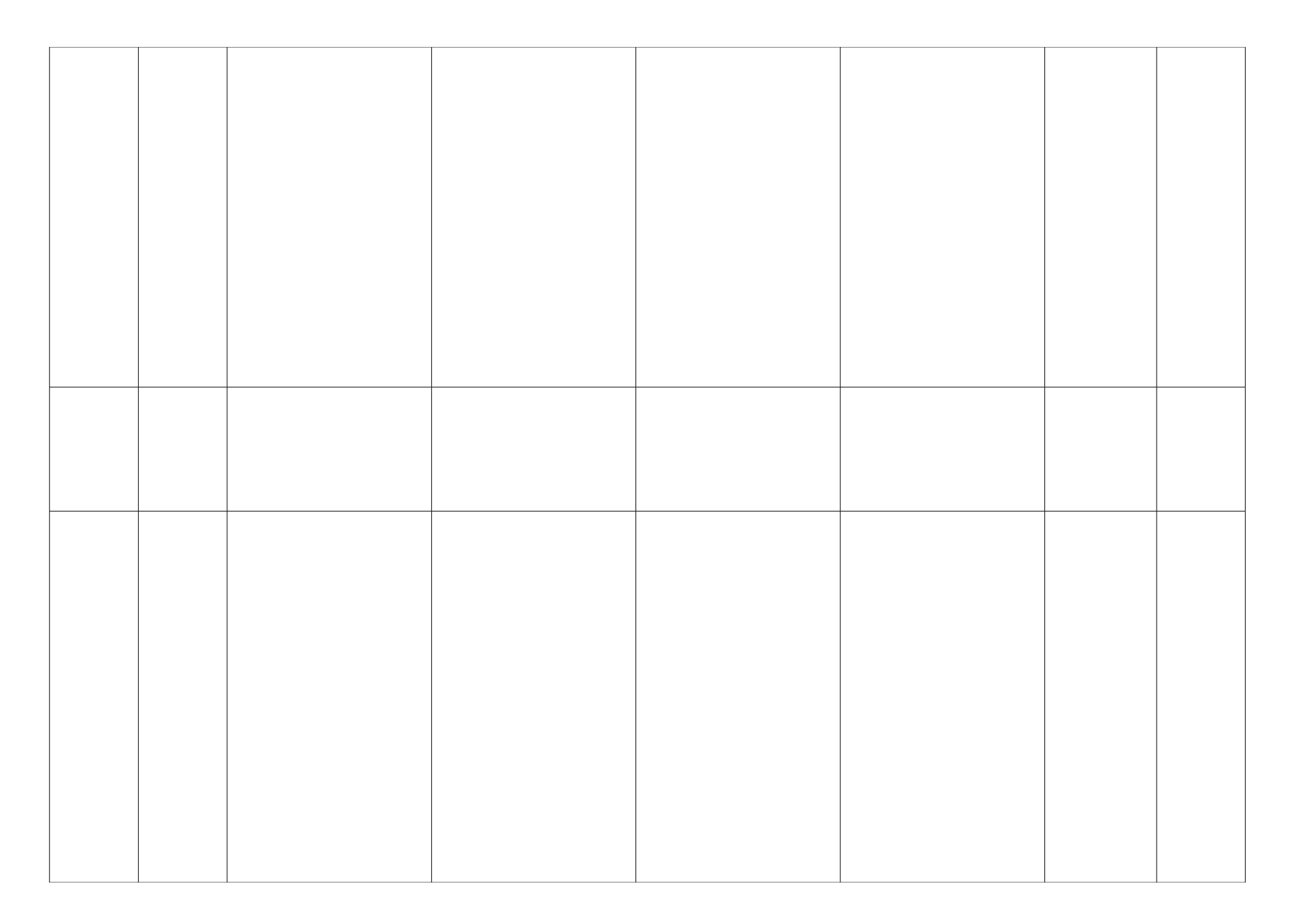

ASEAN

Free Trade

Area

(AFTA)

28-Jan-92

The Common Effective Pref-

erential Tariff for ASEAN

Free TradeAgreement (CEPT-

AFTA): (1992)

CEPT-AFTA: Reduction to

20% in 5-8 years, from 1

January 1993, at an annual

rate of reduction (X-20)%/5

or 8,where X equals the ex

isting tariff rates. Subsequent

reduction of tariff rates from

20% or below within a time

frame of 7 years. The rate

of reduction at a minimum

of 5% quantum per reduc-

tion.

