.60%

44.40%

Source: WTO TFA indicators database

3.2.5.4

Formalities - Documents

88.9% of the OIC MS

(Table 40)accept copies of supporting documents required for import,

export and transit formalities with exceptions (related to the type of good, the circumstances or

the agency), but they are not accepted without exceptions, and original to be presented upon

request (2.2%). Also, 86.7% of the countries accept copies of supporting documents where

another government agency holds the original of the document. When it comes to compliance