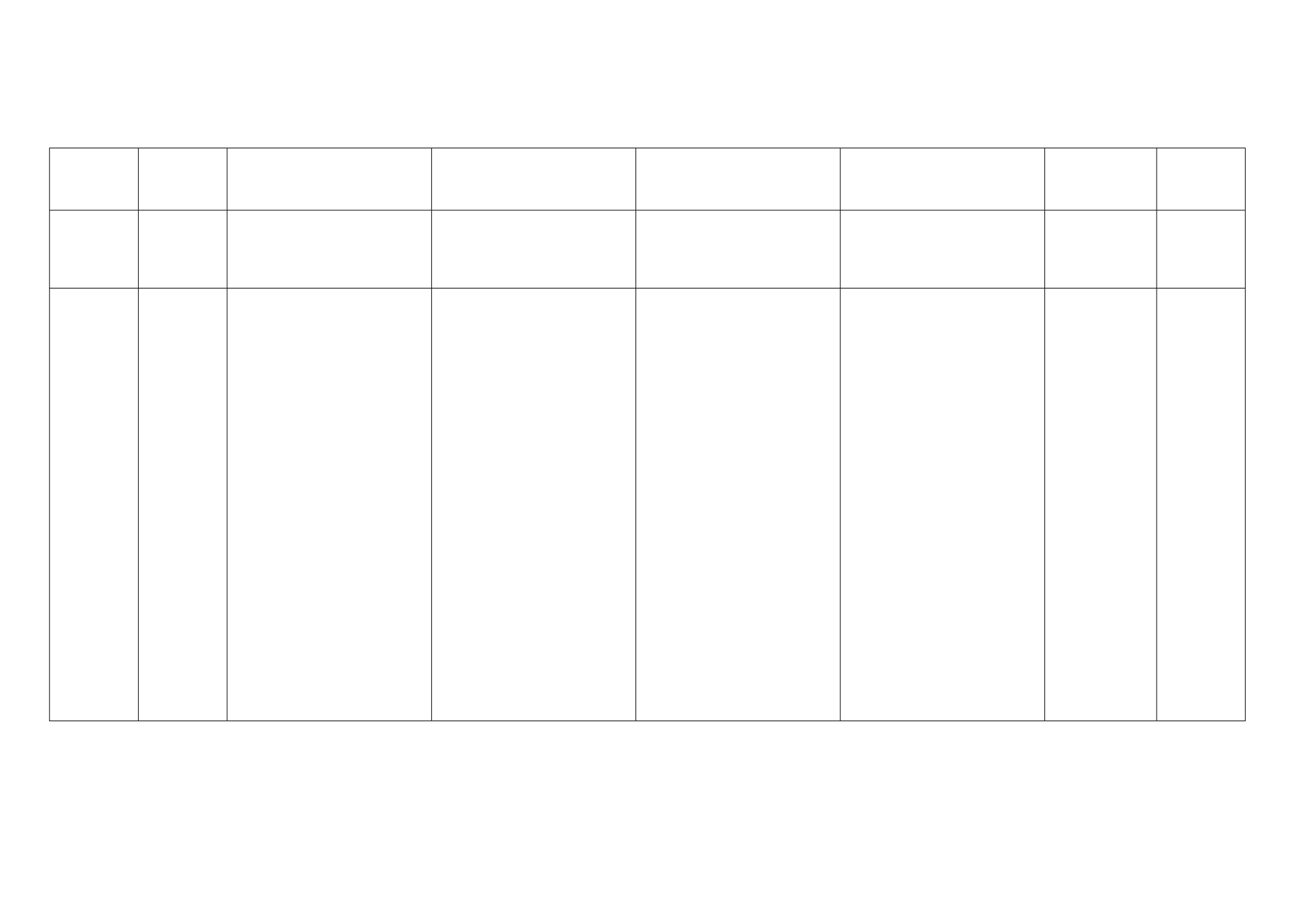

Table 8:Appendix: Comparison of Agreements Notified Under the Enabling Clause

RTA Name

Date

of

entry into

force

Remarks

Implementation period (how

long it took/taking to make the

reductions agreed)

Coverage (% of tariff lines that

will be reduced out of the to-

tal)

(% of lines that will be liber-

alised immediately)

Countries

involved

Services

Andean

Commu-

nity (CAN)

25-May-88

The Bolivarian Republic of

Venezuela is no longer a Party

of the Andean Community.

In 1994, the CET (CET) was

approved

Bolivia and Ecuador began the

process of adopting the CET

on an annual, automatic, and

linear basis, on the date set by

the Commission.

Bolivia,

Colombia,

Ecuador, and

Peru

No

ASEAN -

India

01-Jan-10

Dates of entry into Force:

Framework Agreement: 1 July

2004 TIG Agreement: In-

dia, Malaysia, Singapore and

Thailand: 1 January 2010

Brunei Darussalam, Myanmar

and Viet Nam: 1 June 2010

Indonesia: 1 October 2010

Lao PDR: 1 January 2011

The Philippines: 17 May 2011

Cambodia: 15 July 2011

Negotiations for goods fi-

nalised by June 30, 2005

and that for services and

investments the negotiations

concluded in 2007. India

agreed to special and differ-

ential treatment to ASEAN

group and align its peak

tariff levels, to reduce it s

tariff for Brunei,Cambodia,

Laos,Indonesia,

Malaysia,

Myanmar, Singapore, Thai-

land and Vietnam in 2011.

Correspondingly while Brunei,

Indonesia, Malaysia, Singapore

and Thailand agreed to reduce

their tariff for India in 2001,

the new ASEAN members like

Cambodia, Laos, Myanmar

and Vietnam (CLMV) will do

so in 2016. Philippines which

has expressed its reservations

to the FTA has agreed to

eliminate its tariff on recip-

rocal basis for India by 2016.

India will unilaterally extend

concessions on 11 tariff lines

to CLMV.

(a) Normal Track: Applied

MFN tariff rates gradually re-

duced or eliminated in accor-

dance with specified schedules

and rates. (b) Sensitive Track:

The number of products listed

in the Sensitive Track shall be

subject to a maximum ceiling

to be mutually agreed among

the Parties. India: Reduce

over 89% of all of its agri-

culture, marine and manufac-

tured goods by 2016. Nearly

70% under Normal Track-1, for

which tariffs reduce to zero by

2013.

The

r e m a i n i n g

n e a r l y 9% tariff lines fall

under Nor- mal Track-2, for

which tariffs reduce to zero by

2016. 496 products under the

Exclusion List constitute 9.8%

of India’s total tariff lines,

while India has kept 11.1% of

its total tariff lines under the

Sensitive

Track.

Special

Products con- stitute just 0.1%

of its total tariff lines.

Implement an Early Harvest

Programme (EHP).

India, Cambo-

dia, Lao PDR,

Malaysia,

Myanmar,

Philippines,

Singapore,

Thailand, Viet

Nam

Yes