Single Window Systems

In the OIC Member States

45

operators, banks, logistics and insurance companies. It covers the business processes/services

mentioned i

n Table 8.The use of Czech CDPS and Single Window is mandatory. 100% of customs declarations are

processed and approved by the Czech Customs services using the CDPS/CZSW; 100% of the

payments are made electronically through bank transactions; 100 % of permits and certificates

are processed by government agencies; 100 % of declarations and permits are processed

thought risk management system - 85% of permits and declarations processed within 10 - 15

minutes – se

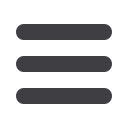

e Table 7Table 7: Processed Customs Declarations with Permits / Certificates – Czech SW

Customs declarations with permits / certificates

Year

Import

Export

2012

217303

48165

2013

231499

60735

2014

271978

67060

Source: Authors from OIC survey

Inventory of services

The CZSW is the interface between traders and the government agencies for trade related

permits and certificates that are presented jointly with the initial, not supplementary, customs

declaration. In 2012 the number of national government agencies delivering certificates through

the Single was 12. In the meantime, responsibilities for many regulatory procedures have been

transferred to the EU level and EU institutions deliver certificates through the EU Single

Window. Only three national agencies continue to deliver certificates/permits based on

domestic regulation (weapon, dangerous materials / dual use goods and export of objects of

cultural value).

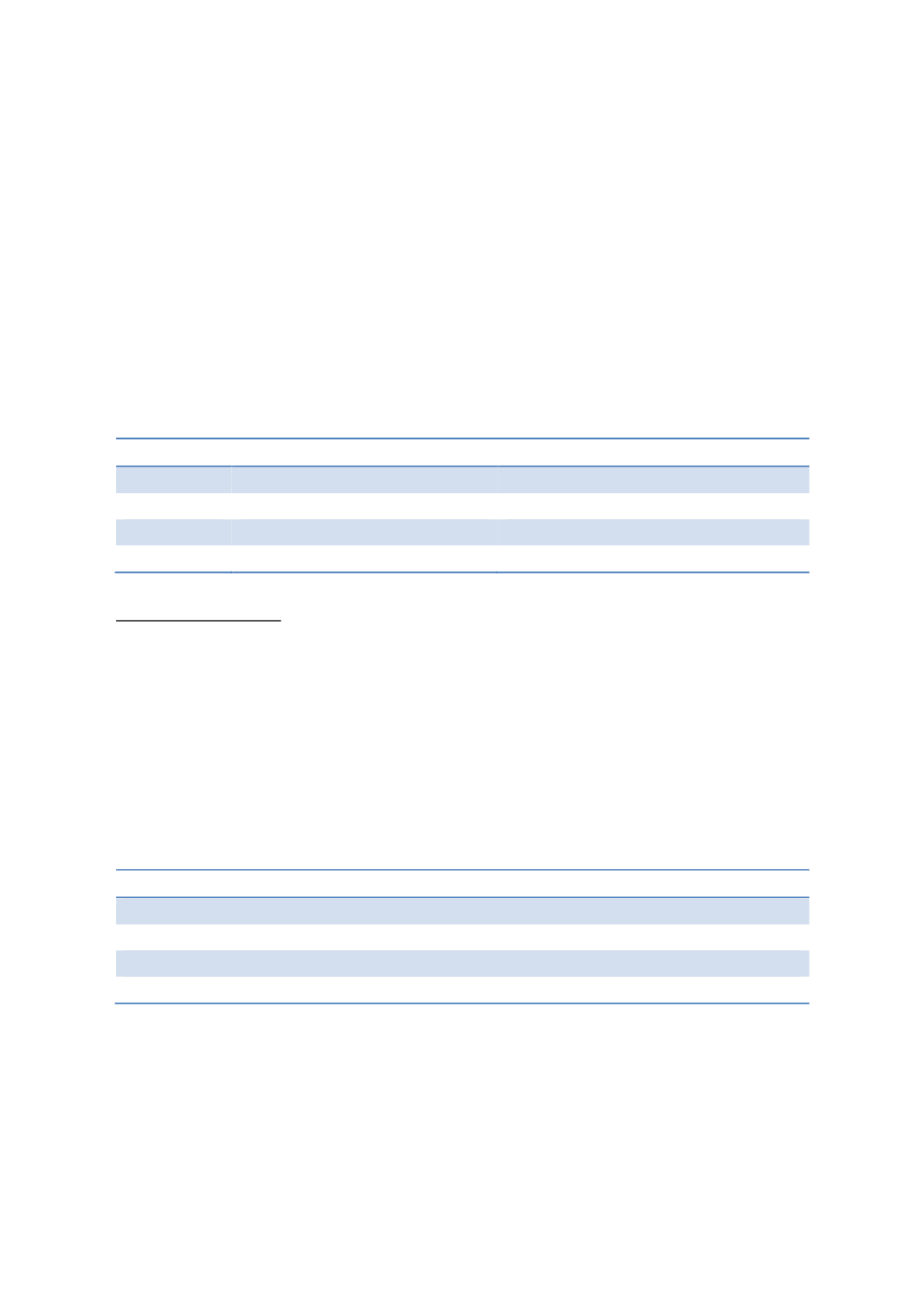

Table 8: Czech Republic SW Services

Inventory of Business Processes / services

Request for permits and certificates

Submission of Customs declaration

Risk management at all levels

Exchange of Common Veterinary Document (CVED) with all EU MS.

Source: Authors from OIC survey

The CZ Republic SW rests on the single submission of trade data as shown i

n Figure 16.The trader is lodging the Single Administrative Document (SAD) to the EU Member States (MS)

Customs Declaration Processing System. After authentication and validation, the SAD is

accepted. The rule-based engine, integrated in the Integrated Tariff Environment (ITE) is