ATIGA:MemberStates

shall eliminate import duties

on all products traded between

the Member States by 2010

for ASEAN-6 (Brunei Darus-

salam, Indonesia, Malaysia,

the Philippines, Singapore and

Thailand) and by 2015, with

flexibility to 2018, for Cambo-

dia, Lao PDR, Myanmar and

Viet Nam (CLMV).

Schedule A: (i) For ASEAN-

6, by 1 January 2009:- Import

duties of at least 80% lines

eliminated; - Import duties on

ICT products eliminated;- Im-

port duties on all Priority Inte-

gration Sectors (PIS) products

at 0% except those listed in

the negative lists. Import du-

ties on all products equal to or

less than five percent (5%); (ii)

For Lao PDR, Myanmar and

Viet Nam, import duties on all

products equal to or less than

5% by 1 January 2009; (iii) For

Cambodia, import duties of at

least 80% lines are equal to or

less 5% by 1 January 2009; (iv)

Import duties on some prod-

ucts of CLMV, not exceeding

seven percent (7%) of lines,

shall be eliminated by 2018.

Brunei Darus-

salam, Indone-

sia, Malaysia,

Cambodia,

Lao

PDR,

Myanmar,

Philippines,

Singapore,

Thailand,

VietNam

Yes

Asia Pa-

cific Trade

Agreement

(APTA)

17-Jun-76

Formerly known as "Bangkok

Agreement". Entry into force

of the amended Agreement:

01-sept-06

Participating States shall en-

ter into periodic negotiations

to further expand the Agree-

ment.

Each Participating State shall

apply tariff, border charge and

fee, and non-tariff concessions

in favour of the goods originat-

ing in all other Participating

States as are set out in its Na-

tional List of Concessions.

Participating States conduct

their negotiations for tariff

concessions by : (a) product-

by-product basis; (b) across-

the-board tariff reductions; (c)

sectoral basis. The tariff ne-

gotiations based on the current

MFN rates.

Bangladesh,

China, India,

Lao, Republic

of Korea and

Sri Lanka

Yes

Chile - In-

dia

17-Aug-07

The PTA was signed on March

8, 2006. The Parliament of

Chile approved it in April 2007

and President of Chile signed

the decree on August 16, 2007

on ratification of the PTA in

Chile. The PTA came into

force with effect from 17th Au-

gust, 2007 in Chile and in In-

dia on 11.09.2007. Implemen-

tation of India-Chile PTA has

been notified to WTO on 13th

January, 2009.

The products covered in the

mutual offers account for more

than 90% of the value of to-

tal bilateral trade amounting

to USD 447.54 Million, which

took place between the two

countries during 2004-05.

India offered tariff concessions

on meat and fish products (84

lines), rock salt (1 tariff line),

iodine (1 tariff line), copper ore

and concentrates (1 tariff line),

chemicals (13 lines), leather

products (7 lines), newsprint

and paper (6 lines), wood

and plywood articles (42 lines),

some industrial products (12

lines), shorn wool & noils of

wool (3 lines) and some oth-

ers (7 lines). Chile’s offer cov-

ers some agriculture products

(7 lines), chemicals & pharma-

ceuticals (53 lines), dyes and

resins (7 lines), plastic, rub-

ber and miscellaneous chemi-

cals (14 lines) leather products

(12 lines), textiles and clothing

(106 lines), footwear (10 lines),

some industrial products (82

lines) and some other products

(5 lines).

India offered fixed tariff prefer-

ences ranging from 10% to 50%

on 178 lines at the 8 digit level

to Chile, the latter offered tar-

iff preferences on 296 lines at

the 8 digit level with margin of

preference ranging from 10% to

100%.

India, Chile

No