Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

172

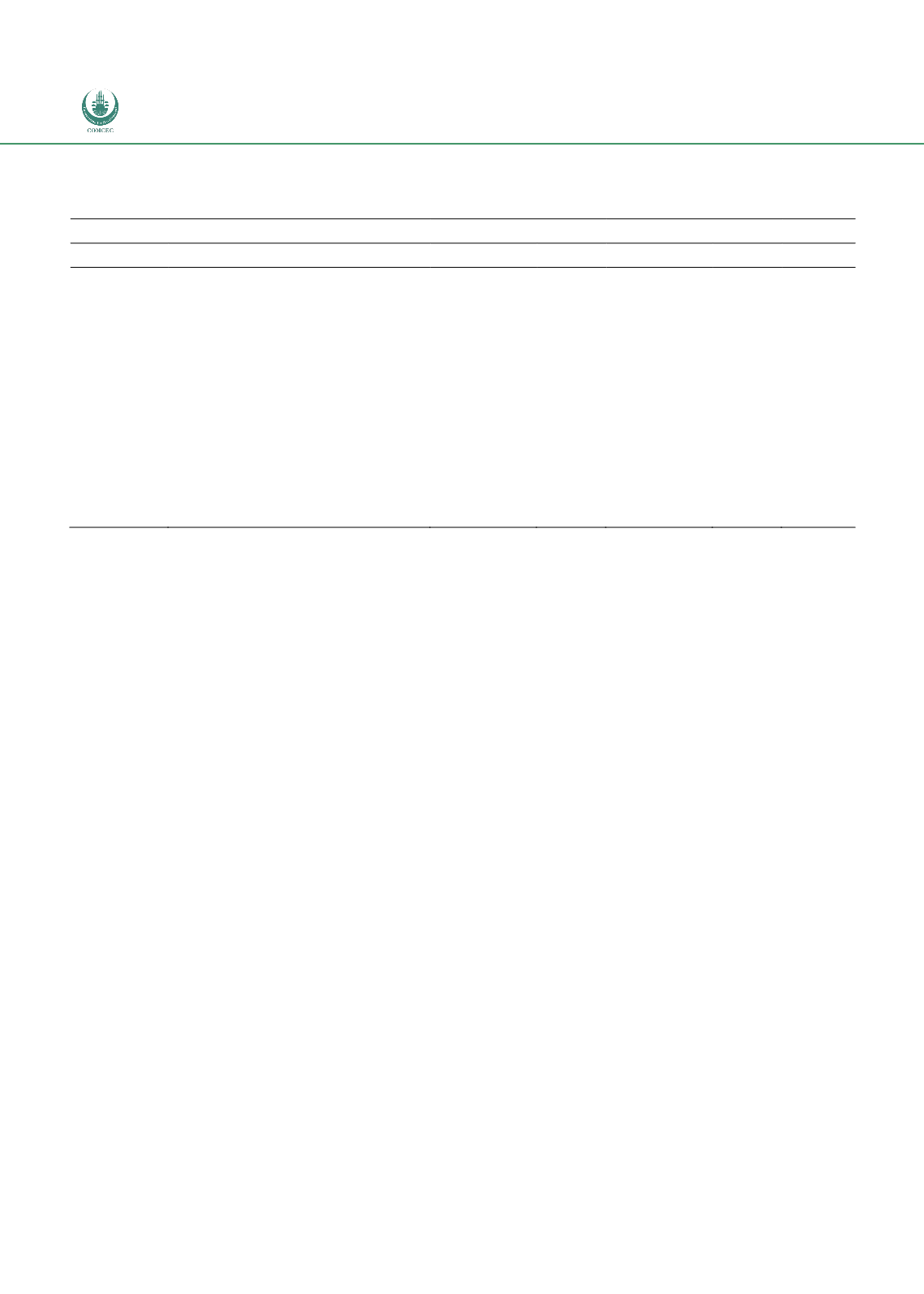

Table 42: Top 10 Jordanian Imported Products from TPS-OIC Countries 2012 & 2013 (1000s USD)

Product

Product Name

2012

2013

MFN

Imports

Share

Imports

Share

Tariff

271019

Petroleum oils

1,511,705 22.67%

594,447 10.33%

25

271111

Natural gas, liquefied

296,610

4.45%

282,357

4.91%

30

293100

Organo-inorganic comps

134,160 2.01%

118,610

2.06%

0

390110

Polyethylene

100,165

1.50%

95,607

1.66%

0

390120

Polyethylene

71,680

1.08%

85,653

1.49%

0

170199

Cane/beet sugar

89,108 1.34%

66,537

1.16%

17.5

711319

Articles of jewellery

46,686

0.70%

97,366

1.69%

20

220290

Non-alcoholic beverages

56,117

0.84%

65,378

1.14%

30

390210

Polypropylene,

54,096

0.81%

64,369

1.12%

0

40210

Milk in powder/granules/oth

44,205

0.66%

44,565

0.77%

3.3

Grand Total

2,404,533 36.06% 1,514,887 26.33%

Source: Comtrade using WITS, tariff data from TRAINS database

Malaysia

The top 10 Malaysia products exported to the Parties of TPS-OIC System represent around 55% of

the total Malaysia exported products (excluding oil) to the agreement. On the import side, only two

products on the lists would be applicable for tariff reductions as their tariffs are above the 10%

threshold. These products are both polyethelene where the current tariff is 30%. Hence should they

be included these tariffs could go down to 25% giving the Parties of TPS-OIC System a relatively

small preference margin of 5%. These two products currently account for just under 3.5% of

Malaysian imports and are clearly quite heavily protected. There is scope for greater effects should

Malaysia choose to voluntarily, under the fast track procedure, reduce these tariffs further. However,

given the high MFN tariff, a greater degree of intra-bloc liberalisation may then lead to trade

diversion in these products.